Content navigation:

- What is a dynamic pricing algorithm?

- Which industries use dynamic pricing?

- Algorithms & machine learning for dynamic pricing

- Traditional pricing is dead. Long live algorithmic pricing

- How does dynamic pricing algorithm work?

- How to choose dynamic pricing model?

- Dynamic pricing algorithms in use

- Prepare to the era of algorithmic pricing

What is a dynamic pricing algorithm?

A dynamic pricing algorithm is a code-driven technology that adjusts prices in real time based on dozens of both pricing and non-pricing factors, including competitive data, geography, customer preferences, and other market conditions.

These algorithms leverage advanced AL and ML techniques that enable retailers to maximize revenue, profit margins, and market share using pricing. By continuously analyzing and adapting to changing markets, dynamic pricing decision support enables businesses to stay competitive, gain market share, and meet customer expectations more effectively.

Which industries use dynamic pricing?

Although dynamic pricing model machine learning is used predominantly in retail, it is also utilized across other industries. These include hospitality, real estate, transportation, and other industries. Simply said, dynamic pricing decision support becomes more popular in every economy segment where multiple market factors are constantly changing and where businesses want to improve customer satisfaction without risking financial metrics.

A good dynamic pricing algorithm example can be found in the transportation industry. Airlines and even ride-sharing services implement dynamic pricing solutions to adjust prices right after a change in demand is observed. If a particular destination quickly becomes popular, the flight prices will grow almost immediately too.

Here is another dynamic pricing algorithm example. The prices for events, sports games, or concerts become more defined by dynamic pricing decision support rather than traditional pricing approaches. It means that the difference in demand for one or another event will ultimately make a ticket price either higher or lower.

Algorithms & machine learning for dynamic pricing

Algorithmic pricing is a process of setting optimal prices using the power of machine learning and artificial intelligence to maximize revenue, increase profit or gain other business goals set by retailers. Algorithmic pricing is one of the most powerful means of getting a competitive advantage.

