Content navigation:

- Introduction

- What is value-based pricing?

- The basics of how good value pricing works

- Implementation of value based pricing strategy

- Real-world examples

- Value-based pricing: challenges and solutions

- Conclusion

Shortly before their closure, Toys R Us slashed nearly all their prices by 10-30% in a desperate attempt to bring customers in, but the customers never came. Despite this store-wide discount, Toys R Us was selling nearly all of their toys at prices too high to entice buyers and boost the demand. Over the course of decades as the market and competition evolved around the retail giant, they lost sight of how their customers valued their products and what they were comparing them to. As a result, they shut their doors.

Their demise was a shining example of why value-based pricing is so important to retailers, and why it is vital to have a clear understanding of what customers want, and what companies they’re comparing to yours. This article will navigate you through the theme of value added pricing, and how it can be used in your business.

What is value-based pricing?

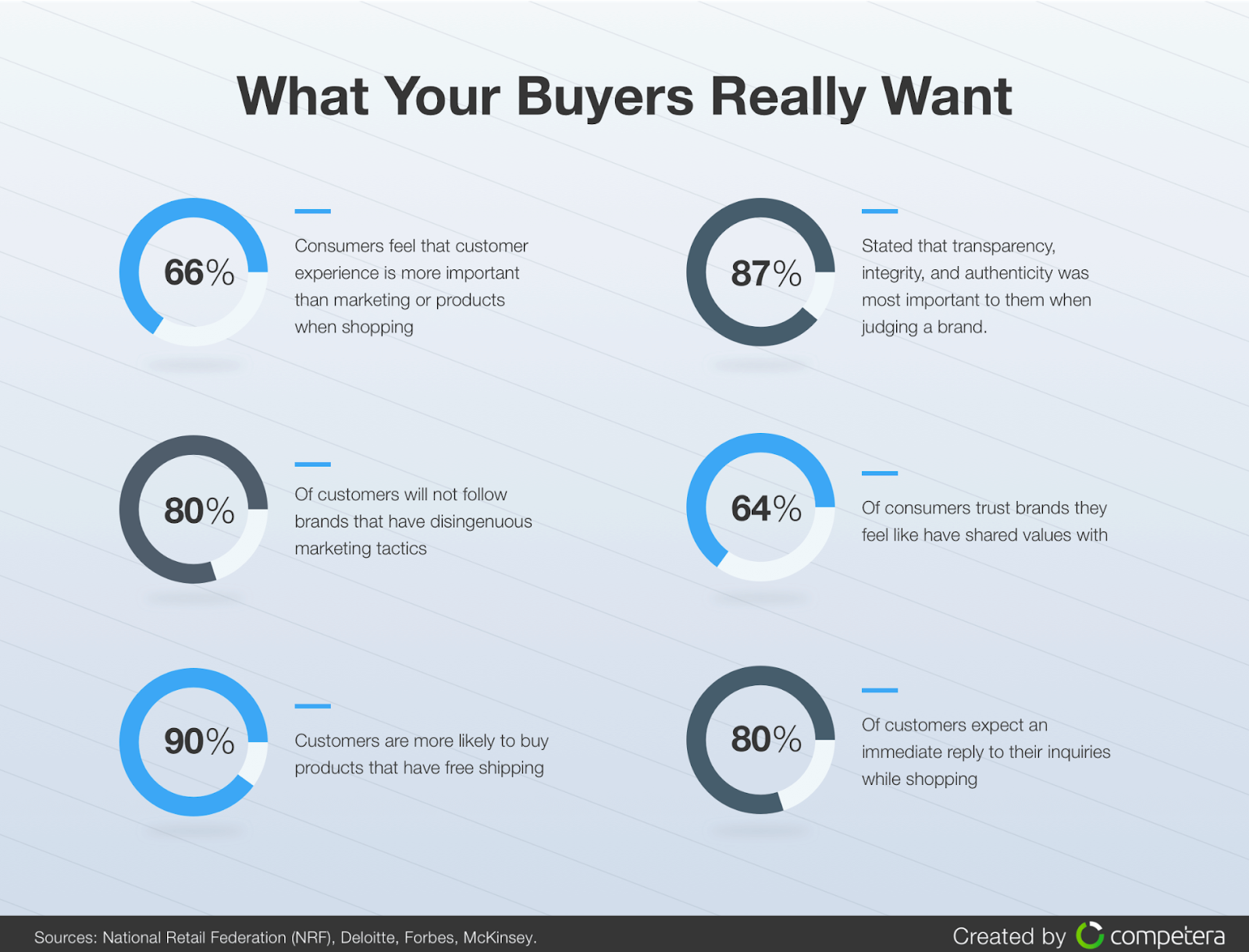

Value-based pricing revolves around pricing items based on a customer’s willingness to pay. By reaching an equilibrium with consumers and understanding the value that they put on a given product, a retailer can maximize their revenue and maintain competitive prices. To comply value based pricing retail with the overall strategy, retailers should have a comprehensive vision of customer’s requests and needs. The visual below highlights crucial motivations underlying consumer behaviour today.

