AI-Driven SKU Journey: Stop Losing Money at Every Product Lifecycle Stage

Product roles tend to change as each SKU goes through different lifecycle stages. Let’s see how AI-driven pricing software can help retailers to get the most out of each SKU with every repricing.

Retailers Should Keep Up With Constant Changes

Product roles tend to change over time. The product which was a new entry a few weeks ago, becomes a routine SKU before it joins the group of long tail products or becomes KVI (Key Value Item), which generates a lot of traffic as well as drives price perception index of the retail store. Changing SKU roles mean that the mix of pricing strategies and tactics should be changed too. Lastly, regardless of product’s current role, it is also impacted by plenty of pricing and non-pricing factors which may change every repricing.

- Seasonality

- Inflation

- Weather

- Promo

- Inventory level

- Shopping history

- Elasticity

- Destinatination

- Routine

- Convenience

- Seasonal

- Competitive / Traffic building

- Transaction building /Profit generation

- Profit Generation

- Excitement generation

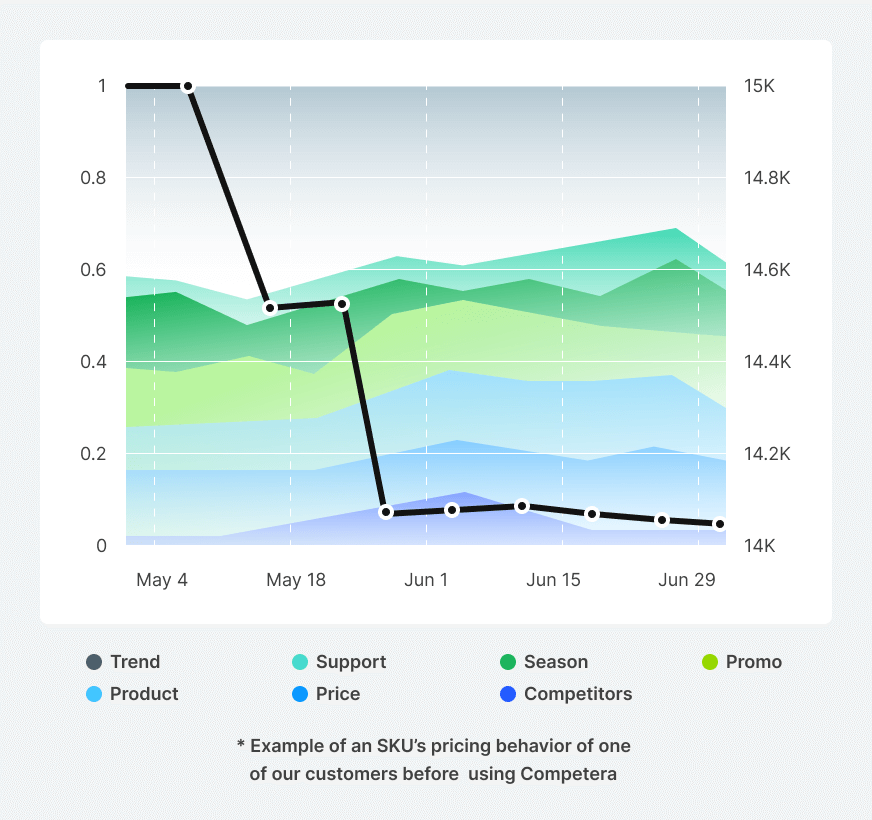

Retailers fail to copу with all the changes

Typically, retailers underestimate both the complexity of dynamically changing factors impacting the price and the variety of pricing strategies that can be applied with every new repricing cycle. As a result, the SKU journey looks as follows: it starts with a high initial price, drops to follow competitors, and then drops again so the stock of an SKU can be sold out. Eventually, pricing strategy does not reflect the market reaction as well as changing factors.

