Content navigation:

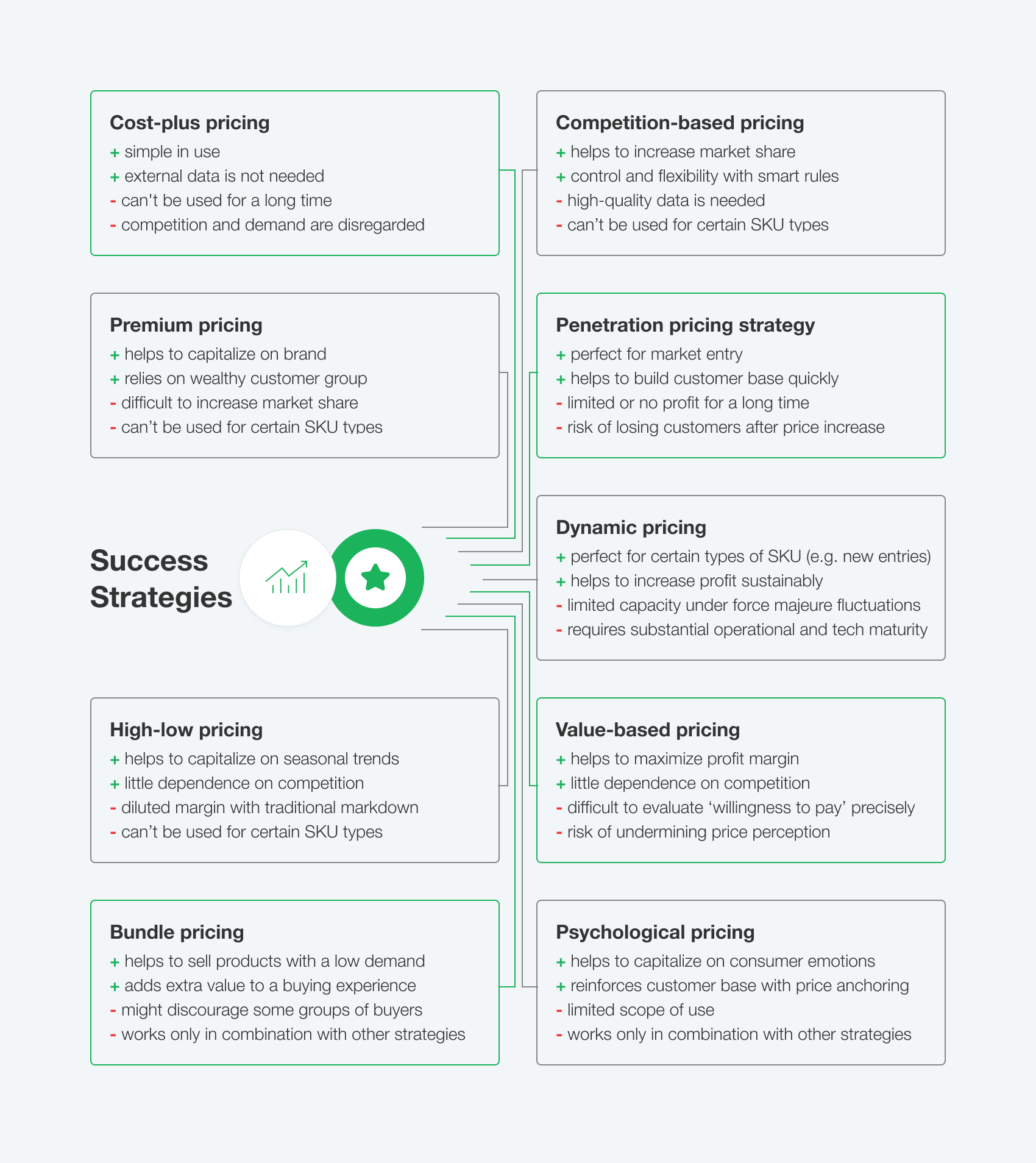

- What is pricing strategy?

- Cost-plus pricing strategy

- Competition-based pricing strategy

- Premium pricing strategy

- Penetration pricing strategy

- High-low pricing strategy

- Value-based pricing strategy

- Dynamic pricing strategy

- Psychological pricing strategy

- Bundle pricing strategy

- How to find the best blend of pricing strategies?

What is pricing strategy?

Pricing strategy is a systematic approach aimed at setting the optimal price for every product. Choosing the right blend of strategies helps retailers to maximize profit and revenue as well as satisfy market requests and keep customers loyal.

