According to Nielsen, the most anticipated changes in the FMCG retail industry in 2020 are a decrease in demand due to a drop in real incomes, an increase of the online channel, and a significant restructuring of offline retail. Meanwhile, the other consultancy McKinsey & Company claims that market price tests become obsolete after just a few weeks or months in a dynamic and evolving market. How to measure pricing performance under these conditions – let's try to figure it out.

Pricing Performance is complicated

Price-performance ratio is a category traditionally used in economics and engineering to mark a product's ability to deliver performance for its price. Within this kind of meaning, the lower the price/performance ratio is, the more desirable is the product. However, in pricing and category management, the meaning of word combinations "price-performance" or "pricing performance" is much different.

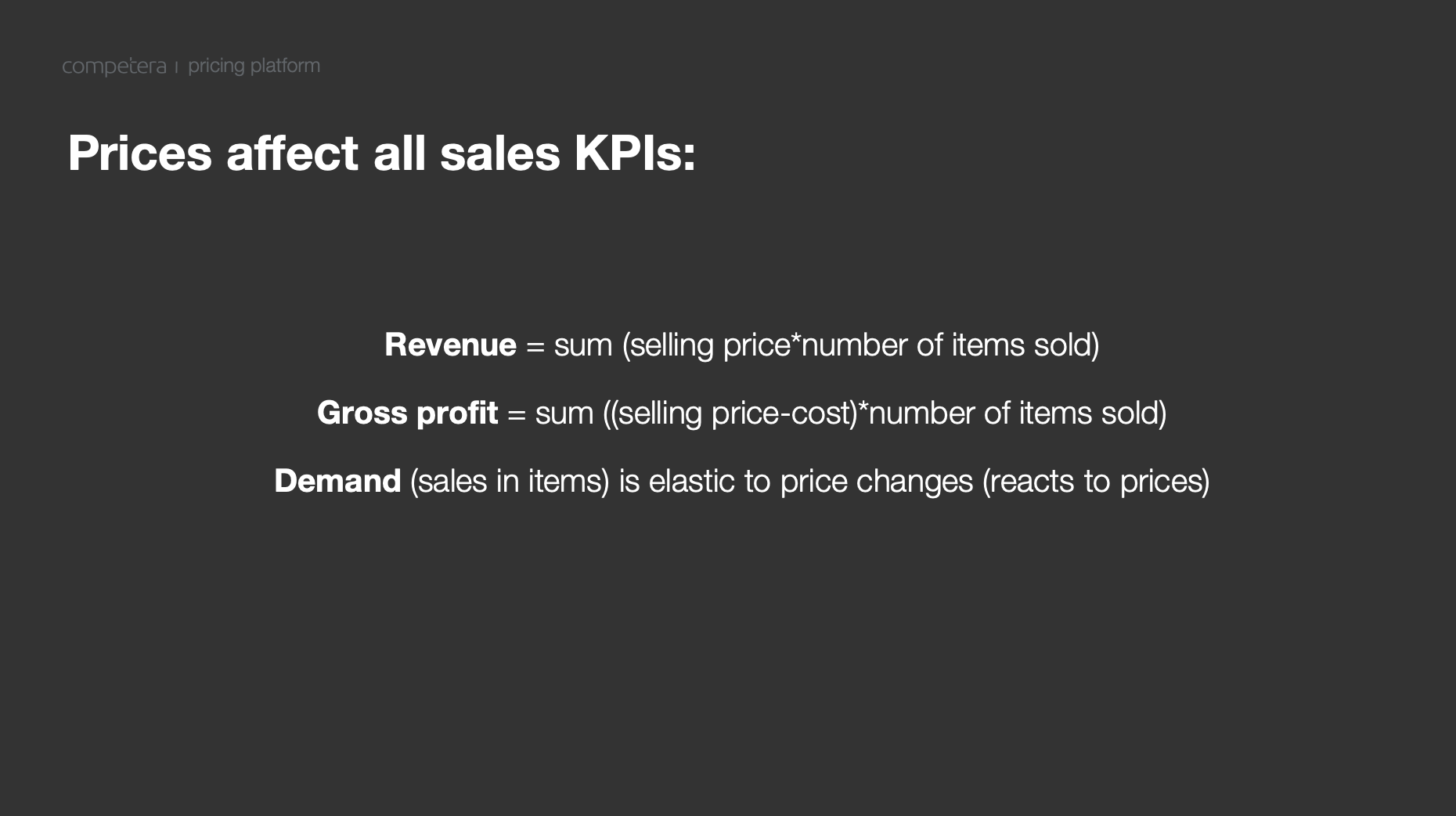

Let's start with the fact that the price, as an essence, affects almost all major KPIs of any business. Check this:

Prices affect your revenue or the number of sales by your bills. If you have a portfolio, then you have the price for each product and the number of sold items. These things are interrelated. Prices affect your profits (your revenue minus the purchase and logistics costs). Even sales in items react to prices by themselves. Here the dependence is absolutely direct.

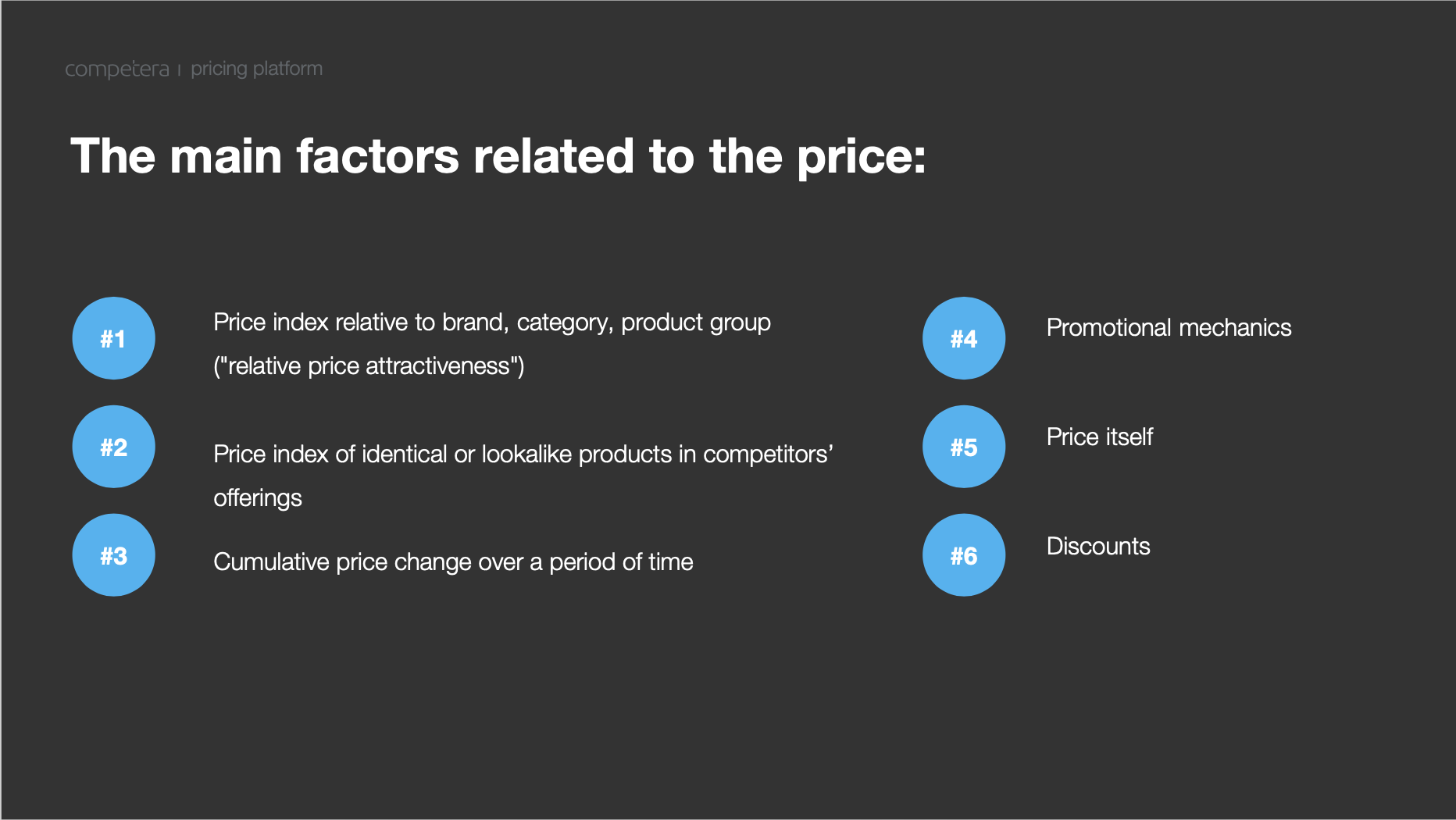

Next, it is impossible to predict future sales response to the current business activities. “Why?” you might ask. Because of factors affecting the price itself. Here they are.