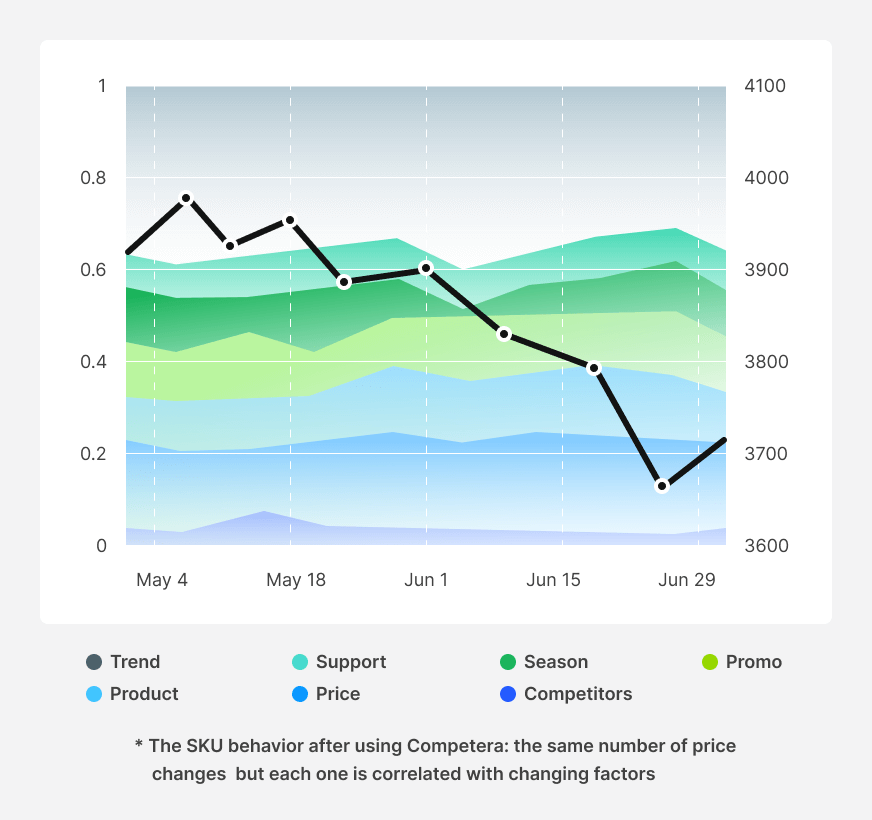

AI-driven pricing prevents retailers from losing money

Using Competera Pricing Platform and its elasticity-based pricing engine, retailers can identify the optimal price point per SKU at every repricing cycle taking into account both the product’s current role and multiple pricing and non-pricing factors automatically. The graph on the left shows how the smart tech-driven SKU journey looks like.

