Content navigation:

- What is price elasticity?

- Price elasticity of demand formula

- Price elasticity of demand examples

- Determinants of price elasticity of demand

- How to calculate price elasticity of demand?

- What factors determine the size of the price elasticity of demand?

- Types of price elasticity of demand

- Reach goals with tech-driven price elasticity management

What is price elasticity?

When we talk about price elasticity meaning, we need to keep in mind that is used to mark the relation between the change in the demanded quantity of a product and a change in its price. If a demanded quantity remains the same after the price is changed, the product is considered an inelastic one and vice versa.

According to researches, over 55% of consumers prefer the branded product to unbranded ones. What it means is that there are particular pricing and non-pricing factors that make customers pay more for products even if cheaper alternatives are available. Together, all these factors compile a price elasticity of demand. Eventually, an accurate calculation of price elasticity enables retailers to maximize their revenue while keeping customers loyal. Find out how to effectively optimize prices when purchasing behavior changes.

In this article, we’re going to dive into the depths of price elasticity of demand examples to show how helpful might it be on your way to strategic business targets. We would first define it, learn how to calculate the price elasticity of demand and explore essential formulas and graphs. Also, we'd explore elastic products examples and learn to calculate the elasiticy itself. We’re also going to discuss the factors impacting high price elasticity and find how products in your portfolio could be classified based on the type of price elasticity. Finally, we’d show the way advanced software solutions are used by retailers to deal with the elasticity of price. Let’s start!

Price elasticity of demand: formula

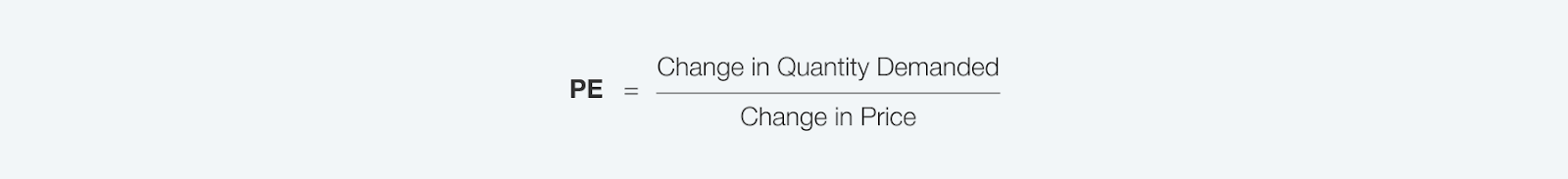

The dominating trend implies that consumers buy fewer products if the price increases. What it means is that the price elasticity is in most cases negative. The positive price elasticity implies that the higher price results in increased demand. The latter situation occurs rather rarely, yet some luxury products might still be the case. Anyway, as a matter of convenience, only positive numbers are usually used to rate the elasticity. The formula to calculate the elasticity of price goes as follows:

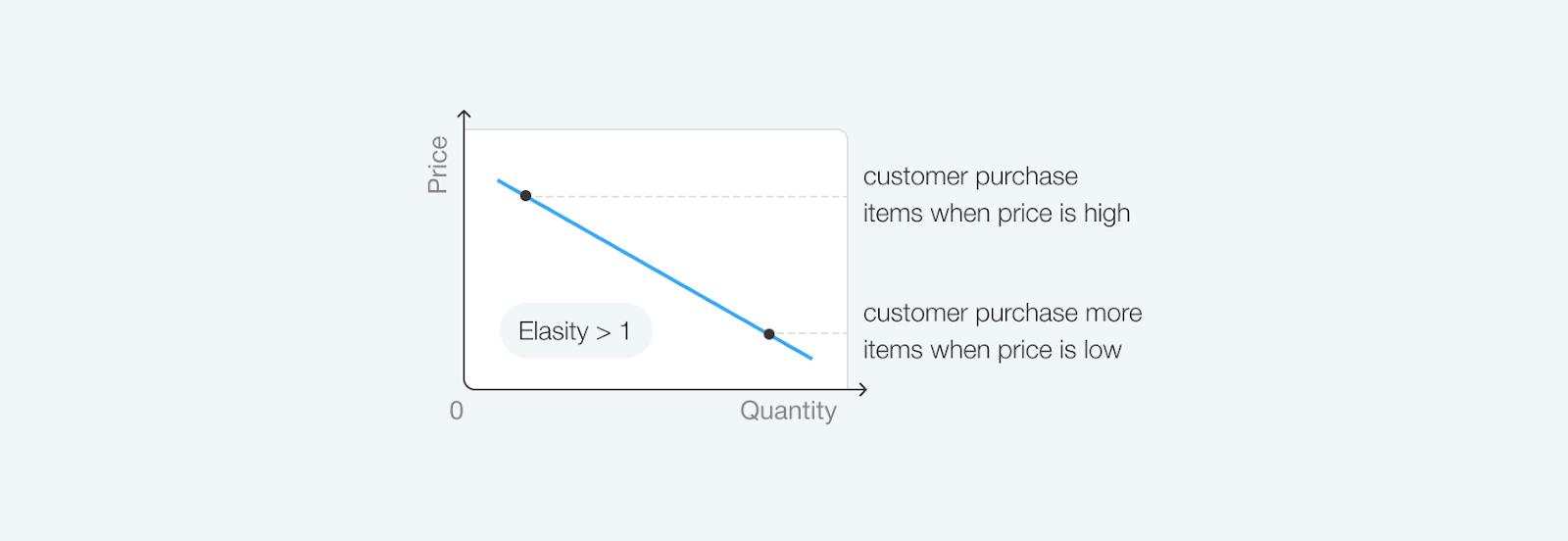

The demand is considered elastic in case elasticity is greater than ‘1’ and inelastic if it is ranked below ‘1’. In case elasticity is high, the demand depends on the price dramatically and may change within a short time period. The graph below illustrates the dependence.

Price elasticity of demand examples

Price elasticity of demand is a crucial concept in retail that helps businesses understand how changes in price affect the quantity demanded of a product or service. It measures the responsiveness of demand to changes in price and is calculated as the percentage change in quantity demanded divided by the percentage change in price.

One real-life example of how price elasticity is used in retail is in determining the pricing strategy for luxury goods. Luxury products are often used as elastic demand examples, meaning that consumers are highly responsive to changes in price. For example, if the price of a luxury handbag increases, consumers may be less willing to purchase it, leading to a significant drop in sales. On the other hand, if the price is lowered, sales may increase as consumers perceive the product as more affordable.

Another price elasticity example is in the pricing of essential goods such as food and household items. These products typically have an inelastic demand, meaning that consumers are less sensitive to changes in price. For example, in contrast to elastic products examples, if the price of bread increases, consumers may still purchase it because it is a necessity. However, if the price of a luxury food item like gourmet cheese increases, consumers may be more likely to switch to a cheaper alternative.

And two more simple price elasticity examples showing how the concept works in practice:

- Cheap packaged frozen vegetables are among the best elastic demand examples. Here is how it works: consumers are likely to frozen vegetables more during the short-term period, yet they won’t buy enormous amounts of vegetables even at low prices during the lasting period. This indicates the high price elasticity.

- Gasoline may serve as an illustration of a price elasticity example with inelastic demand. What it means is that drivers are going to buy almost the same amount of gasoline regardless of price changes. Of course, it doesn't mean that gasoline operators may put any price per gallon, but the demand or this kind of product is much more stable compared to the mentioned above frozen vegetables.

Determinants of price elasticity of demand

Now, the price elasticity of demand is different for various SKUs, e.g. gasoline and frozen vegetables. But what determinants make the demand for some products more elastic than for the others and how to find price elasticity? Here are the four major aspects that can help you consider whether the demand is likely to be elastic and vice versa:

- Product Substitutes. The more alternatives for a particular product are available, the more elastic demand is. If the price per chocolate bar of one brand is increased, the demand for similar bars of other brands grows.

