Content navigation:

- What Is Price Optimization Model?

- How Machine Learning Price Optimization Models Help

- Visualize Price Optimization Models To Find Opportunities

- Why Should Retailers Use Price Optimization Models?

- How Can Pricing Optimization Models Help Business?

- Advantages of Price Optimization Models

- Again: How Does It Work Exactly?

- Conclusion

What Is Price Optimization Model?

Price Optimization Models are complex algorithms designed to evaluate the change in demand at various price levels and match the results with the data on costs and inventory levels to craft optimal prices and maximize profits.

How Machine Learning Price Optimization Models Help

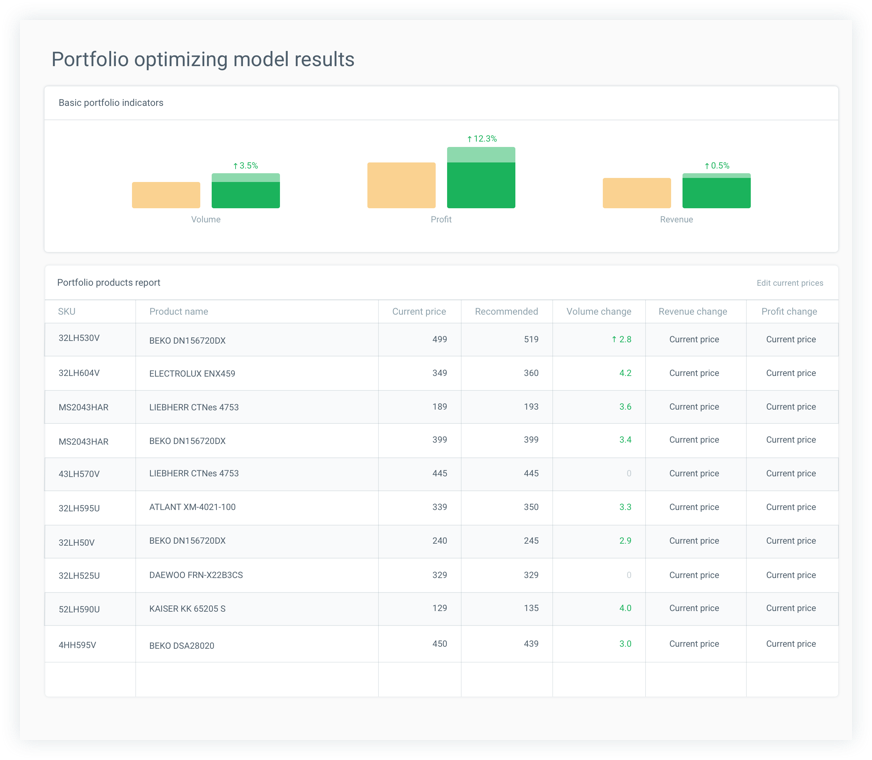

Optimization of Portfolio Pricing

The Problem

Retailers need to ensure they factor in all the interrelations between products when changing prices. It is challenging to determine which products and how many of them require price changes. Besides, sometimes a price change can damage KPIs instead of fueling them.

By changing the price of one product, the retailer triggers a chain reaction across a group of ‘neighboring’ products in the perception of the shoppers. Thus, the fine-tuning of portfolio pricing architecture becomes a rocket-science task, given the thousands of latent relationships between product sales.

The Solution

To maximize the KPI of choice the retailer needs optimization models that factor in both the elasticity of the product and its cross-elasticity with related products. An elaborate equation combines all of these coefficients and provides a solution for optimal prices across the retailer’s portfolio.

With such an optimization model, the retailer implements the so-called 'differentiated' pricing recommendations across selected products to predict and maximize the portfolio target of choice – volume, revenue, or profit – for each SKU.

Thus, retailers change the cost for each SKU individually, while taking into account the competitors’ actions and their own business needs and goals.

Data needed for this model: sales volume and price by product, and competitive prices for similar products (by day or week) for no less than three years.

Optimization of Prices on Individual Products

Price optimization in retail is the process of state-of-the-art math analysis to predict how the demand will change in response to different prices via various channels. Price optimization helps the business to craft prices that would meet customers' readiness to pay and maximize profits.