We’re going to specify the merits and drawbacks of each strategy so you can use this practical guide to select the right pricing strategy for each product group in your portfolio. We’d also outline the major factors retailers ought to consider while choosing a pricing strategy. Finally, we’re going to present how advanced pricing software helps to choose and implement the best blend of tools so retailers can reach their strategic business goals and keep the customers loyal. Let’s go right down to business!

Cost-plus pricing tactics or where it all starts

A cost-plus pricing strategy implies adding a particular markup to the product cost. What it means is that the products are priced based on only two factors: the cost and the markup. In most cases, the markup is a fixed percentage set by a retailer depending on how much profit the business would like to receive from selling a single item. The basic formula underlying cost-plus pricing goes as follows:

Here's an example of using a cost-plus pricing: imagine you're selling sunglasses and one pair costs 30$. On each sale, you would like to earn 50% of the price. 50% is, therefore, your markup which would be 15$ in the case of 30$ sunglasses. The final price would then be 45$.

A cost-based pricing strategy is a good starting point for those retailers that have just launched the business and barely know anything about the market, customer preferences or the price elasticity of demand. The strategy could sometimes be applied for the brand-new products on the market as there is no relevant historical data to find how the product should be priced. At the same time, a cost-based approach remains remarkably unsustainable and insecure, so it is given up by most retailers right after they become more mature.

Competition-based strategy: look around

A competitive pricing strategy is a pricing approach used by retailers to boost sales and gain a competitive advantage through smart pricing differentiating them from the rivals. Put it simply, competition-based pricing implies using other payers’ prices as a benchmark. That’s why the strategy is also often referred to as a competitor-based pricing. This type of pricing should be considered within the broader concept of market-driven pricing. The basic formula for a competition-based price might look as follows.

The ‘market factor’ here stands for competitive and any other market data referenced by a retailer while ‘premium factor’ marks the money equivalent charged for exclusive services or product features. The latter factor is relevant primarily for the premium pricing which we're going to discuss below. The point is that the simplified formula might be different in regard to retailer's positioning, e.g., for a discounter, there will be no premium factor at all.

A simplistic implementation of competition-driven pricing strategy has substantial drawbacks and risks. For example, a retailer blindly following other players would most likely get involved in the devastating price wars damaging financial health and price positioning. One of the most important things here is that you cannot price every product regarding the competiiton. Instead, you should consider the role every SKU plays in your portfolio and apply the corresponding pricing approach towards each product bucket. For example, it is crucial to price 'Best Price Guarantee' products in regard to competitors while you cannot use the same approach towards your exclusive range.

The idea of looking at competitors to adjust own prices based on your positioning is simply only in theory. In practice, you would face dozens of challanges right after you make a shift to the market-drvien prcing. Especially now, when retailers around the globe are intensively moving theit sales online in the face of global recession provoked by Covid-19 pandemic. So, when dozens of new competitors enter the market, you must find which competitors are really impacting your sales and which not. Besides, you need to get the high-quality competitive data to make sure your pricing decision logic is build upon relevant variables.

The good news is that retailers can deal with these challanges using advanced pricing software, like Competera. Clicking below, you can find how the smart market-driven pricing works.

Premium pricing: more expensive is better

Competition-based pricing is a complex approach and a link to the market is its' crucial feature. At the same time, the way retailer interprets competitive data to set up pricing logic is not less important in terms of defining the pricing policy. Depending on whether a retailer is pricing products higher or lower than competitors, the two strategic approaches could be defined: premium and penetration strategies. Let's look at premium pricing in detail.

Premium pricing is used by the retailers willing to differentiate them from other players as ones selling better or unique products as well as providing premuim service. In this case, aligning with the market would imply defining and tracking your true competitors to price products somehow higher compared to the rivals. The added value here is the very same 'premium factor' we've mentioned in the competition-based price formula above.

The premium factor often covers the value of additional premium services provided for customers. The essence of premium pricing lays at the junction of competition-based and psychological pricing strategy (below we'd focus on the latter in detail). What it means is that premium segment buyers tend to consider making purchasing as also a means of reinforcing their social status. This phenomenon explains why the prices appearing to be unreasonably high might work exceptionally well.

Finally, it must be noted that the premium pricing strategy is mainly a privilege of those retailers that have put a lot of effort and funds to build their brand. The examples of effective premium pricing implementation are found almost in every industry from grocery to consumer electronics and fashion.

Unlock new markets with penetration pricing

Now, let's take a more thorough look at the penetration pricing strategy, an approach largely opposite to the premium pricing. Just like the latter, it should be considered within the broader framework of competition-based pricing. The difference is that penetration strategy implies offering prices considerably lower than the market average.