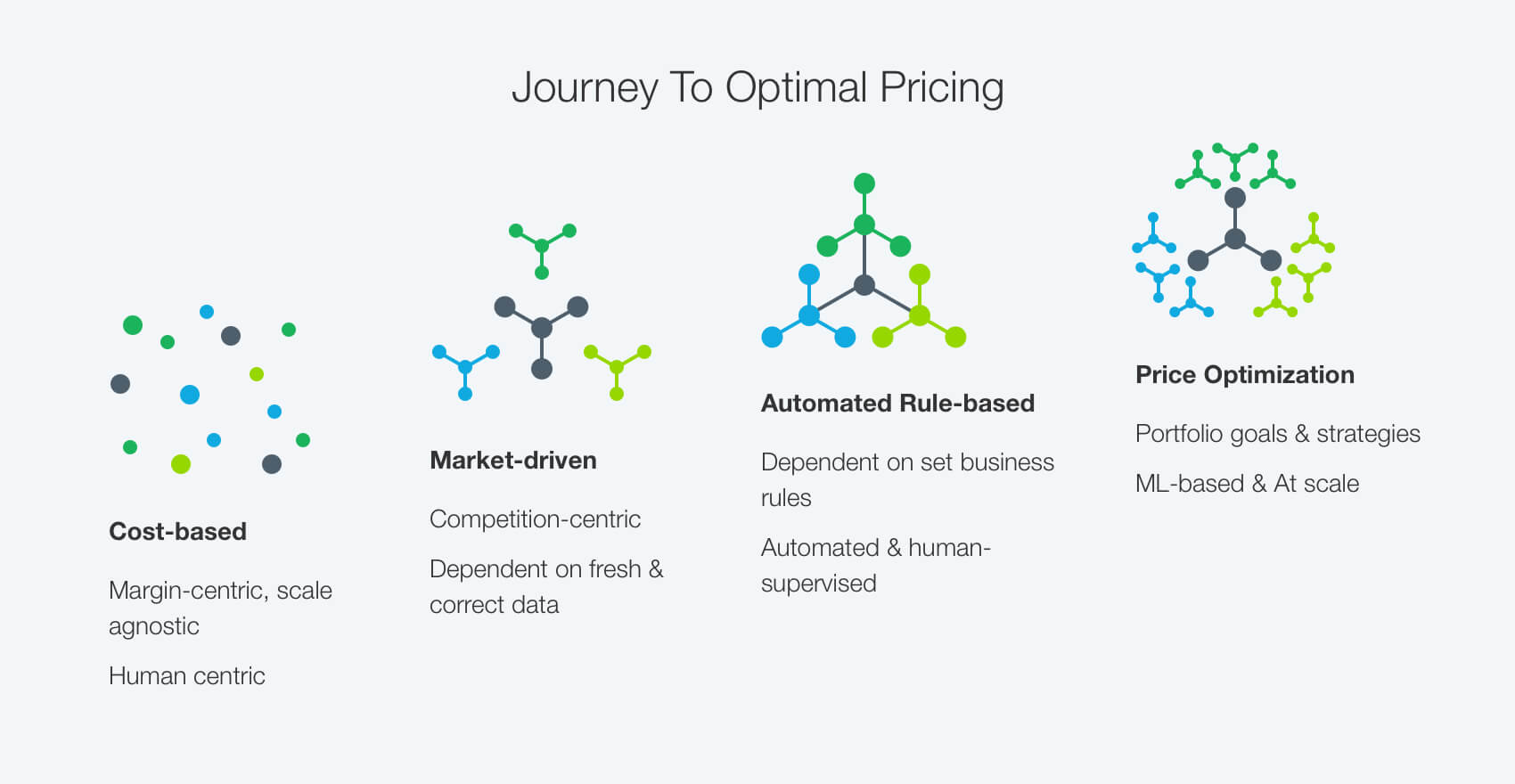

In this article, we’ve compiled everything you need to know about the benefits, models, and practical implementation of dynamic pricing model machine learning. An ongoing technological shift revolutionizing the retail industry proves that there’s always room for further improvement of pricing policy. The guide will be useful for all retailers regardless of their position on the journey to optimal pricing. Let's deepdive to specifics of demand-based approach and a role of price elasticity.

Traditional pricing is dead. Long live algorithmic pricing

The roots of traditional pricing approaches trace back to the 1980s. At that time, retailers started to hire consultancy agencies to somehow systematize their pricing policy. These early attempts to manage pricing strategically were reliant on a manual calculations of price based on human-centric analysis of the cost, demand, and supply. As a result, the two basic and most common approaches to pricing appeared:

-

Premium pricing was applied by the retailers willing to differentiate them from other players as ones selling better or unique products. In practice, premium pricing implied often manual collection of competitors’ prices that were then used as a reference point to be increased by a predefined pricing point.

-

Penetration pricing was an opposite approach based on offering prices lower than other retailers. Even though human-centric penetration pricing helped retailers to increase customer loyalty, the approach was hardly effective in terms of increasing revenue or sustaining profit margin.

Nowadays, many retailers continue to use these approaches in practice. Either premium or penetration pricing might bring some results, however, they still lack efficiency when it comes to sustainable growth and strategic goals' achievement.

First of all, traditional pricing relies on human-centric decisions and manual checks being highly vulnerable to mistake. Besides that, traditional pricing requires managers to focus on separate SKUs rather than the whole portfolio. As a result, the risk of cannibalization effect increases.

Another disadvantage shared by both premium and penetration pricing stems from the fact that they target only a particular limited group of customers. That’s why retailers might face difficulties with increasing their customer base and growing strategically.

Dynamic pricing model machine learning can help overcoming these limitations. The very first prototypes of dynamic pricing solutions released in the 1990s were expensive and rough in integration. Then, in the 2000s, the new generation of highly-accurate and easy-to-use solutions appeared. The dynamic pricing engines were now capable of considering cross-elasticity and demand fluctuations while processing billions of data points at once. The new era of pricing has begun: dynamic algorithms are used by all types of retailers across the industries.

Using machine learning algorithms to optimize the pricing process is a must for pricing teams of mature retailers with at least thousands of products to reprice regularly.

How does dynamic pricing algorithm work?

In most cases, advanced pricing algorithms are powered by the combination of AI and ML technology. In contrast to traditional pricing, the dynamic approach ensures scalability of the pricing decisions. Subsequently, algorithmic pricing enables retailers to shift from SKU-centric to portfolio-based pricing in which all sorts of both explicit and implicit dependencies are considered.

Dynamic pricing algorithms also bring flexibility as retailers can set prices targeting different groups of shoppers. The latter is achieved by crafting an optimal value offering based on market trends, demand fluctuations, customer behavior, purchasing power, and plenty of other factors.

Dependency between price and demand is a core estimation when it comes to dynamic pricing algorithms. With relevant data on this dependency, the revenue-optimal price could be calculated using the formula below.

In the equation, p marks the price while d(p) stands for a demand function. The dynamic software engine extends this formula adding a range of other pricing and non-pricing factors to be considered. Typically, these may include procurement expenses, inventory costs, demand cannibalization between particular products, competitor prices, promo activities, and other factors. The more diverse and relevant data points are processed by pricing algorithm, the more accurate results it generates.

The vast majority of pricing algorithms use historical sales data based on which the demand function is estimated. The workflow of a typical pricing algorithm goes through the four main stages:

- Historical data on price points and demand on particular products is consumed by the engine to be processed using the dynamic pricing algorithm

- The demand function is build based on identified dependencies

- The state-of-the-art math processes dozens of pricing and non-pricing factors to generate optimal prices

- After the recommended prices are applied, the algorithm goes through the cycle again taking into account the latest repricing results

The workflow outlined above represents a unified basic pattern while, in each specific case, the model of dynamic pricing algorithm is aligned with the targets and constraints of a retailer.

Dynamic pricing providers offer a wide range of tech approaches to make their pricing engines more effective. At Competera, we use the latest-generation neural networks capable of processing billions of repricing scenarios to ensure the integrity of results with the price effect prediction accuracy of 90-98%.

