The Future of Pricing: How AI Is Transforming Price Planning in Retail

March 18,2024

Executive Summary

Pricing is a critical business decision that can determine business success (or lack thereof) as it directly impacts a retailer’s bottom line and, if done incorrectly, can hinder sales and erode margins. We explore the current landscape of artificial intelligence (AI) within pricing strategies, as well as the technology’s overarching advantages in regard to pricing. We aim to understand the principal obstacles encountered when harnessing AI within pricing strategies and propose strategies for retailers looking to mitigate these challenges. Our analysis is informed by a recent Coresight Research survey of 150 retail business decision-makers in the US, conducted by Coresight Research on February 1–2, 2024.

Market Scale and Opportunity

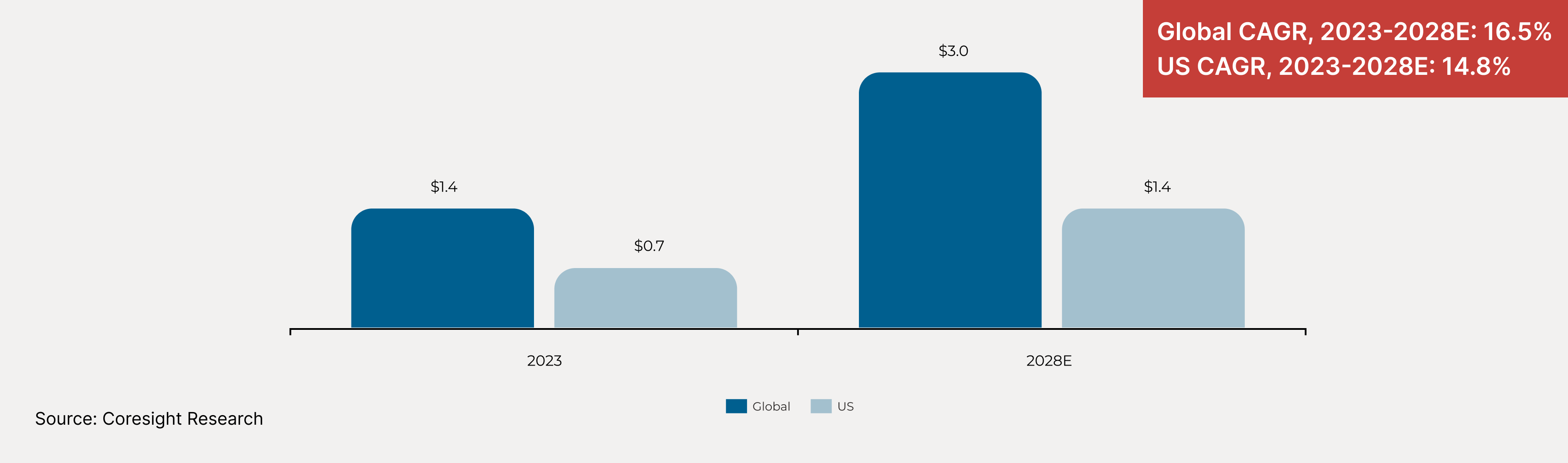

- The global retail pricing optimization software market is poised for significant growth, reflecting the retail sector’s increased reliance on technology for product pricing amid economic volatility. Coresight Research estimates that the market will total $1.6 billion in 2024 and grow at a CAGR (compound annual growth rate) of 16.5% between 2023 and 2028.

- The US holds the largest market share, at 51.0% (as of 2023), and is set to grow at a significant 14.8% CAGR between 2023 and 2028, with its market share totaling $1.4 billion.

Coresight Research Analysis

-

Optimal Pricing Strategies Contribute to Success

- The global retail pricing optimization software market is poised for significant growth, reflecting the retail sector’s increased reliance on technology for product pricing amid economic volatility. Coresight Research estimates that the market will total $1.6 billion in 2024 and grow at a CAGR (compound annual growth rate) of 16.5% between 2023 and 2028.

- The US holds the largest market share, at 51.0% (as of 2023), and is set to grow at a significant 14.8% CAGR between 2023 and 2028, with its market share totaling $1.4 billion.

