[Case study] F.ua B.C.&A.C.: Before And After Competera

2017-01-30

The duration of the test was one month. Test subject — Kettles group from Small Domestic Appliances (SDA) category.

The need to monitor competitors' prices and immediately reprice online store items when necessary is one of the main product manager's functions, which affects their and other departments' efficiency. It is hard to overprice the value of this process. The correctness of the repricing and timeliness of the items on the store's virtual shelves affects customer loyalty, and repetitive purchases (aka, lifetime value). Therefore, the price of the goods F.ua is receiving a great deal of managers' attention.

The Problem

Before testing out Competera PI Solution, F.ua had been using its own internal competitor monitoring system. This system met with some common disadvantages self-made systems typically have: algorithms' and robots'-collectors imperfection, and as a consequence, abnormalities in monitoring result. That is why internal systems' data is far from sufficient, and may lead to inaccurate pricing.

The Task

The main task of the following experiment is to calculate the impact Competera Suite gives a retailer in the context of a single product group under established KPI. An optional task was to explore the Category Managers' time efficiency with Competera in comparison to traditional methods.

Therefore, the following indicators (KPIs) were selected:

- The share of electric kettles in the turnover (money indicator);

- The share of electric kettles in the turnover (quantity indicator);

- Marginal revenue category share;

- Time for repricing.

The Results

The experiment, which started at the beginning of December 2016, complemented F.ua' objectives to optimize pricing and increase the store' KPIs during the peak holiday sales season.

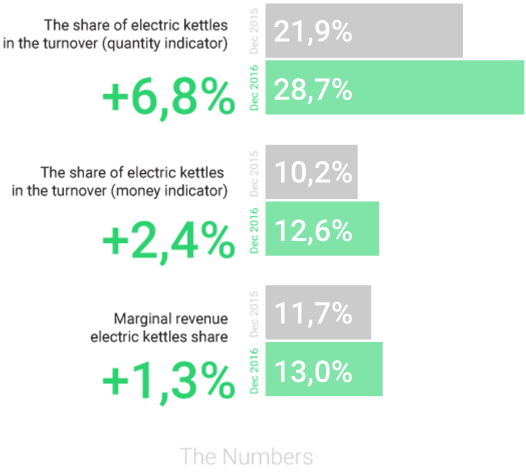

The Numbers

Indicators from December 2016 were compared with the corresponding period in 2015. This measurement method was chosen because it gives clearer results, than the comparison between Nov and Dec of the same year: holiday sales spikes of leading technology segments do not distort the real statistics.

The assessment criteria also considered any additional factors which could affect the sales. To get the most pure data out of the experiment, during the test period there was no additional marketing activities running, or marketing channels added as compared to the corresponding period of 2015.

As a result of the experiment, in total sales, the electric kettles' group quantity share increased by 6.8%, financial share by 2.4%. The share of electric kettles in marginal revenue of online store increased by 1.3%.

The Time

Before Competera Suite was hired, a substantial part of the Category Managers' day was spent updating of the internal monitoring system data, which sometimes had to run several times per day to get a complete picture.

Loading of the monitoring results from the database was another «time killer»: the internal monitoring system was providing data with a delay more or less often, and the price, which manager saw within the system, was not equal to the competitors' website price. Therefore, cross-checking of the most important SKUs manually to make the correct repricing also was irregular. In addition, it was necessary to analyze all of the assortment matrix, not only the abnormal segments that violated the rules.

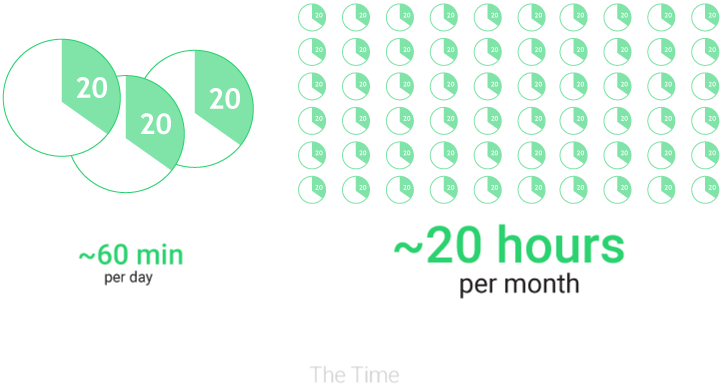

Use of Competera Suite reduced repricing time from 30 minutes to 5-7 minutes per single product category.

Twenty minutes that have been saved does not look impressive until you will count its increment. According to the fact that repricing might be done, three or more times within the day, it is possible to save 1 full working hour per day, i. e. 20 hours per month, i. e. 30 working days of the Category Manager within the year:

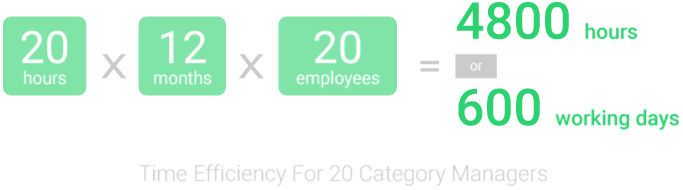

For a team of twenty category managers, this is pretty common for a such retailer. The potential time savings looks even more impressive:

The Conclusion

As mentioned above, Competera Suite integration was called upon by F.ua to achieve the KPI set, and to optimize their Category Managers' workflow: repricing automation, releasing working time for other important tasks, and more....

F.ua on the results of a month of using of Competera Suite shows next:

- Kettles category perceived traffic growth from price aggregators by 43.29%. Assortment pricing «on the average market level» has allowed the store to compete effectively, and affect the conversion rate with the help of pricing.

- Competitor-based prices, by itself, can increase turnover. Increased turnover affects marginal revenue, leads naturally to a rapid purification of the stock remnants, and improves KPIs.

- Repricing based on correct Competera Suite' data gives F.ua an ability to control the gap between their and competitor's prices, and allows them to earn more on small increases in price (1-2%, depending on the product) when working with loyal customers.

As a result of Competera usage F.ua obtained growth across all analyzed metrics. More significant of them are the share of electric kettles in the turnover (quantity indicator) of the analyzed categories (compared to others) and the savings of Category Manager's time.

It is also worth noticing that these results were achieved by active participation and interaction with Competera Price Intelligence Suite by the F.ua' category managers.

Alexander Kirichenko, Category Manager @F.ua