- Necessities. It's not easy for consumers to give up buying particular products. If you are a car driver, giving up purchasing chocolate bars would be easier than reducing gasoline consumption. These types of products are called necessities and the demand for them is almost inelastic.

- Time and product lifecycle. It is also important to consider how long the product is available on the market. For example, for the new entries, the price elasticity of demand is low as there are few if any substitutes on the market. In contrast, the long-tail SKUs or ones under markdown are rather elastic products.

- Buying behavior. Some people are ready to buy particular products almost at any price. Cigarettes could be a good example along with the other products to which consumers might be addictive.

How to calculate price elasticity of demand?

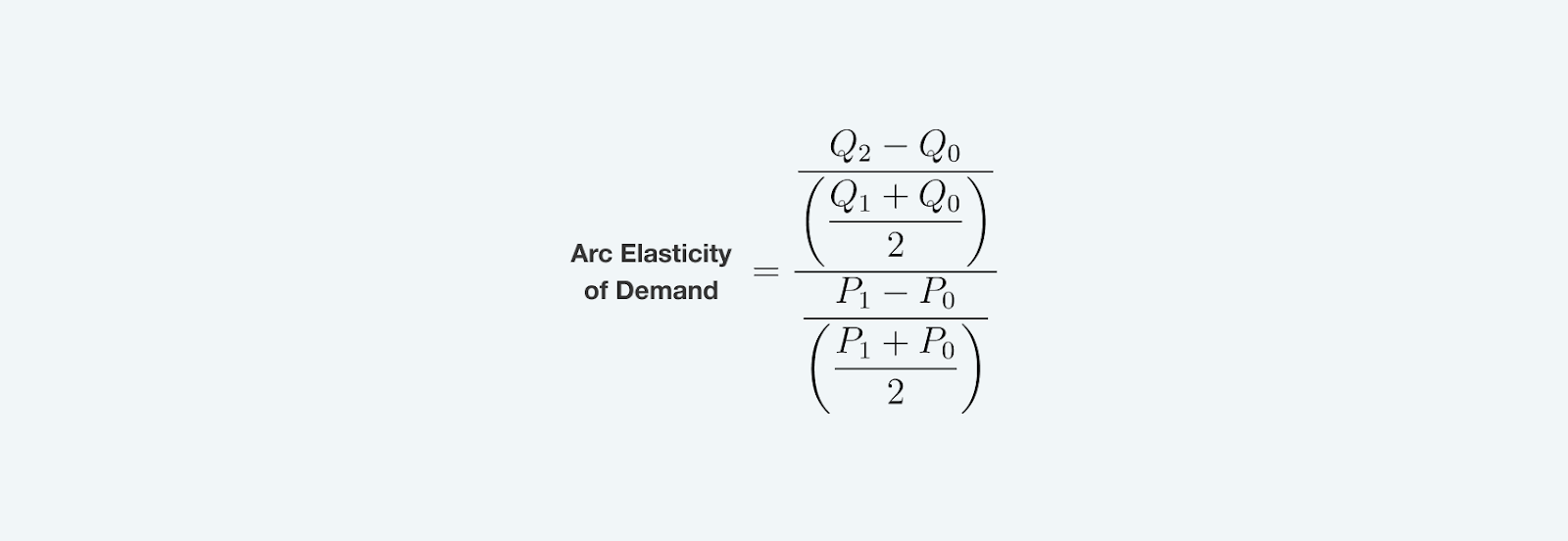

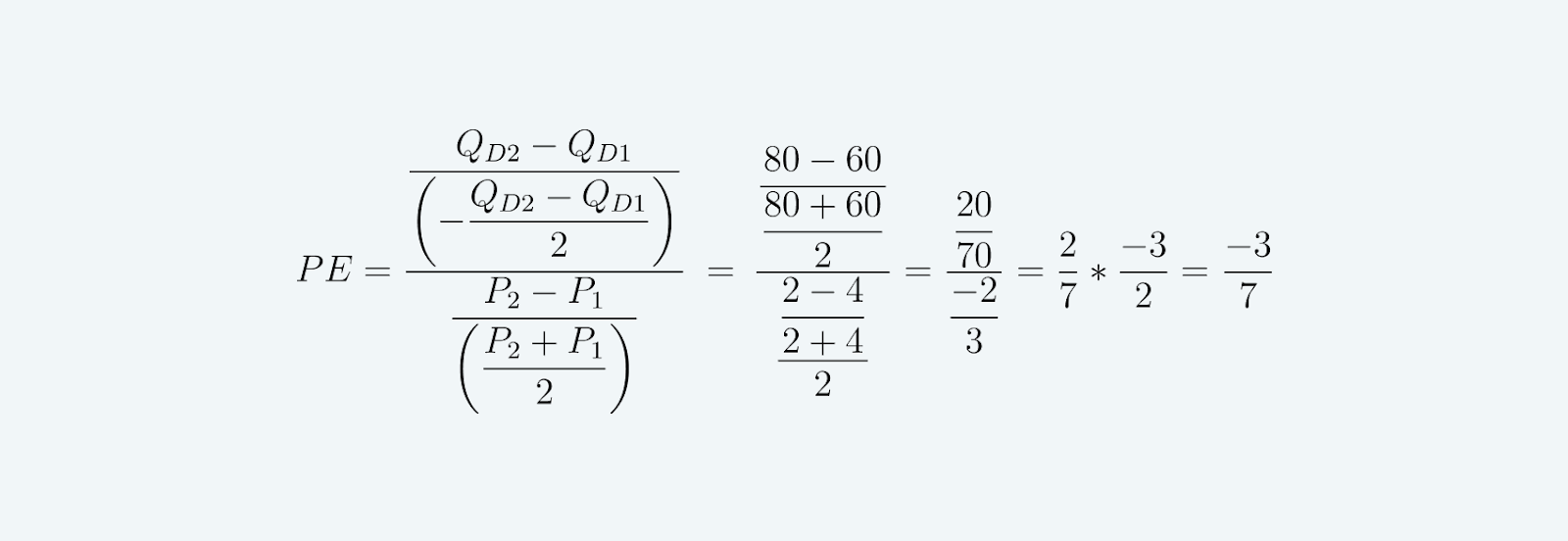

Imagine you're a pizzaiolo and the price of pizza is $4 while the demand is 60 slices of pizza per day. If the price is $2, the demand increase to 80 slices per day. To calculate price elasticity of demand, we use the following formula:

'Q' in the formula marks the demanded quantity of a product before and after the change in price while ‘P’ marks the old and new price. Let’s now use the numbers from above and put them in the formula. Here’s what we get:

What factors determine the size of the price elasticity of demand?

There are dozens of pricing and non-pricing factors that can impact the price elasticity of demand. According to a recent study, promo conditions and brand perception represent the most impactful factors defining the product’s price elasticity.

Taking into account the results of the mentioned above and other issue-related studies, the following implications for price elasticity management could be outlined:

-

If the cost is the same or higher than the cost offered by a market leader in the category, the elasticity gets higher as well. It is not the price itself that matters, but the relative price availability, i.e. the way it relates to the category leader and the round point (for example, $10).

-

To keep the demand optimal, retailers have to take into account the brand strength of the rivals. Therefore, if you’re a follower in price, you should calculate the optimal price index in regard to the segment leader.

-

Price elasticity also depends on the brand’s “commodification” i.e. its’ assignment to the market value. The brand value could be “diluted” cause the quality of commodities, like washing powder, is more or less the same for every brand. In such cases, consumers would buy a less expensive or better-promoted product.

-

Drastic price increase may ruin the price elasticity of demand. That’s why retailers use a rule of single-digit price increase implying that the round point should not exceed a 9,9% change. If the price is increased by 10%, consumers are likely to get discouraged and, eventually, buy less.

-

Mass-market products have the highest price elasticity of demand. In contrast, the price elasticity is usually lower for the economy and premium segments.

