Table of contents

What is a price maker?

A price maker is a seller that has enough market and pricing power to influence prices within the market. In such a case, market and pricing power is determined by the ability of a business to change the prices of products and services effectively. The important aspect of the phenomenon correlates to affecting market price without losing buyers to competitors. Any market participant with a degree of market power that can influence market price is considered a price maker. Companies that do not have market power are referred to as price takers.

Often, price makers are found in imperfectly competitive markets. Such environments are often coined as monopolies or oligopolies. One can offer the following example - there is a company X making a particular technological device. The business holds a patent for the innovation, which means no other company has a legal right to develop similar products. At this point, company X sells the device for $500, while its production costs only $100. Notably, while the demand for the technology might be high, the company makes only a limited number. This approach shows how company X is a price maker and can fully control and manipulate the market price.

In such a context, it is apparent that the price makers' phenomenon correlates with the concept of monopolies. Such companies have enough pricing power employing control the demand and the price itself. One of the adverse effects of price makers correlates to the ability for price manipulation for the sake of making immense profits. Yet, there are anti-trust and anti-monopoly laws trying to regulate price makers.

Monopoly is a price maker.

Monopolies and price makers exist in imperfectly competitive markets. Many experts indicate that a perfectly competitive market is unrealistic in such a context. It suggests that current business environments and practices of establishing a market price often lead to the emergence of monopolies and price makers. When dealing with monopolies within the market, it is crucial to appeal to product differentiation. Such an approach allows buyers to choose from a range of products and urge sellers to boost the quality of their products for the sake of gaining a competitive advantage.

Another key aspect of allowing price makers to exist correlates to limiting the power of monopolies. There were many instances when imperfect competition led to businesses with pricing power abusing such a condition. When only a fraction of economic parties within the market control demand, they can set any prices they deem as appropriate. Following the doctrine of profit maximization, many businesses operating in monopolistic environments set inadequate prices. That is why governments impose laws and regulations to keep monopolies at bay.

Keeping all the insights from above, it is correct to say that monopoly makes price makers happen. At this point, markets need to avoid imperfect competition when the market price is manipulated by a few players who have total control over the sector.

Price maker diagram

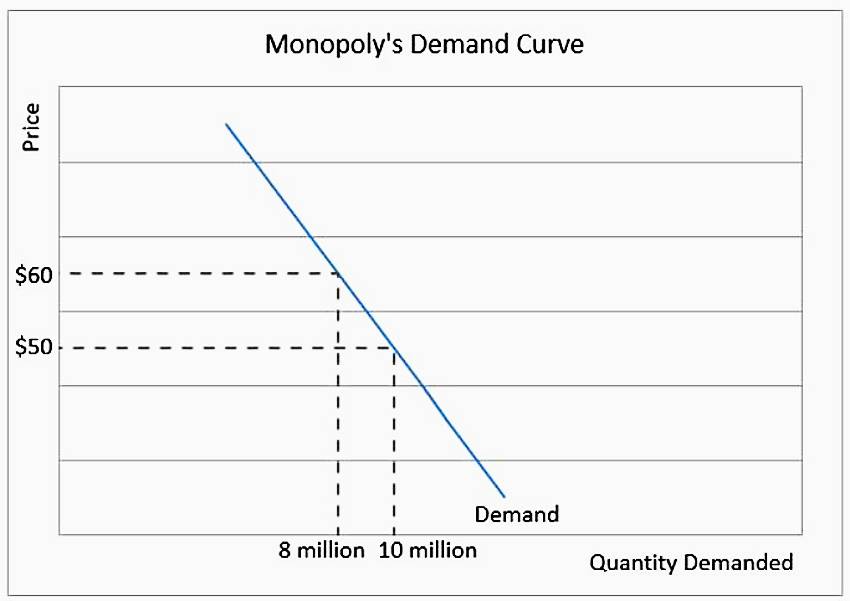

The price maker diagram entails several key components. There is a direct correlation between price and quantity demanded. At this point, any business showing a downward sloping demand curve can be qualified as a price maker. In such a case, the pricing power can be minimal, which means the diagram relies on the factor of demand.

Following the key elements of the diagram above, the pricing power of any business in such an environment directly depends on the number of substitutes and the price elasticity of demand. Respectively, sellers with a flat demand curve do not have sufficient pricing power to become price makers. Depending on the given demand within a market, one can determine whether its economic parties have adequate pricing power to establish the market price.

If there are no substitutes, the demand will be high, and it is the perfect condition for the emergence of monopolies and price makers. A monopoly’s demand curve equalizes with the overall industry’s demand curve from the demand perspective. It happens because the market has only one producer. By controlling an output, a business can have a major impact on market price.

Interestingly, monopolies can control prices by also artificially altering production. If the management of a price maker company chooses to raise a price, one can reduce production, thus boosting the demand. At this point, a monopolistic company can cut production costs while keeping the profit the same.

Adverse effects of a price maker phenomenon

When understanding the key aspects of a price maker, one can speak about several key adverse effects of the phenomenon:

- The emergence of price makers driven by the idea of profit maximization leads to inadequate prices for products and services.

- In an imperfect market, companies can control demand and production, creating massive entry barriers.

- In an imperfect market competition scenario, there is insufficient governmental regulation to ensure companies won’t transform into monopolies.

- When businesses can set prices as they desire, product quality may suffer because it becomes all about quantity and speculation in pricing.

These factors make the price maker phenomenon destructive. There is no place for a no-competition zone in a free market environment. Companies should have no total control over demand and production. Buyers need to have different options to choose from.

Conclusion

The key thing to understand is the nature of price makers in creating monopolies. Imperfect competition markets should not exist. Companies must be exposed to competition and diversification. Besides, governments need to impose regulations that will stop firms from exploiting demand and prices on the path toward profit maximization.

FAQ

Find answers to some of the most common questions people have regarding the use of Competera.

Who is Price Maker?

A price maker is a seller that has enough market and pricing power to influence prices within the market.

Can any business be a Price Maker?

The short answer is no. The Price Makers in a strict sense of the word are only the monopolists offering unique products or services with no competitors. For competitive markets, the businesses’ capacity to be act as price markers is limited.