The nature of any price is multifactorial. When a new buyer comes to a shelf representing a particular category, he or she is usually aware of only 2-3 intensely advertised brands. So, the SKUs of these brands are the first to be considered by a shopper who, often subconsciously, believes that these brands are trustworthy.

In this case, the famous brands' products become the so-called anchors. Customers consider their prices and compare them with each other. As a result, the shopper builds a subjective pricing scale with anchors used as a benchmark.

This example is a good one to understand how a range of pricing factors impact consumer behavior. Eventually, the price index for a product could be built concerning the brand, category, or group of products with an established category leader. These are only three dimensions, yet there could be more of them.

Subsequently, customers begin to recall the price of this product in another label or the price for a similar or substitute product of another brand. And this is another factor impacting sales via pricing.

In addition to that, the perception of cumulative price changes should also be considered. That is when customers have an established understanding or memory of how the price per particular product has changed recently. If shoppers feel that the product is getting more expensive too quickly, they might feel irritated. In such a case, customers would react to another price change rather painfully.

The last factor is discounts and markdowns, i.e., the approaches and tools retailer uses to promote unique offerings. Often, retailers consider these things separately from the price, which is a wrong approach. The concept of Unified promo pricing management might be helpful here. It implies that shelf prices and promotions should always be considered in relation to each other. For example, if you are offering a discount, then you should also track how much revenue was generated by attracting new customers and how much was simply sourced from other products on your shelves.

Costs aren't a panacea

At the early stage of business development, the retailer's usual practice is to use cost-plus pricing measuring its performance only by a gained margin. However, in the book, "Purchasing in the 21st Century: A Guide to State-of-the-art Techniques and Strategies", an interesting idea was expressed. The price measurement against a cost is "actually more of a reflection of how well the standard was established than of how wisely the buyers (i.e., retailers) are using the company's financial resources."

Simply put, you can unwittingly trap yourself by using standard calculations, putting a possible inflation rate on the cost agreed with the supplier, and calculating the average one. If the calculation is wrong and say the inflation is 15% instead of the planned 10%, the financial year will be closed with losses.

With the case described above, the Price Index indicator comes into play. With its help, you can calculate all price increases and decreases for a specific period, for each product within each category. As a result, you will get a weighted average value that allows you to measure the performance of both the category manager team and your suppliers. However, this method is not quite accurate, especially in conditions of uncertain demand and market turbulence.