There’s more to value added pricing other than the consumers’ willingness to pay, however. The key to utilizing value-based-pricing to the fullest extent is to truly understand how customers view your products, what they want and expect from products as well as the retailers they buy from, and what features they seek in a given item.

Value based pricing retail adds necessary detail to other pricing strategies. Competitor based pricing, for example, can give you a general idea of the value of your products - if customers are willing to pay $20 for your competitor's t-shirt, they should be willing to pay $20 for yours. However, basing your prices solely on this concept misses a fundamental aspect of pricing products accurately; that you should differ from your competitors, and so should your products, the way you market them, and therefore the way you price value. Taking the time to find out exactly what your customers think about your business, your products, comparable products on the market, and other key information can therefore bring your pricing to the next level, increasing your sales and revenue as a result.

The basics of how good value pricing works

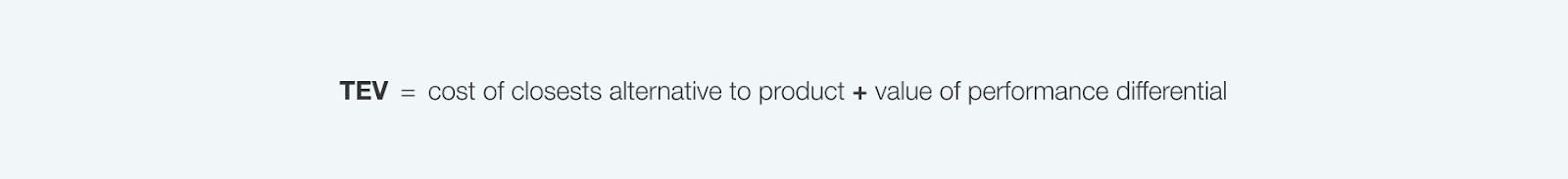

One way to determine a customer’s willingness to pay is to calculate the TEV (True Economic Value). The basic equation for the TEV of a product goes as following:

Let's see how value-based pricing example may look. Imagine that a competitor may be selling a plain white t-shirt valued at $10. Your t-shirt however, has an admired brand name on it. The meaning: it is more price elastic and also your customers view this brand a $5 more in value compared to a plain white t-shirt, making the TEV $15. Calculating the TEV this way is a basic but decent method to determine how willing a customer will be to pay for your products.

As you may have noticed, the latter segment of the equation, the price vs.value differential, is going to differ based on the customer segment you are focusing on. This makes it important to target the right customers and if needed, recalculate the TEV (just like price elasticity) several times according to the various customer segments you are aiming to market your products to.

Depending on the product(s) in question, the demand just like the value of performance differential can vary by region, gender, age, or even on an individual basis. Therefore, if you are hoping to calculate the TEV to begin implementing value-based pricing strategy, customer input is vital in getting your numbers right. This can be done easily by providing optional surveys and questionnaires for your customers, asking relevant questions to the right customer segment.

So let’s say you’ve surveyed your target segment and demand elasticity, calculated your TEV, and set your prices according to your findings, only to find that customers find you price value too high. Why is this happening? Because you did not get the full perspective on your customers’ view of your product(s). What is following from here is that prices can often be lower than the TEV you calculate. Why is this so?

You know the ins and outs of your product. You know which products are more price elastic than other. You know the meaning of it’s true value, all of its features, and how they compare to your key competitors and their products. You know all of these things which play a part in the true value of your product, but your customers do not. Customers will almost always have a more limited view of a given item. They may not be aware of certain features or how they compare to the next best alternative on the market.

This is what creates the difference between perceived value and delivered value, and it is also why delivered value is usually a bit lower than the perceived value, with perceived value being close to or exactly the TEV calculated. The decrease in value from perceived to delivered value can fortunately be slightly lessened through the right marketing tactics or depending on the structure of your company, a very good sales professional.