If you've found a business offering prices not slightly but significantly lower than other players do, it is most likely the case of penetration pricing strategy. Examples of penetration strategy could be found not only in retail. The case of Netflix is probably the most illustrative one. Netflix entered the market offering a relatively low and affordable subscription price attracting even those users that did not plan to subscribe initially. After that, the company started gradually to charge more while the very price step was too small to make the large group of users give up the service at once.

The example of Netflix demonstrates two major benefits associated with the penetration pricing strategy:

- It is a good means for new players willing to enter the market and draw the attention away from competitors.

- The strategy also enables businesses to quickly build the customer base and increase the market share.

Within the current global economic context, penetration pricing strategy becomes especially relevant for those retailers that have just moved their sales online in the face of the crisis. Using this approach, the business can quickly occupy market share in the new segment and win the group of loyal customers.

High-low pricing to gain maximum profit

High-low strategy implies sequential repricing with high initial prices being lowered as products drop in novelty and demand. As prices are high initially, this strategy could be associated with premium pricing, yet they differ significantly. The first and most important difference here is that high-low pricing has to do little with the competitors. In contrast, retailers using high-low approach should be aware of seasonal trends.

This type of pricing strategy is applicable primarily to apparel and footwear industries, for which the demand is directly dependant on seasonality. This approach could also be effective for particular SKUs in other industries. iPhones and popular consumer electronics devices appear to be the best example. As the new iPhone is released, the demand is soaring and the prices are high. After a year cycle is almost done and the next model is about to be released, the prices are lowered to clean off shelves and prepare for the new cycle.

This example also shows why markdown is one of the most essential pricing use cases faced by retailers using high-low strategy. The most common types of markdown include:

- Limited stock: selling out all items before the new season begins.

- Stock clearance: clearing excess inventory before the product end-of-life stage is reached.

- Outlet stores: Liquidate old collections through outlet stores, factory outlets, and other clearance-specific stores.

Value-based pricing: how much will you pay?

Value-based strategy implies pricing items based on customers' willingness to pay. The idea is simple: a product is worth just as much as people are ready to pay for it.

The unique products may serve as a good example to illustrate how value-based pricing works. Imagine you're selling football jerseys in your store. Suddenly, one of the players wins a Ballon d'Or award and fans are immediately willing to pay more for his jersey, even though it's quality features are the same for all jerseys in the portfolio. In this regard, applying the value-based strategy means identifying the level of customer's willingness to pay and then pricing the jerseys respectively.

One way to determine a customer’s willingness to pay is to calculate the TEV (True Economic Value). The basic equation for the TEV of a product goes as follows:

For example, a plain football club jersey is valued at $15. Another jersey with the name of a top player on it is viewed by customers $5 more valuable. In this case, $15 would be a cost of the closest alternative while $5 would be a differentiating value. What it means is that TEV is equal to $20. This example is a rather simplistic one, yet it illustrates the basic relationship between customers' willingness to pay and the final price.

In practice, it might be very difficult to take into account every single factor influencing customer willingness to pay and that's the main challenge of value-based pricing strategy. In addition, the value-based approach is effective while applying only towards a specific group of products, yet it remains one of the most effective means of maximizing the profit and revenue.

Dynamic pricing strategy: it’s all about flexibility

Dynamic pricing strategy implies setting diversified prices targeting various groups of shoppers using the analytics at the junction of market trends, demand fluctuations, customer behavior, purchasing power, and other factors.

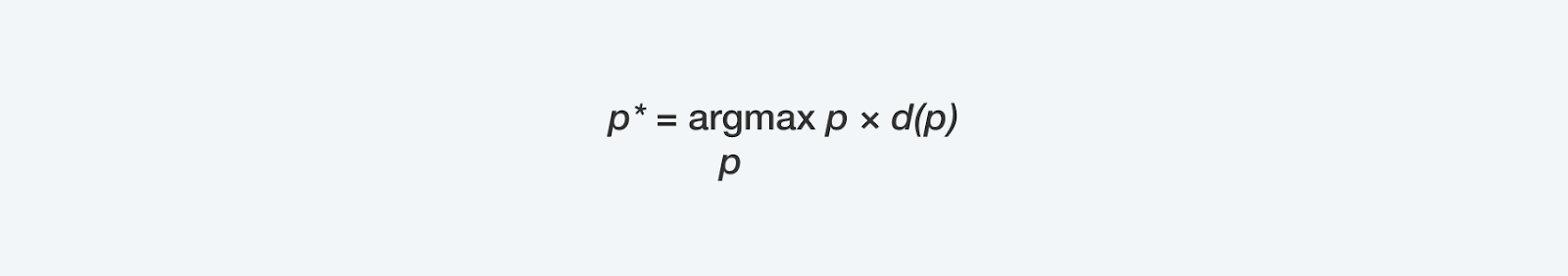

The dependency between price and demand is the core element underlying dynamic pricing strategy. With fresh and relevant data on this dependency, the revenue-optimal price could be calculated with the formula below.