But building a forecasting model is a complex process that might be different in every case depending on the particular goals and needs of a retailer. For example, Competera data science team has recently designed a model for a retailer working in high-seasonality business using the recurrent forecasting approach. The right combination of tools and approach helped to forecast the revenue with a 96+% accuracy.  Algorithm-driven price optimization — the pricing journey's top point

Algorithm-driven price optimization — the pricing journey's top point

Competera’s dynamic pricing engine is based on a two-stage machine learning. The first stage implies calculating the precise effect of price changes on sales. And the second stage is state-of-the-art math price optimization which uses the results of the first stage to recommend prices for the whole portfolio.

How to choose dynamic pricing model?

The workflow described in the previous section relies on the use of historical data. What it means is that most of the pricing algorithms learn demand function passively. In case of products with a relatively long life cycle and a stable demand function, this could hardly bring any problems. But the difficulties might appear when it comes to brand-new products or ones with a short life cycle and unstable demand function.

In such case, the lack of accuracy might result in significant financial risks. It means that retailers face an exploration-exploitation problem as they have to find optimal prices with a very limited time for testing different pricing approaches and collecting the demand points. And that’s when a retailer has to choose the right dynamic pricing model.

To put it simply, the choice of a dynamic pricing model depends on the retailer’s maturity level, overall market strategy, and specific business goals. Let’s look into some typical examples of goals retailers might seek to achieve while choosing a pricing model:

-

Maximize revenue from selling a product with an unknown demand function. In such case, the dynamic pricing model’s primary goal implies building a demand function based on the history of similar products’ sales and other related data. Then, the engine then generates prices that would maximize the retailer's revenue.

-

Increasing gross profit without dropping marginality. The pricing algorithm is designed to generate a price that would balance two metrics.

-

Avoiding inconsistent customer experience. In this case, satisfying a particular service level is the main target of an algorithm generating prices.

-

Ensuring that the cannibalization effect between particular products is minimized. The dynamic pricing model is designed to generate prices for a new product with no risks for KVIs’ sales.

If you decide to switch to dynamic pricing, you must first have a clear vision of your current business position and the point where you want to get.

Dynamic pricing algorithms in use

Above we've outlined some specific needs that can stimulate a retailer to implement algorithmic pricing. The good news is that dynamic pricing engines rarely cover a single need alone but they bring integrity and coherency to the entire pricing process within the organization. What it means is that a retailer that has implemented an engine often gains plenty of additional wins going beyond the initial expectations.

The case of a leading sporting goods retailer Wiggle Chain Reaction Cycles may serve as a great illustration of the statement. The company's initial request implied the repricing time reduction through automation. But after the complex solution was implemented, Wiggle has not reduced the repricing time by 50% but also got full competitive landscape coverage at lower costs. The latter was achieved through the smart marketplaces' monitoring run by the Competera platform. Eventually, this market data was used in the complex cascade of pricing rules calculating the best prices.

Another good example of dynamic pricing algorithms use is the case of a large Eastern European electronics retailer gaining a 4.5% uplift in gross profit after using Competera’s demand-based engine. The use of ML-driven algorithmic pricing on portfolio level enabled the retailer not only to increase gross profit but also gain an uplift in other key business metrics, including profit margin and total revenue. The real-life practice shows that algorithmic pricing not only resolves particular challenges but also helps to harmonize the entire process and achieve sustainable strategic growth.

Prepare to the era of algorithmic pricing

One of the greatest advantages of dynamic pricing is that it retakes a lot of routine and time-consuming work from managers. Just one example: the use of advanced pricing software can save 4 hours for category manager per repricing cycle. What it means is that managers can focus on more creative and strategically important tasks, like building a unique shopping experience for their customers.

Obviously, the use of dynamic pricing has no alternative. ML-driven algorithms process thousands of SKUs and data points to generate optimal prices. If a manager can deal with only 3 or 4 factors while crafting a single price, the advanced pricing software, like Competera, processes 60 factors at once.

Of course, switching to algorithmic pricing requires time, resources, and efforts. Each vendor has its' own approach and it's not always easy to choose the right dynamic pricing engine. We believe that in a rapidly changing industry like retail, the solution's time-to-value is crucial. That's why Competera provides retailers with proven results and the first ready-to-use recommendations in just 8 weeks after launch.

Numbers speak better than words, so try our market test to see how dynamic pricing engine can boost your business.

FAQ

There are various instances of dynamic pricing engine use depending on the goal set by the business. For example, in case the goal is to maximize revenue from selling a product with an unknown demand function, the dynamic pricing model’s primary goal would imply building a demand function based on the history of similar products’ sales and other related data. Then, the engine would generate prices that would maximize the revenue.

Dynamic pricing is one of the most sustainable approaches to revenue and margin growth. Other advantages of dynamic pricing stem from the fact that this approach enables businesses to solve complex challenges by implementing a pricing architecture of any complexity. The disadvantage is the cost. Only mature businesses can afford to use advanced dynamic pricing engines.