The Problem

Today, setting prices based on the retailer’s business goals alone is not effective anymore. As they do not live in a vacuum, businesses need to factor in a variety of factors that influence the cost, including price elasticity.

Price elasticity is a non-linear relationship between the sales volume and cost: the more elastic the prices, the more they influence the sales. It is difficult to calculate the right price that would maximize revenue without knowing exactly which are the elastic categories of products, and which of them should be repriced.

The Solution

The retailer identifies price points to predict with high precision how many items of product shoppers will buy at different price points, and maximize the parameter of choice, be it volume, revenue, or profit for a specific product.

Factoring in the price elasticity by identifying relevant price points helps:

-

Simulate the ‘real life’ market in price optimization retail with the help of elasticity curves for the products of choice by price points within an interval.

-

Make more precise sales volumes, revenue, and profit (optional) predictions for specific price change scenarios.

-

Create a list of competitors who impact the sales of the retailer, and measure the power of the impact.

Data needed: sales volume and price by product, competitive retailer prices for similar products by period (by day or week) for the past three years.

Visualize Price Optimization Models To Find Opportunities

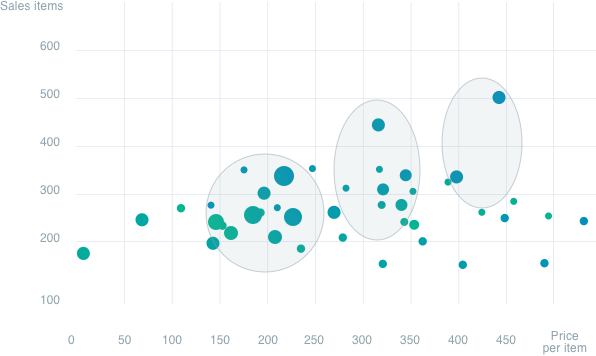

Price Partition

The Problem

It is difficult to predict if customers will perceive the price as justified, and easy to set either too high or too low a price. In both cases, the potential profit is lost.

The Solution

Products with similar value and set of features ‘stick together’ in a buyer's perception of clusters or segments. Shoppers are very specific about the minimum, average, and maximum price they are ready to pay for products representing each specific segment.

Img legend: Scatterplot of the top 100 SKU. The X-axis is the price per piece. The Y-axis is the sales. Optional visualization—the size of the bubble is equal to sales.

Price optimization algorithms group products within a category into 'clusters,' the centers and external borders of which are visible on the chart. This graph immediately determines which price segment a particular product belongs to, and the price variations interval which is ‘safe’ for sales.

The price optimization formula and visualization, data about product sales, and median price by product, by period (by day, week, or month) for the past year is needed.

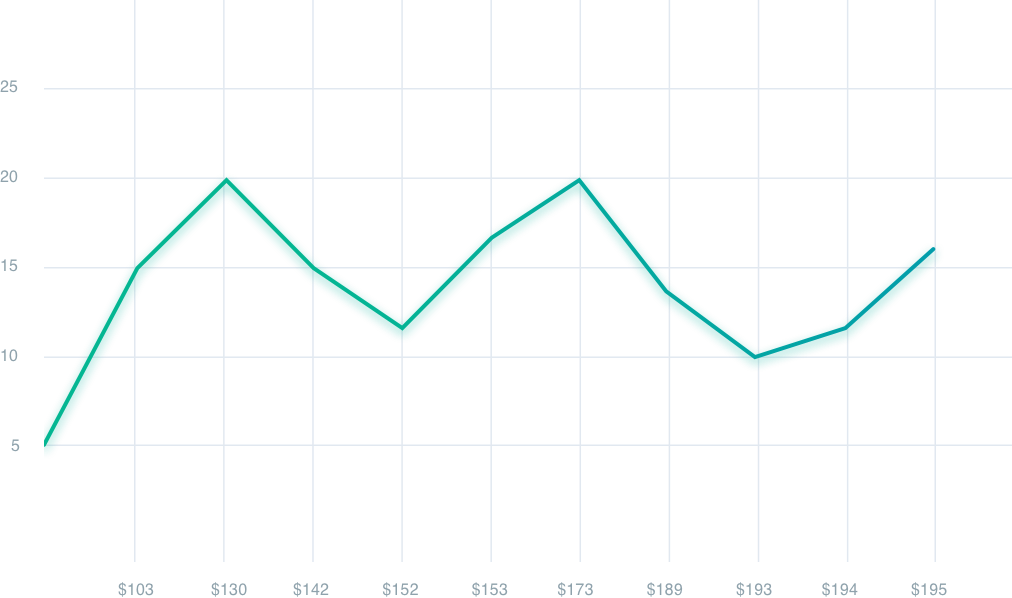

‘Magic’ price points

A price point is a retail price that allows for keeping a relatively high demand for a product.