Strategy is a strength

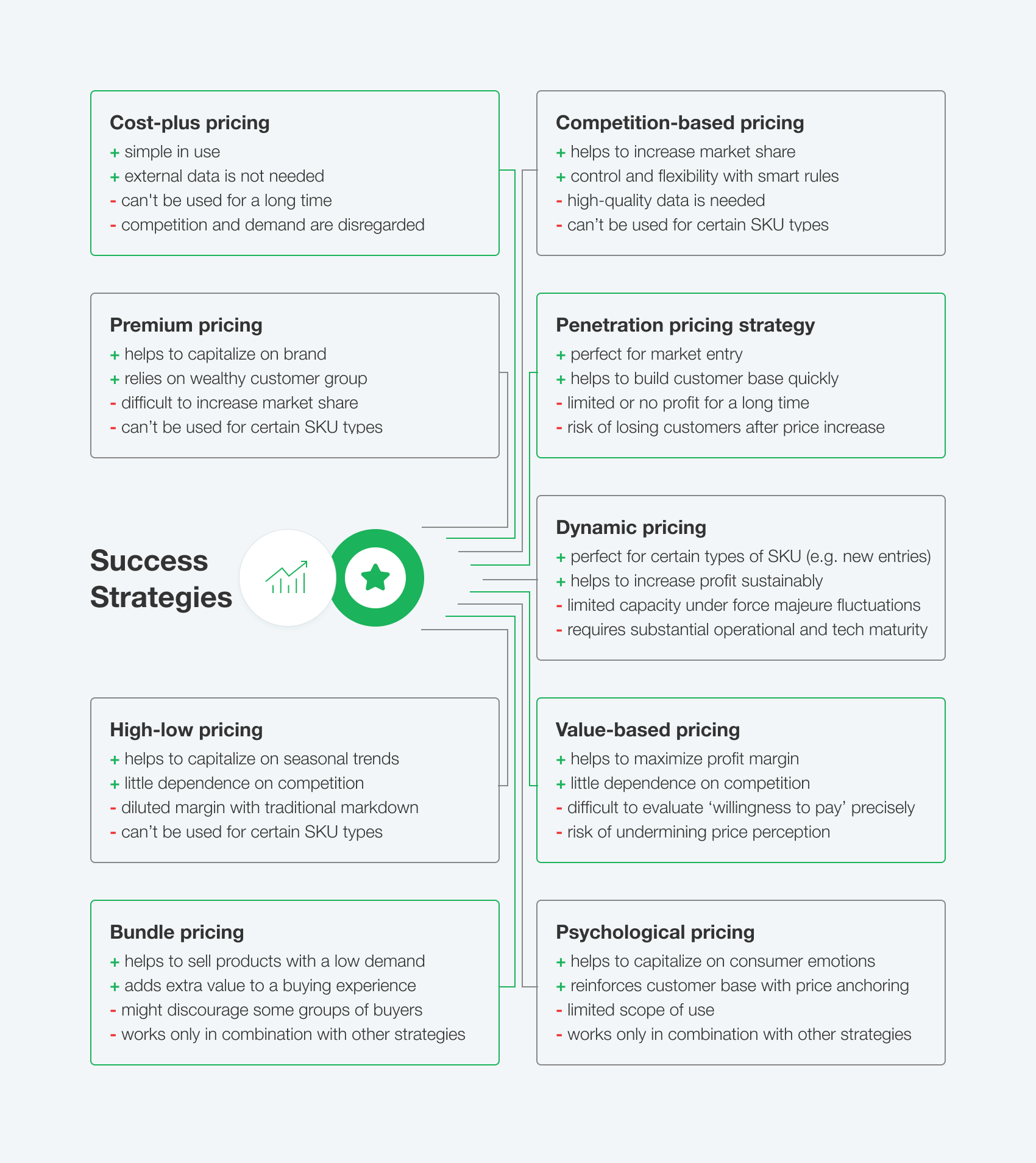

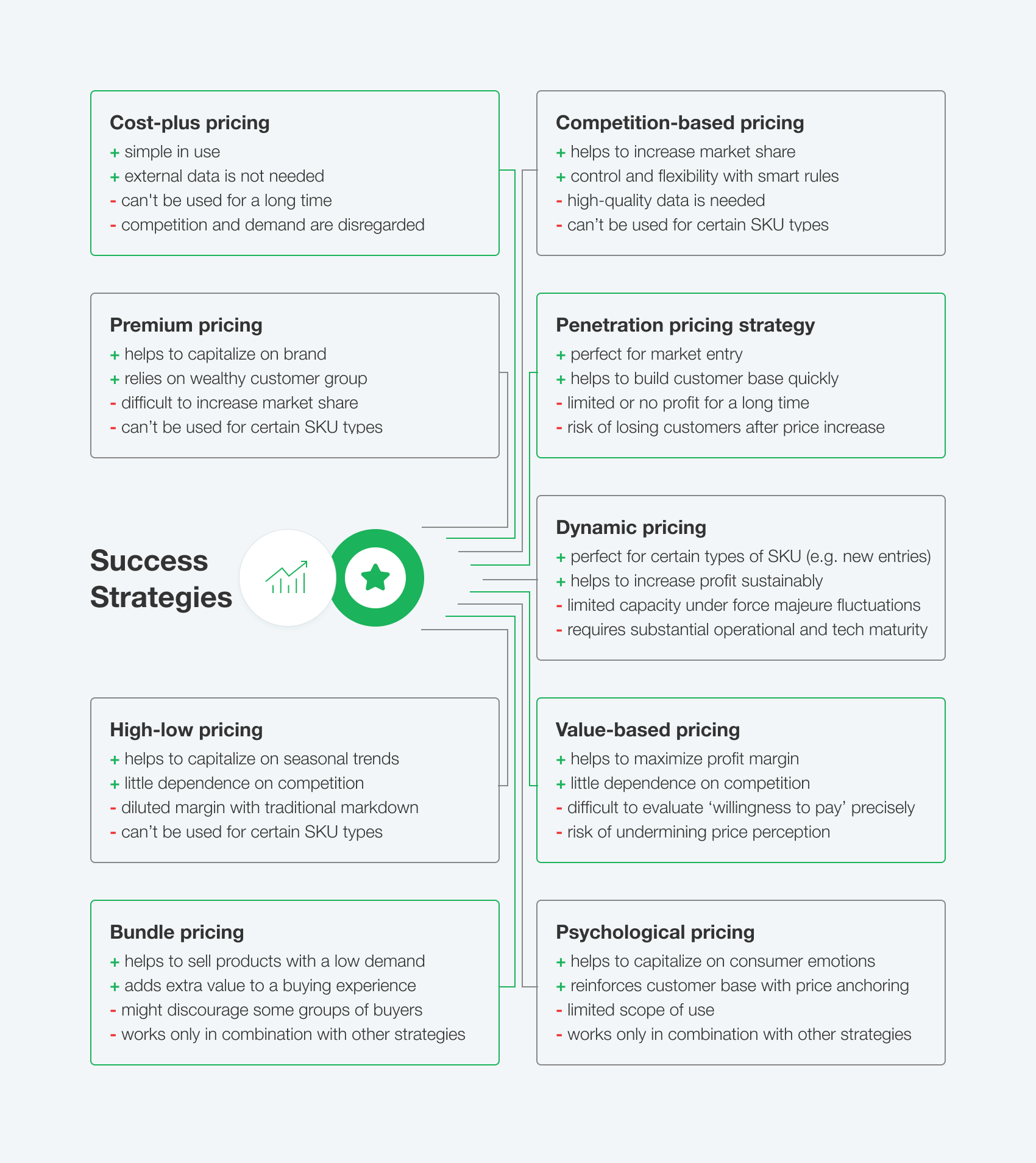

Knowing all the information above, we can say that pricing efficiency is also multifactorial, as well as the prices. Pricing performance starts with the right questions – precisely, your goals and targets for a specific period. They, in turn, depend on the strategy, so we recommend starting the measurement process by selecting a strategy or strategies that suit the retailer's portfolio. Here you can read about the pros and cons of different strategies. Also, feel free to use our short reminder.

How to measure your pricing performance

Finally, as soon as you understand your goals, implement strategies and tactics to work with different products, you can begin to measure pricing effectiveness. In this matter, the market does not stand still either.

Previously, every manager could find their own metric for each target and keep all the records in a good old Excel file building a variety of summary tables with charts and graphs. With the growth of turnover and retailers portfolios, this approach may fail simply because of the increased amount of data. After all, the more internal and external data you can process, the more detailed report you will receive. So, the more qualitative will be the analysis and developments of further plans.

Being a software company, we adhere to a software approach to meet the challenge. In a case with pricing performance, Competera recommends using advanced pricing analytics tools. Their workflow can be presented as a set of three repetitive steps:

-

The system receives and processes data from different sources. It can be information about competitors, retailer's sales data, data from marketing tools, etc.

-

The user sets the necessary parameters for achievement. For example, to increase stock sales.

-

The system makes root cause analysis, measures results, and gives the whole picture about pricing to the user. Next, it empowers the user with insights and recommendations for achieving the set goal.

In this way, you can adjust your pricing strategy, find violations of your pricing policy, track the effectiveness of a particular pricing decision, and much more without wasting resources on monotonous manual tasks.

Conclusion

Although measuring the pricing performance is not the most trivial task, having developed a coherent strategy and armed with modern software tools, any retailer can handle it. Remember that the price isn't just a number on the price tag, but a set of variables that, one way or another, you need to consider.

FAQ

The price performance measures mark the quality of the pricing policy standard established by the business.

High price performance could be used as a synonym for a cost-effective pricing policy.