Content navigation:

- Introduction

- What is price test and why it is a win-win?

- Why price testing matters?

- How to do a pricing test?

- What are the risks of a/b price tests and how to manage them?

The Market Track study reveals that nearly 80% of customers compare the prices using their smartphones even while they are at a brick-and-mortar store. What it means is that the price remains an integral factor in the optimal value offering sought by consumers. But how can retailers find the price that would both satisfy the customer requests and help the business to reach goals and grow strategically? Well, price testing gives the answer.

In this entry, we’re going to explore what ‘price test’ actually means and why it is mutually beneficial for business and consumers. We’d also take a look at some useful tips on doing price testing so you can use this article as a practical guide. Specifically, we’d discuss the a/b testing model, the controversy and risks of the method, as well as approaches to overcoming these drawbacks with the help of pricing software. Let’s go right down to business!

What is price test and why it is a win-win?

Price testing is a method used by retailers to evaluate the correlation between demand and price change. In other words, price testing helps retailers to measure the demand elasticity. Knowing the latter, retailers can set optimal prices that would both satisfy the customer requests and contribute to the business goals' achievement.

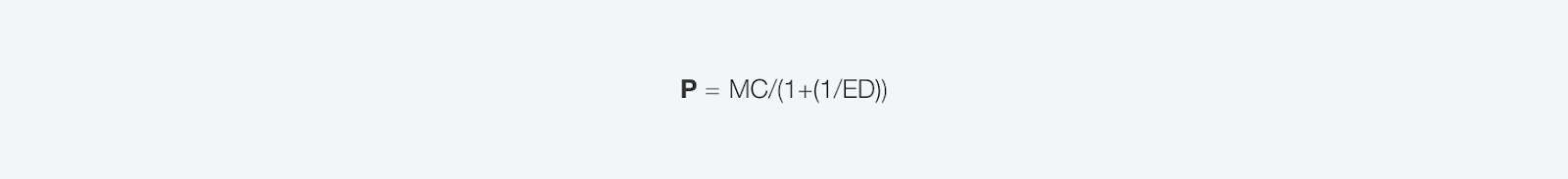

The fundamental formula to find the best price goes as follows: P in the formula stands for price, ED marks the demand elasticity, and MC represents marginal cost. Price testing represents the most effective means of evaluating the demand elasticity as it helps to reveal the price point for each product in the retailer’s assortment. What it means is that retailers can maximize profit while sustaining an appropriate level of the customer lifetime value (CLV). The other benefits of using pricing tests include:

P in the formula stands for price, ED marks the demand elasticity, and MC represents marginal cost. Price testing represents the most effective means of evaluating the demand elasticity as it helps to reveal the price point for each product in the retailer’s assortment. What it means is that retailers can maximize profit while sustaining an appropriate level of the customer lifetime value (CLV). The other benefits of using pricing tests include:

-

Price testing could be done in a limited scope as well as differentiated in time and product category, so the changes would not confuse the shoppers.

-

This method enables retailers to apply differentiated pricing strategies to particular categories or SKUs.

-

The complex price testing gives a comprehensive vision of the demand elasticity and cross-dependencies between the sales of different products.

Why price testing matters?

In the previous section, we’ve mentioned some fundamental terms, like ‘price point’ or ‘demand elasticity’. These terms are an essential part of the retail professional vocabulary, but not all managers are aware of how exactly these categories are connected with price testing. That’s why we’re going to dig deeper into some theory behind price testing.

So, why should retailers test prices? Setting prices for products with a lasting sales history is always easier because you have historical data revealing the way a particular price change could impact the demand. But imagine you have to price a new product without relevant data from the past sales. That is the case when price tests can help.