The Problem

Buyers classify products into price segments or categories with clear “thresholds” according to their subjective 'value' indicator. The sales are maximized around the center of these segments and strive towards zero on their borders.

The seller’s assortment does not always take into consideration these patterns, which makes the sales suboptimal. Thus, retailers usually lose profit by increasing the price or offering a discount for “inappropriate” products.

The Solution

Price points in categories indicate the highest or zero sales for the products within a category. Knowing these “highs” and “lows”, the retailer can significantly increase sales by offering an optimal price for the right product.

Option 1. The top X of the SKUs are taken, and they are ranked by sales. Axis X - the price of the products. The Y-axis is sales per unit. Visual price breaks along the X-axis are thresholds of price segments.

Option 2. The sales of all SKUs in the market are taken. Products are grouped into price 'baskets', and then the 'top-X SKU' approach is applied.

With a price optimization retail system, the manager will be able to detect different price levels:

- Those which maximize sales

- Price “thresholds” should not be crossed.

Also, this helps retailers avoid the trap of following their competitors entering the “dead zone” and losing sales.

The model requires data about sales and prices (either median or weighted by sales) by product, by period (by day, week, or month) for the past year.

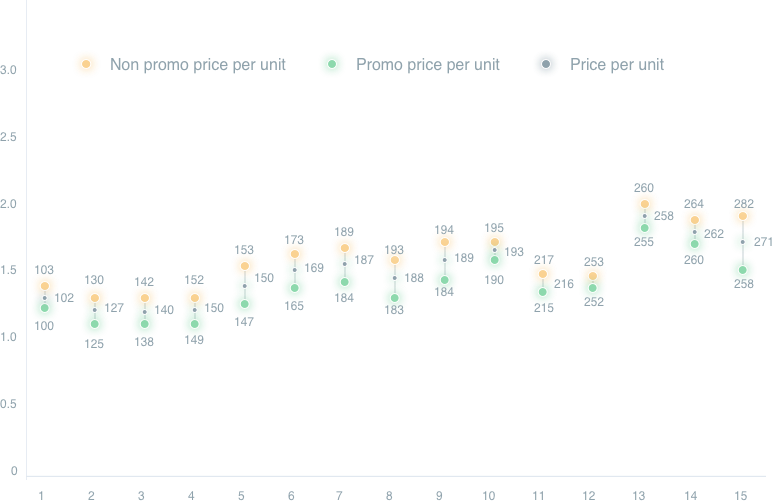

'Price Ladder' or Optimal Price Intervals

The Problem

As in the game of chess, the retailer needs to set optimal prices to neutralize the competitors or to milk their weaknesses. This task becomes complicated, given the proliferation of categories and the high dynamics of prices.

The Solution

To outplay competitors, the retailer needs to understand the category leaders' “alignment”:

- At which price points do shoppers buy them most often?

- What is the price range: from the “premium” price of expensive competitors to the “convenience” price with a deep discount or a regular price in a discounter?

It is challenging to keep a hand on the pulse since prices are dynamic and change every day. But dynamic pricing software may significantly ease the task.

Buyers are willing to pay the same price for similar products. The same rule applies to the price range (max — a convenience price, min — a promo price). The leader's most frequently encountered price is the benchmark from which to build the optimal price. The optimal “spread” is the leader's interval from the maximum to the minimum registered price.

Img legend: This type of chart is a 'candle/ladder chart.' The three points represent the minimum, maximum, and median prices for the observed period. In the chart, there is either the top-seller in the category or the same product of different retailers.

The ‘price ladder’ chart allows retailers to indicate the following:

-

the current price points;

-

the price points to play;

-

the retailer’s price positioning against competitors;

-

typical discounts in the category.