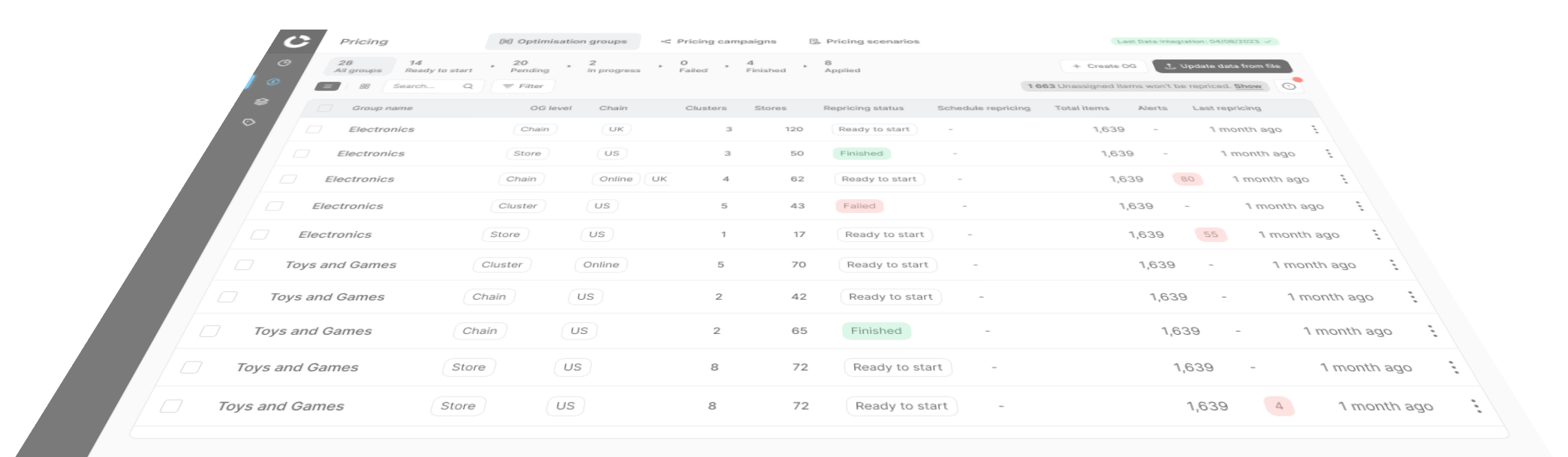

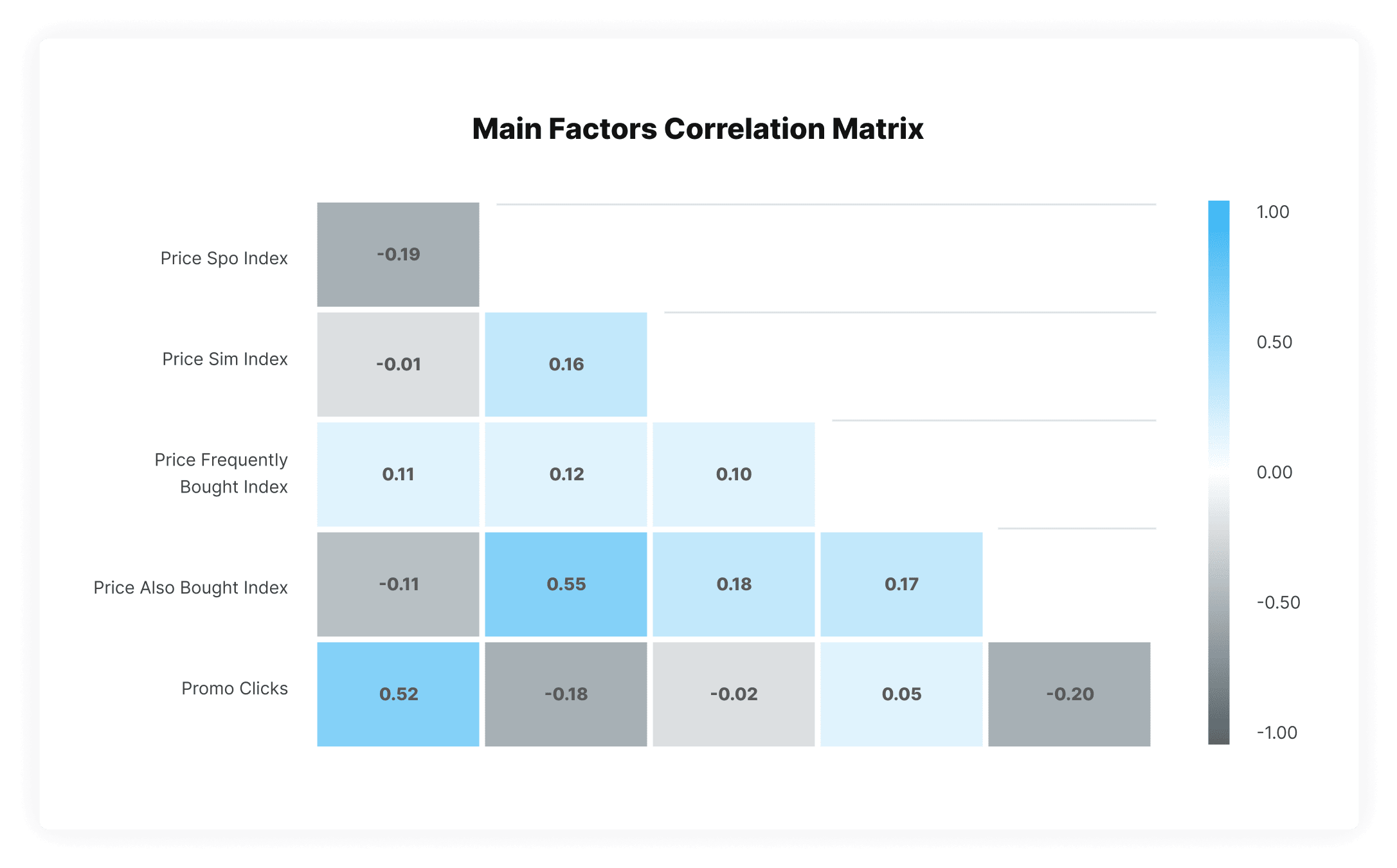

How it Works: Matrix View on Optimal Price Position

One of the key capabilities behind the platform’s ability to set optimal prices at every repricing cycle implies an ML-based analysis on how a retailer’s current price position conflicts optimal price index in regard to the core factors. Visit our technology page to get more on what’s under the hood of Competera.

Uncover the full potential of Competera

Read how Competera’s pricing solutions help retailers across different industries.