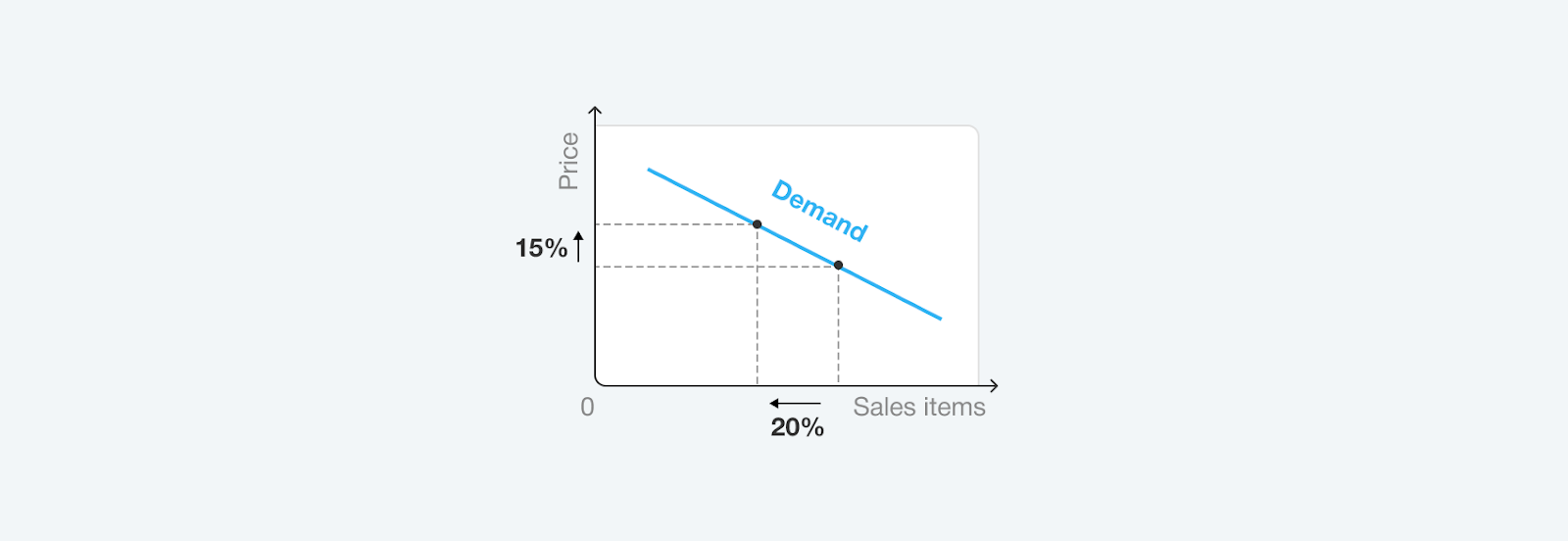

The basic assumption retailers often use while pricing new products implies that the higher the price is, the lower would be the demand. On the other hand, the price should also not be too low as there is always a risk of financial losses. These two points are rather simplistic, yet they shed light on the way price elasticity of demand works. The point on the graph where the retailers receive as much profit as possible is called ‘price point’. Sometimes, like in the case of brand-new products, price testing is the only appropriate way to find the price point.

The point on the graph where the retailers receive as much profit as possible is called ‘price point’. Sometimes, like in the case of brand-new products, price testing is the only appropriate way to find the price point.

How to do a pricing test?

The first thing needed for a test is the starting price. You need to choose an initial price that would make economic sense to be then tested in practice. Overall, there are two basic approaches to set the initial price for a test:

-

Cost + margin. The easiest way to define the starting point for a test is to take the product’s cost and add a margin you’d like to get. For example, if a new gadget’s cost is 120$ and a margin you’d like to get is 10%, the starting point would be 132$.

-

Value-based approach. Another way to define the starting point for a price test is to use product value. For example, if a newly released power bank has a capacity twice as big as the previous model, it’s value and a starting price would be twice higher compared to the previous release.

Once you've chosen a starting price, you can start testing. The latter implies collecting data and observing the way tested price impacts the profit rate and market demand. The overall workflow of a pricing test goes as follows:

-

Collect the set of sales data linked to the price under test.

-

Use promo or special offers to find how lower prices impact demand and sales.

-

Define an interim time frame for testing and change price after each period is over.

-

Analyze the set of test-related data to specify the best price.

Another common example to do a price test is A/B testing. A/B test implies offering two different prices for the same product at the same time to find which price is better. The main advantage of the A/B testing stems from the fact that the different prices are tested simultaneously and under the same conditions. In this case, the results are likely to be more accurate compared to non-simultaneous tests.

What are the risks of a/b price tests and how to manage them?

Even though A/B testing is quite accurate, there is a substantial controversy associated with this type of price tests. One of the major concerns over A/B test stems from the risk of price discrimination it might cause. Price discrimination implies diversifying pricing for different groups of customers based on their purchasing power and willingness to pay.

The negative impact of price discrimination has become a huge problem in many industries. For example, travel fare online aggregator Orbitz has been showing higher hotel prices to Mac users since 2012. Besides the ethical aspect, price discrimination could also cause significant legal problems for a retailer. The other disadvantages of the A/B price tests include:

-

The problem of statistical significance. To make sure that the A/B test results are relevant, the large number of customers should participate in the test. Often, like in the case of premium or brand-new goods, the number of shoppers is not enough to guarantee the accuracy of the results.

-

Risk of undermining brand reputation and customer loyalty. Those customers who have bought the product for a lower price are safe while those who paid more might not return to the retailer. In other words, A/B price testing could damage price and brand perception.