P in the formula marks the price while d(p) stands for a demand function. Implementing a dynamic pricing strategy requires a substantial level of business and organizational maturity. It also depends on the pricing software retailer uses as a large number of scenarios and dependencies have to be processed and analyzed smoothly.

The dynamic software engine extends the basic formula outlined above adding a range of other pricing and non-pricing factors to be considered. Among others, these may include procurement expenses, inventory costs, demand cannibalization between particular products, competitor prices, promo activities, and other factors. The more diverse and relevant data points are processed by pricing algorithm, the more accurate results are achieved.

Here is a typical four-stage workflow of a dynamic pricing algorithm:

-

Historical data on price points and corresponding demand rates is consumed by the software platform

-

The demand function is built based on the dependencies found by the algorithm.

-

Sophisticated math processes dozens of pricing and non-pricing factors to craft price recommendations.

-

The prices are applied and then analyzed by the algorithm to make corrections and craft the next recommendations.

Psychological pricing or emotions do matter

The psychological pricing strategy is based on the idea that various types of prices have a different psychological impact on shoppers. Subsequently, the psychological effect is taken into account while pricing products to maximize revenue and profit.

Recent studies show that up to 95% of purchasing decisions are subconscious. What it means is that if retailers can understand human behavior patterns, they would be able to make their offers more attractive. Let’s use some examples to see how psychological pricing works in practice.

