4.5% uplift in gross profit after using Competera’s demand-based engine

Omnichannel electronics giant sees 4% growth in key business indicators from price recommendations suggested by Neural Networks.

Our client is one of the leading Eastern European retailers in the consumer electronics sector. With a versatile range of products, the retailer sought to optimize its pricing process, and as a result, to increase the margin. And do it using the portfolio pricing strategy. After implementing Competera’s bespoke deep learning algorithms for price recommendations, the client was able to achieve several key business objectives, including a 4.5% uplift in gross profit.

4.5%

uplift in gross profit after 8 weeks

4.4%

increase in total revenue of the test category

42 000

applied price recommendations during PoC

The challenge

Since our client is the #1 consumer electronics retailer in their country, the assortment of their categories can be described as a variety of brands of any model, color, or shape. Managing over 3$ billion yearly revenue, the pricing team was motivated to streamline all their pricing processes. In addition to that, they required a solution that could assist in solving a number of challenges.

Due to the high number of similar goods available on the market, price changes for similar products of direct competitors affected client’s sales more than changes in their own prices.

Every pricing decision had to take into account cross-impact dependencies with different reactions of demand to price changes.

The client faced sales changes within the portfolio from more profitable to less profitable products.

The need for frequent repricing of large quantities of SKUs.