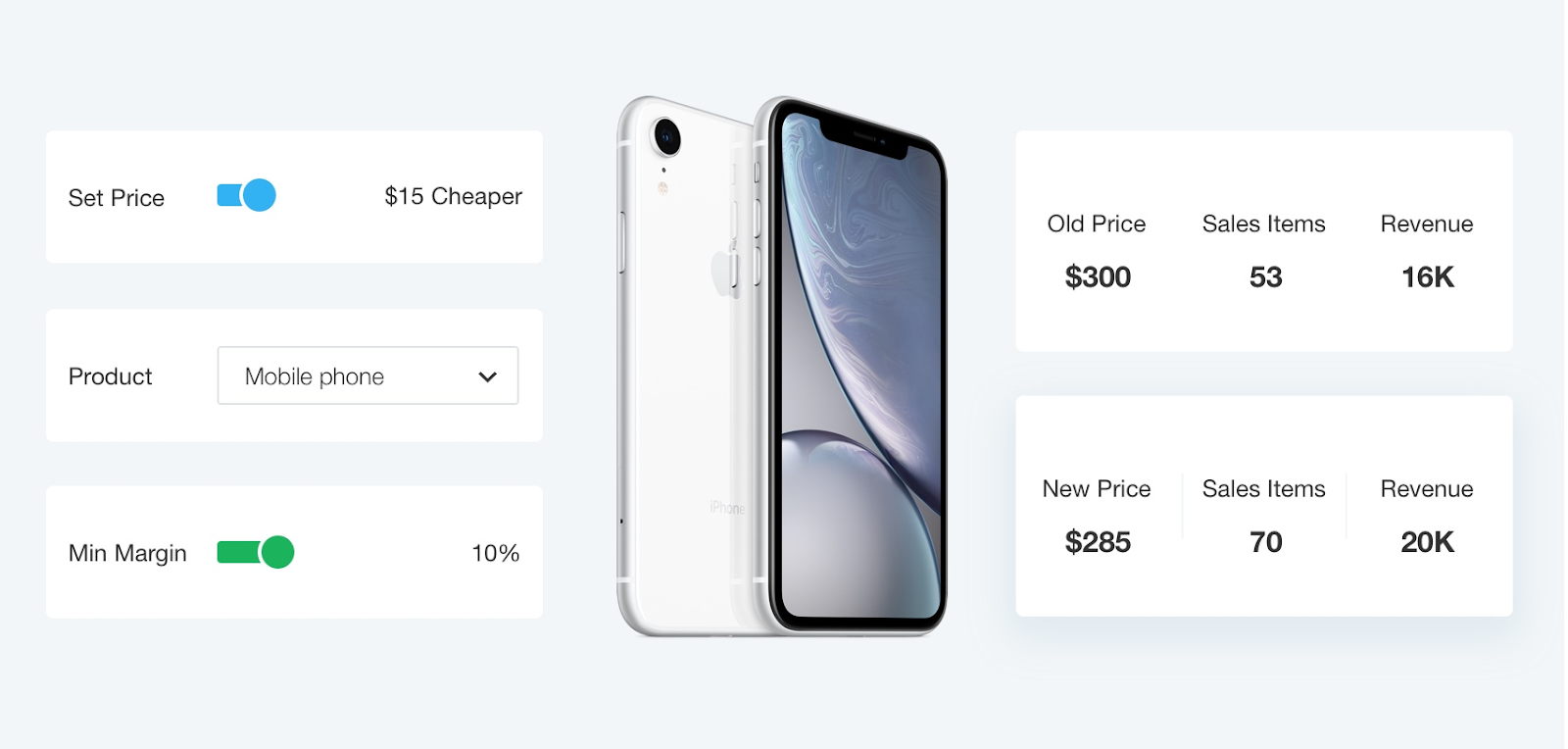

As you can see, the benefits of A/B testing could hardly outweigh potential risks and disadvantages. So, what are the alternatives to A/B pricing tests? We believe that advanced pricing software is the best tool to find the optimal price and stay out of risk. Each software provider offers own approach to price testing. Here’s what we do at Competera: the pricing platform is powered with a special Sandbox feature helping to test various pricing scenarios including predefined strategies and custom ones. We recommend testing scenarios on portfolio level to prevent the sales cannibalization effect. Even if you test the price for a new product, Sandbox can generate highly-accurate results based on the historical sales of similar products. With Competera’s price optimization solution, managers get the market predictions of 90-98% accuracy.

Each software provider offers own approach to price testing. Here’s what we do at Competera: the pricing platform is powered with a special Sandbox feature helping to test various pricing scenarios including predefined strategies and custom ones. We recommend testing scenarios on portfolio level to prevent the sales cannibalization effect. Even if you test the price for a new product, Sandbox can generate highly-accurate results based on the historical sales of similar products. With Competera’s price optimization solution, managers get the market predictions of 90-98% accuracy.

We know that these figures are impressive, so here you got some real-life proofs. Just one example: Competera helped a leading Eastern European apparel retailer Intertop to reach the point of 10.3% gross profit saving along with 200 BPS of profit margin saving after only 6 weeks of using Competera platform. You can find more facts and numbers in the case studies section on our website.

FAQ

Sellers are free to test different prices and pricing models along as no regulations (e.g. RRP) are violated.

Pricing software solutions powered with advanced analytics features are the best means of measuring every pricing decision's impact.