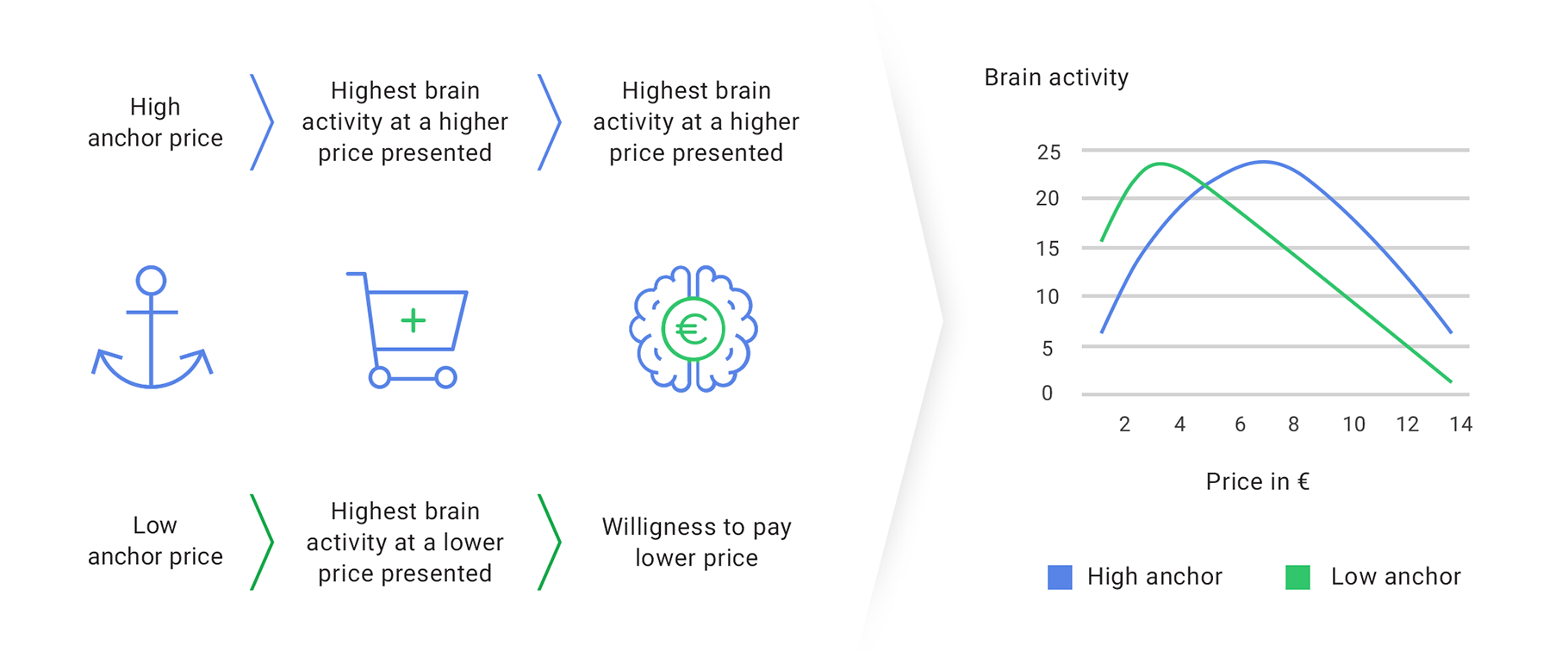

Anchoring is one of the most influential psychological patterns impacting shoppers. In particular, anchoring entails relying too much on the first piece of information (which is the “anchor”) while choosing between several products. Therefore, the higher anchor is, the higher is also customers’ willingness to pay. The visual below shows why a high anchor is important.

There are dozens of tricks to get a high anchor price. Here are some of the most common ones:

-

Consider price lining. If you want to sell an expensive item, put it next to an even more expensive one.

-

Avoid the same prices for similar products. The recent Yale research shows that in case two similar items have the same price, shoppers are less likely to purchase anything than if the prices are even slightly different.

-

Make the prices seem smaller. There are dozens of tricks to make the price seem lower than it is. The “$9.99” rule is the most illustrative example.

-

Use fewer syllables. The rule here is: the more simple the price appears, the better. For example, $2599 is better than $2,599.00.

Psychological pricing could bring a significant boost to a retailer’s financial results, yet it has a limited scope of practical use. That’s why psychological pricing works best as a supplementing tool in combination with more complex strategies.

Bundle pricing tactic to sell more

Bundle pricing strategy implies selling a set of products for a lower price than each of these products separately. This approach is one of the most effective means to sell the products with a relatively low demand.

The Microsoft Office software pack is one of the best examples of a bundle pricing strategy's use in practice. Most of the users purchasing Microsoft Office package need no more than 3-4 services on average even though they have access to the whole package. Special promo offers in retail may also serve as an example of a bundle pricing strategy. For example, KVI products are paired together with the low-demand products and then sold at a discount price.

The main advantages of bundle pricing strategy stem from the fact that customers like purchasing products in groups, as it usually ads value to their buying experience. In addition, shoppers tend to enjoy versatility in a single act of purchase and avoid frustration while choosing complementary products.

However, customers do not always need all the products in a bundle while paying for all of them. Besides, It is difficult for retailers to remain transparent in their pricing decisions for bundled products and find a balance between their and customers’ total value for the items. Therefore, similarly to a psychological approach, bundle pricing works best in combination with other strategies.

Find the best blend of pricing strategies

After we’ve outlined the merits and drawbacks of all major pricing strategies, you’re probably asking: “Ok, but how should I choose a single strategy for my business?”. Of course, the choice of a particular pricing strategy depends on a plethora of internal and external factors unique for each business. However, there are two fundamental recommendations that we believe are relevant for all types of retailers regardless of industry, size or business maturity.

First of all, the combination of approaches is always better than a single strategy. As we've mentioned above, every product in the portfolio has its unique role and you cannot apply a single approach for all SKUs. It means that you can find the major prevailing strategy, but it is worth being supplemented with elements of the other ones. For example, you can rely mainly on the competition-based strategy and, at the same time, use some principles of psychological, bundle or dynamic pricing. The visual below highlights the major pillars underlying the balanced development of a pricing strategy.

Whatever blend of strategies you choose, it’s successful implementation is hardly possible without relying on advanced pricing software. And that’s our second recommendation. Just one example: if a manager can deal with only 3 or 4 factors while crafting a single price, the advanced pricing software, like Competera, processes 60 factors at once.

Human-centric pricing is hardly a sustainable way to cope with the growing competition in retail. Instead, you need an integrated, automated, and self-service solution to ensure that pricing process is controllable, coherent, and transparent for all the stakeholders. Competera enables businesses to manage prices on portfolio level applying the right strategy for every product group with the combination of ML, AI, and other next-generation technologies.

FAQ

The 4 major types of pricing include cost-plus pricing, competition-based pricing, premium pricing, and value-based pricing. These types of pricing represent the most commonly used strategies, but not all of them.

The combination of approaches is always better than a single strategy. Every product in the portfolio has its unique role and you cannot apply a single approach for all SKUs. Unique pricing implies the use of advanced pricing software to scientifically segment products in the portfolio and apply the right strategy towards each bucket.