Data for this price optimization technique: the minimum, maximum, and median price by product by period (typically, a week or a month) by the seller. Eventually, using ML-driven pricing software, retailers can get market recommendations and predictions with 90-98% accuracy.

Optimal Promo Pressure

The Problem

Promotion pressure or volume per deal has significantly increased in recent years. Vendors (brands) and retailers often start “promo wars” which usually lead to a loss in sales or market share. It is impossible to determine the strategy to use at the beginning: whether to activate or deactivate deep discounts or offer low prices every day.

The Solution

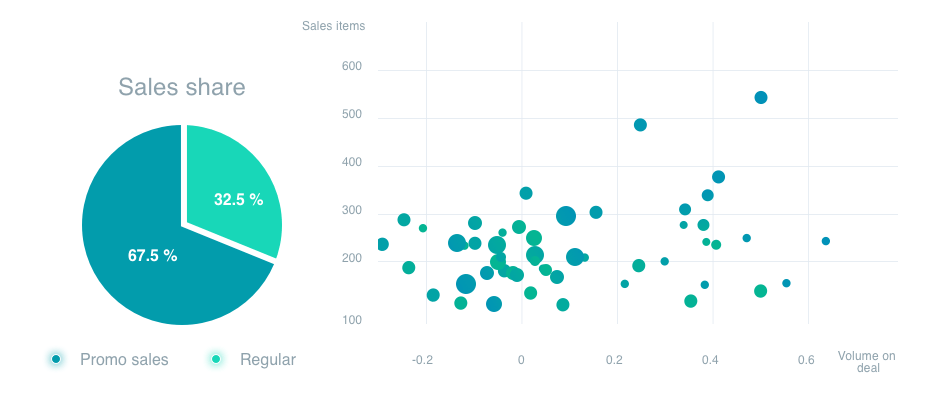

Retailers should analyze the share of the volume sold per deal across the total category and among the top sellers to evaluate promo pressure that would be optimal for the category.

Scatterplot of the top 100 SKU. The X-axis is the % of sales per deal (or the % of registered promo prices to all tracked sales cases). The Y-axis is for regular sales (or tracked sales). A scatterplot visualizing sales items and volume per deal will highlight the products that have optimal promo pressure, and those that are overselling with a discount.

After analyzing such a chart that highlights the “highs” and “lows” of promo pressure, retailers should choose the moderate path.

Data necessary for such a model: the minimum, maximum, and median price by product by period (typically, a week or a month) by the seller.

Why Should Retailers Use Price Optimization Models?

Price optimization in retail is at the root of the force needed for profit generation in retail. Retail pricing analytics is powered by science, which is used to price items correctly without the need to discount them.

Want to know a secret? Blanket discounts aren’t working anymore. The numbers of Nielsen Homescan, regardless of which channel, showed the following after 52 weeks, the last day is October 8th, 2016: “spend on offer” for brands such as FMCG went down 40% from 42% in 2015 and 44% the year before.

Maciej Kraus, partner at Movens Capital and Stanford guest lecturer in pricing says that price optimization is the right tool for retailers to find the balance between two major goals — increasing their profits right here right now and investing in their long-term growth — and succeeding today and tomorrow. Using machine learning algorithms, the most advanced technology the market can offer is the right way to optimize pricing as it’s quick to implement, makes you 100% sure in every one of your pricing decisions, and ensures the fastest ROI.

Price optimization is the right tool for retailers to find the balance between two major goals — increasing their profits right here right now and investing in their long-term growth.

Picture this! With the algorithms building highly-accurate price models, it’s easy to hit the stock level, accurately manage inventory as well as get larger gross margins.

But that’s not all.

How Can Pricing Optimization Models Help Businesses?

Retail price optimization models let businesses completely take advantage of what shoppers aren’t opposed to spending by knowing both when and how they spend.

With the proper analysis of the manner in which consumers spend, businesses are able to make the most revenue in each situation.

Looking at how an item did based on its previous time on the market is no longer useful since there are a number of factors that influence it today. A few of them include:

- The number of items

- The complexity of items

- The fact that buyers are more aware of prices

Therefore, let’s take a look at how retail businesses can use price optimization to their benefit.