Proper marketing or a good salesman can educate consumers more about product features and differences between your product and the nearest alternative, helping to reach the right price vs.value correlation.

Implementation of value based pricing strategy

Value-based pricing is a strategy that implies setting prices based on the perceived value of a product or service. In a nutshell, value oriented retail strategy focuses on understanding how a product or service can benefit customers and pricing accordingly.

What it means is that implementing a value-based-pricing strategy requires a profound understanding of customer preferences, as well as the ability to communicate the value proposition effectively. The latter is only possible by conducting thorough market research to understand the value which customers place on different features or benefits of a particular SKU.

Following implication of a value oriented retail strategy is segmenting your customer base and tailoring your pricing strategy to different segments based on their willingness to pay. Here is a value based pricing example: you might offer premium features or services at a higher price point to customers who value those benefits while still providing a basic offering at a lower price for more price-sensitive customers. Nowadays, accurate portfolio segmentation can be executed using advanced data-driven solutions like Competera.

Speaking of markets other than retail, successful implementation of good value pricing can be seen in industries such as software, where companies offer different pricing tiers based on functionality or features that customers value most.

Here is a value-based pricing example: Microsoft offers different pricing plans for its Office 365 software, with higher-priced plans providing additional features such as more storage and advanced security options. By understanding and adjusting to customers' value on these features, Microsoft can capture more value from its customers and increase profitability.

Real-world examples

Let's look at some other real-life examples of how product sellers are using the value-based strategy.

- One prominent value based pricing example of is Apple Inc., known for its premium pricing strategy across its product lines. Apple is known to price value of its iPhones, iPads, and MacBooks higher than competitors based on the perceived value of its brand, design, and user experience. This approach has allowed Apple to maximize margins and cultivate a loyal customer base willing to pay a premium for its products.

- Another value-based pricing example is Starbucks, which uses value-based pricing for its coffee products. Despite offering products similar to its competitors, Starbucks prices its coffee at a premium, leveraging the perceived value of its brand, ambiance, and customer experience. This approach has enabled Starbucks to differentiate itself in a very crowded market and command higher prices, leading to increased profitability and brand loyalty.

Overall, value based pricing strategy allows sellers to capitalize on customers' willingness to pay a premium for the perceived benefits of their products or services. Additionally, value-based-pricing helps retailers to differentiate themselves from competitors, strengthen their brand image, and drive profitability using the optimal price vs.value ratio.

Value-based pricing: challenges and solutions

One challenge of value based pricing retail is accurately determining the perceived value of a product or service to customers. This can be particularly difficult in industries where value is subjective and varies among customers. To overcome this challenge, retailers can conduct thorough market research, gather customer feedback, and use machine learning algorithms to identify hidden patterns in customer perceptions of value.

Another challenge associated with customer value based pricing is effectively communicating the value proposition to customers. You can address this by investing in marketing and branding efforts that highlight the unique benefits of their products or services. Providing clear and transparent pricing information can also help customers understand the value they are receiving.

Additionally, implementing value-based-pricing requires a deep understanding of customer needs and preferences. You can overcome this challenge by leveraging data analytics solutions to track customer behavior and tailor your value oriented retail strategy to different customer segments.

Conclusion

Getting to know your customers enough to understand how they perceive value has several benefits to how you do business.

-

By understanding how they see your products, what offers they’re comparing to yours, and what features they value and expect, you can use customer value based pricing that speak their language.

-

Surveying and interviewing your customers to obtain this knowledge will allow you to understand your perceived and delivered value, and make offers that customers just can’t refuse.

-

The proper implementation of good value pricing is a sure-fire way to increase your revenue and sales and stand out from competition.

For what it’s worth, a value based pricing strategy you should look into to thrive in the modern market.

FAQ

The knowledge of customers' needs and preferences is at the core of good value based pricing. That is why retailers willing to use this approach should regularly run consumer researches.

Cost based pricing takes product cost as a major factor contributing to the final price. In the case of value added pricing, the product cost is rather an insignificant factor while the value product brings to consumers is considered primarily.

- #Pricing_Heroes: How to enhance pricing and lead the team through unprecedented retail turbulence with Paul Peugnet, Pricing Director at Carrefour France

- #Pricing_Heroes: The Evolution of Pricing — Going Beyond Pricing to Drive Innovation with Karan Sood

- Pricing Strategies in retail for 2018