-

The price elasticity of demand is different for various groups of consumers. For example, it could be higher in regard to the group of returning brand-loyal shoppers.

The list of implications outlined above is not a comprehensive one, yet it may shed light on the complexity and variety of pricing and non-pricing factors impacting the elasticity of demand. The point is that price elasticity could not be estimated accurately in case only the basic factors are considered. To know how to calculate price elasticity properly, you must not disregard the implications listed above.

Types of price elasticity of demand

SKU-based pricing is hardly an effective approach when it comes to long-term goals achievement and strategic growth in retail. To minimize the risk of sales cannibalization and increase customer lifetime values, retailers have no other choice than shifting to portfolio-level pricing. Dividing assortment into particular groups of products depending on their elasticity is one of the major aspects underlying effective portfolio management.

As we’ve already discussed above, the higher the value of price elasticity is, the more sensitive become shoppers in regard to price changes. However, considering the price elasticity of separate products could hardly contribute to a sustainable pricing policy. That’s why retailers have know how to find price elasticity so they can classify products into groups.

There are numerous types of classifications used across industries. In her topic-related article for HBR, Amy Gallo outlines one of the most balanced price elasticity classifications. The author considers five zones of elasticity:

Perfectly elastic products

Even a minor change in price provokes a significant change in the number of products demanded. Products in this category are often referred to as “pure commodities”.

Relatively elastic products

Relatively insignificant changes in price may cause substantial changes in the number of products being demanded.

Unit elastic products

Any change in price leads to an equal change in the demanded quantity. In such a case, the price elasticity equals the point of ‘1’.

Relatively inelastic products

Even a significant change in price is not likely to change radically the demanded quantity of a product. The already mentioned gasoline may serve as a good illustration of a relatively inelastic product.

Perfectly inelastic products

The change in the price is not likely to have any impact on demand. In real life, perfectly inelastic products remain rather a rare case, yet some perfect monopolies might be an example.

The classification presented above represents a unified framework that should not necessarily fit every retailer’s portfolio. In each specific case, a comprehensive classification of products may vary depending on the industry, market type, geographical region or retailer’s size.

Reach goals with tech-driven price elasticity management

The basic answer to how to calculate the price elasticity of demand is neither too complicated nor sophisticated. However, on a scale of portfolio with hundreds or thousands of SKUs, the human-centric manual calculations of price elasticity might become a problem. If all these calculations fall on the shoulders of pricing managers, the latter could hardly find enough time to focus on strategic business tasks.

The advanced tech solutions, like Competera's price optimization software, are capable of processing thousands of data points finding even the most implicit, yet impactful connections between the demand on various products within the portfolio. Besides elasticity, demand-based pricing solutions powered by ML consider dozens of other pricing and non-pricing factors to craft the optimal value offering. Just think: managers consider only 3 pricing and non-pricing factors at once while pricing software can process up to 60 factors.

Each vendor uses its own approach to evaluate the price elasticity of demand. At Competera, we use the latest-generation neural network capable of processing billions of data points to ensure the integrity of results with the price effect prediction accuracy of 90-98%. The solution’s workflow is divided into two stages. First, the platform calculates the precise effect of price changes on demand and sales. Then, the state-of-the-art math price optimization uses the results of the first stage to craft optimal prices for the whole portfolio.

You would probably like to check some real-life cases showing how Competrera works in practice. Here’s one example: we’ve recently helped a leading Eastern European apparel retailer Intertop to get to the point of 10.3% gross profit saving along with 200 BPS of profit margin saving after only 6 weeks of using the Competera platform. You are welcome to explore more facts and numbers in the case studies page on our website.

FAQ

The range of pricing thresholds for particular products is very limited and these products are considered to be ones with high price sensitivity. These could be products new to the market or ones which are not essential for consumers.

Consumers are more price sensitive to the products that are not essential for them to buy. If prices for this kind of products are increased it might cause a drop in demand as consumers would no longer consider it reasonable to pay more for a particular item.