Advantages of Price Optimization Models

1. Reap immediate financial benefits

Solutions for retail price optimizations provide opportunities to concentrate on various goals, whether it be margin or the amount of sales conversions, etc. For instance, with optimized prices, sales in a specific area aren’t as big anymore, yet the margin as a whole has gone up.

In fact, the Chief executive officer at Michael Kors Holding LTD claims that buyers no longer care about the price as much as they do the item itself. This is backed up by the fact that both their Mercer handbags and smartwatches were all sold at their initial price, thus making them as profitable as they can be.

Therefore, if Michael Kors can do it, then so can you.

2. Working in parallel with categories

With the help of both planning the optimization of prices, the prices of the methods will be allocated to specific pricing strategies, and additionally, they’ll be put to work automatically. Therefore, both consistency and cohesion are guaranteed for the pricing strategy which helps with the management of the entire category development.

This is also highly beneficial to the category manager since it’ll ease up and simplify their incredibly complex work of dealing with all of the categories.

3. Automation

Solutions for retail price optimizations help automate the entire optimization process. This helps remove the need for manual work, thus reducing the possibility of any human-made errors occurring. Therefore, incorrect predictions won’t be made so optimization won’t negatively influence business in any way shape, or form.

There’s no need to make random predictions and hope for the best. With the data that businesses can receive today, they can dynamically adjust their costs automatically whenever a change may occur, across all channels.

Do you wonder why Amazon is the giant that it is today? Well, it doesn’t shy away from price changes! They adjust the prices millions of times a day, and they do so with compelling price optimization retail software.

4. Guarantee consistency

There’s no longer the need to worry about whether or not prices are consistent when using retail pricing analytics. Past mistakes came from inconsistencies with the units used or the pricing for similar, yet different items due to features such as size or color. As a result, businesses can depend on the data to always be correct and relevant.

5. Speeds up how quickly decisions are made

There’s an increase in the rate at which decisions are made due to automation, which provides reviews and comparisons with rivals very often.

Again: How Does It Work Exactly?

Let’s take a look at how Competera, a price intelligence solution, optimizes prices with its platform:

1. Data is both gathered as well as processed in order to make your prices competitive and then the information analyzed from your own business is used to figure out the cost. You can learn more about these strategies here.

The data received is qualitative and returned very quickly. It’s also received promptly.

2. Through data analysis, the raw information is turned into quality data that is actually used through any, for example, discrepancies that may have occurred. Their user-friendly interface then allows for easy decision-making through valuable visuals.

3. After the data analysis, a retailer can begin to make their strategies and goals. For each segment, they start item segmentation to figure out how willing consumers are to pay in order to adjust prices. Their platform helps predict the result of any pricing choices they make, and can even try them out beforehand to figure out which route would be the most optimal.

4. Then the platform automates the decision process and also creates the method for changes to occur automatically based on any changes in the market. It also sends out notifications when any such shift occurs.4.

5. Finally, outcomes are more predictable now that everything has been tried, adjusted, and perfected, therefore the tool knows how various changes influence the company, and it can now predict accurately when the next change could potentially happen. This is accomplished due to the science, machine learning, as well as price simulation that is at the platform’s core.

As you can see, with robust price optimization technology, businesses can reap immediate financial benefits, work side by side with numerous categories, automate processes to ease up the workload and ensure accuracy, guarantee consistency of the data collected, as well as speed up the decision-making process. Therefore, there’s no other direction to go than up should you choose to go the price optimization route. Success is just around the corner.

Conclusion

There are many ways retailers can improve their sales while keeping their margins healthy. All of these approaches require the adoption of price optimization processes, including data management, algorithmic decision-making, and expert supervision.

Competera uses the blend of ML and AI technologies to predict the impact of every pricing or promo campaign based on the data about all the transactions in the retailer’s pricing history, seasonality, customer behavior, and competitors’ actions. In addition, it factors in retailers’ business needs and goals to help them increase revenue.

FAQ

Price optimization in retail is a pricing approach based on state-of-the-art math analysis used to predict how the demand will change in response to different prices via various channels.

Price optimization is important as it helps the business craft prices that would meet customers' readiness to pay and maximize profits.