The Solution

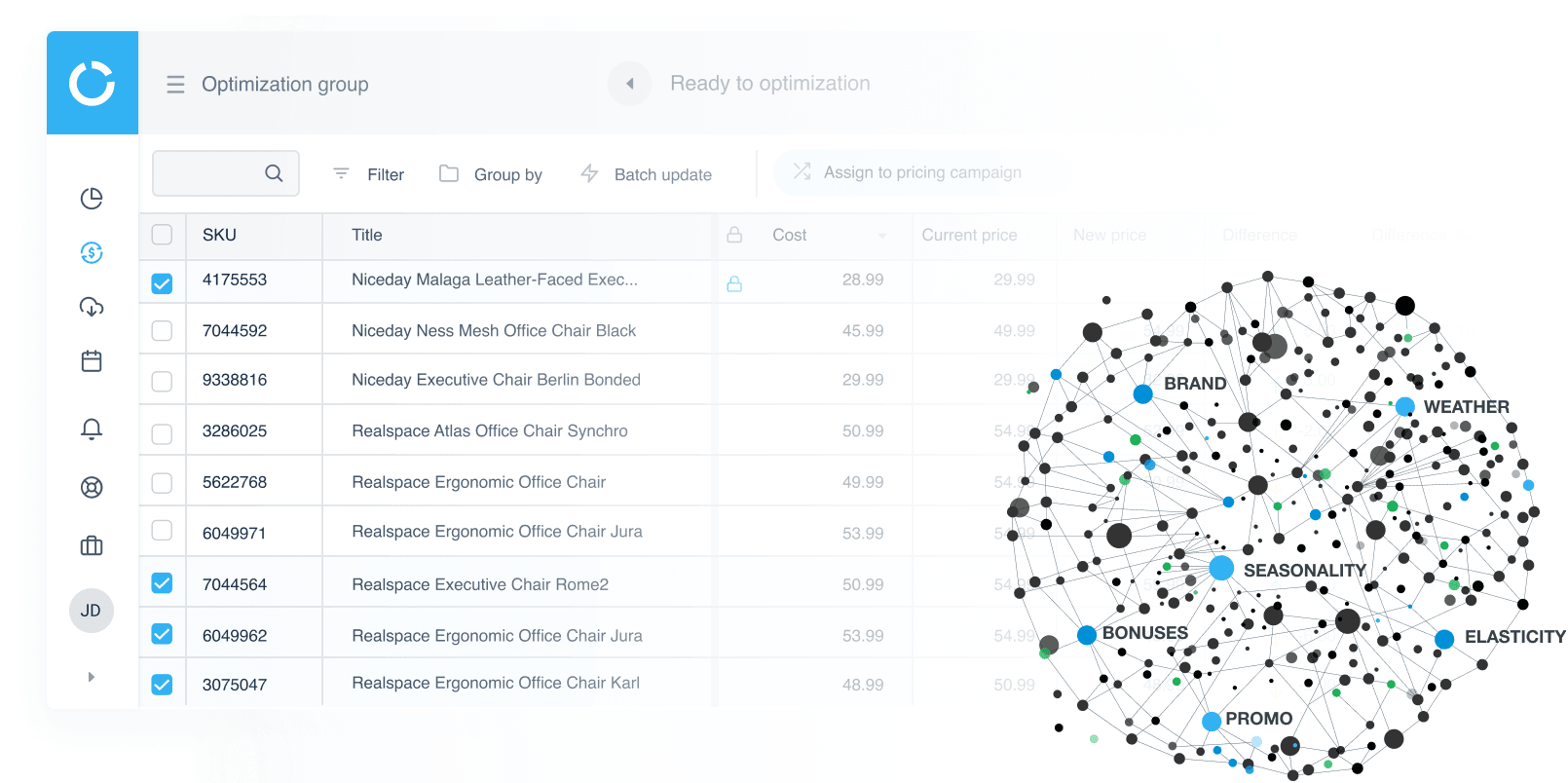

To meet these challenges, our pricing architecture team suggested using a demand-driven pricing engine powered by Neural networks. It considers price elasticity of demand, cross-elasticity, competitive environment, and other crucial factors to recommend optimal prices. Historical data collected throughout 2.5 years (sales, stock, geography, margin, motivation, promo, etc.) was taken as a foundation for calculation and design of ML algorithms.

Execution

The PoC Design

The project’s success was determined by the growth of the target metric – the gross margin. Using algorithmic pricing from Competera, the client expected to see the metric grow by 5% or more.

Revenue retention was chosen as the metric to protect. In addition, the algorithms had to automatically accept and take into account the client’s existing pricing rules, recommending changes only to shelf prices. The decision to conduct promo remained on the client’s side as well as the list of potential promo models.

For the Proof of concept launch, we chose a method of comparing the test and the control groups across two different regions with similar sales histories and customer behavior.

The implementation

Full deployment of the optimal prices recommendation platform goes through a multi-stage process.

Set project goals

Integrate, set and check continuous data flow

Training of ML models

Use price recommendations for one test category

Process debugging and model improvement

Scaling

The fine tuning (key learnings)

- ML algorithms can round prices in accordance with specific business rules of the client. However, this can lead to a significant impact on products with low price elasticity.

- Customers systematically return certain goods. For instance, the ones taking part in “If you find a cheaper product, we will refund the difference or take the product back” promo mechanics. Ignoring this fact leads to inaccurate forecasts and, as a result, a drop in the target metric.

Results

While finding optimal price points across the range, our algorithms mostly make two types of decisions. The first situation is when a product's demand is elastic to its price. It reacts well when price decreases and badly when price increases. This situation is quite typical for the economy price segment. Typically, algorithms recommend decreasing prices after facing such behavior. You can see the reaction on the charts below.

Note: Each chart displays the historical data of one particular SKU and contains three metrics. They are the total revenue from sold products per day, a shelf price set by the customer team, and a price recommended by Competera. If the shelf price index correlates with the price recommendation index, it means that the pricing team accepted the suggested price.

Let's consider the second frequent type of situation when the product reacts well to a price increase. In such a case, an algorithm would recommend setting a higher price. We will observe an increase in profit without a fall in revenue. For example, we can see it on these charts.

Of course, these are just a few options suggested for specific products and specific situations. If you look at the overall picture, our work with each SKU separately and in relation to each other showed cumulative growth in general. Thus, the growth of the two targets was 4.4% in revenue and 4.5% in gross margin. Thanks to effective cooperation with the client, all the project goals were achieved and the company has moved to the next stage of its pricing journey.

Download PDF file to share it with whomever you deem right

A consumer electronics retailer maximized revenue without losing their margins

Download PDF file

Competera Pricing Platform helps retailers to craft optimal offers

Want to know more or leave a comment? Email us at [email protected]