-

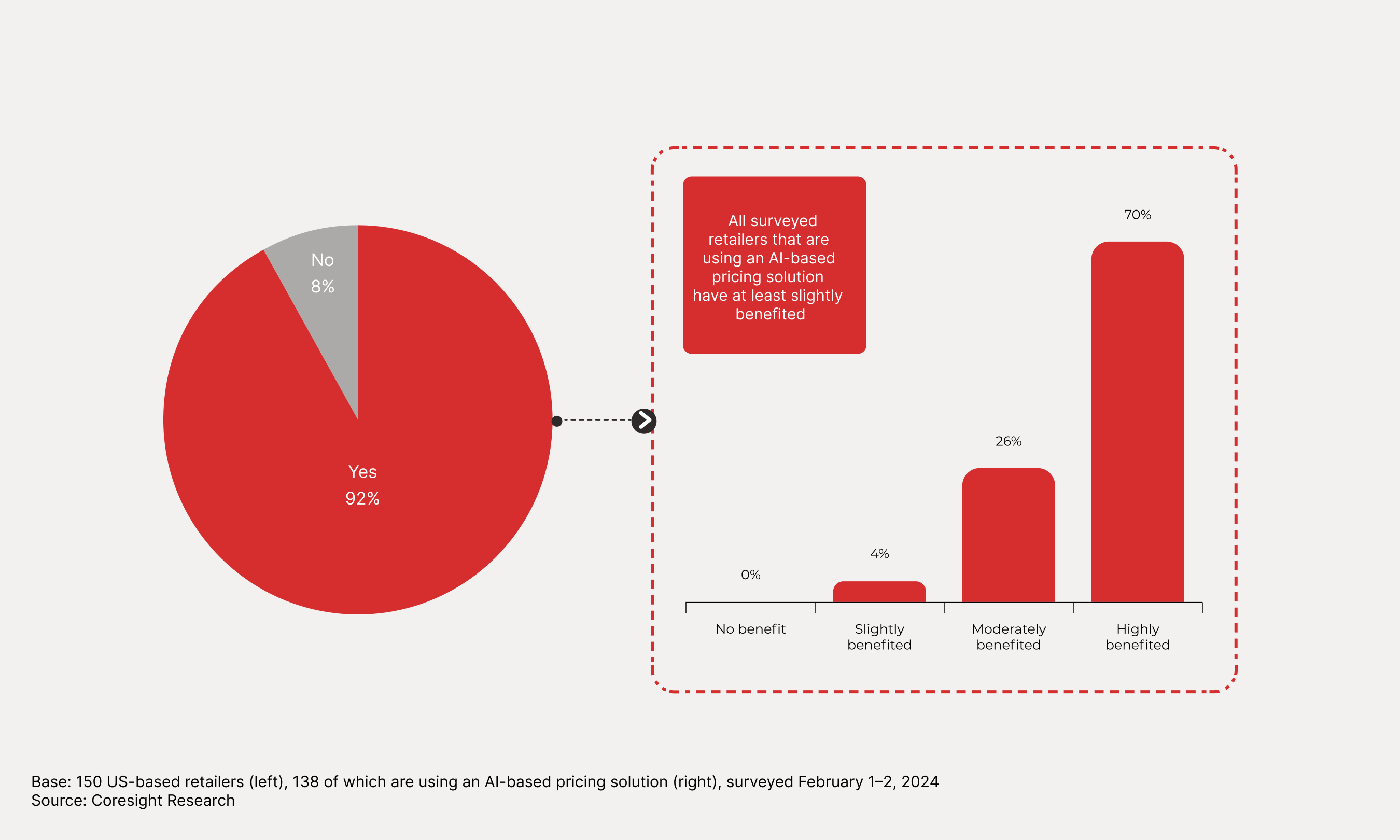

AI-Informed Pricing Decisions Are Prevalent Among Retailers

- Our survey found that an overwhelming majority — 92% of respondents — stated that they use an AI-based pricing solution to inform their pricing decisions. We then asked those who are currently using an AI-based pricing solution whether they have benefited from that AI-based pricing solution and found that all respondents have benefited at least “slightly.”

-

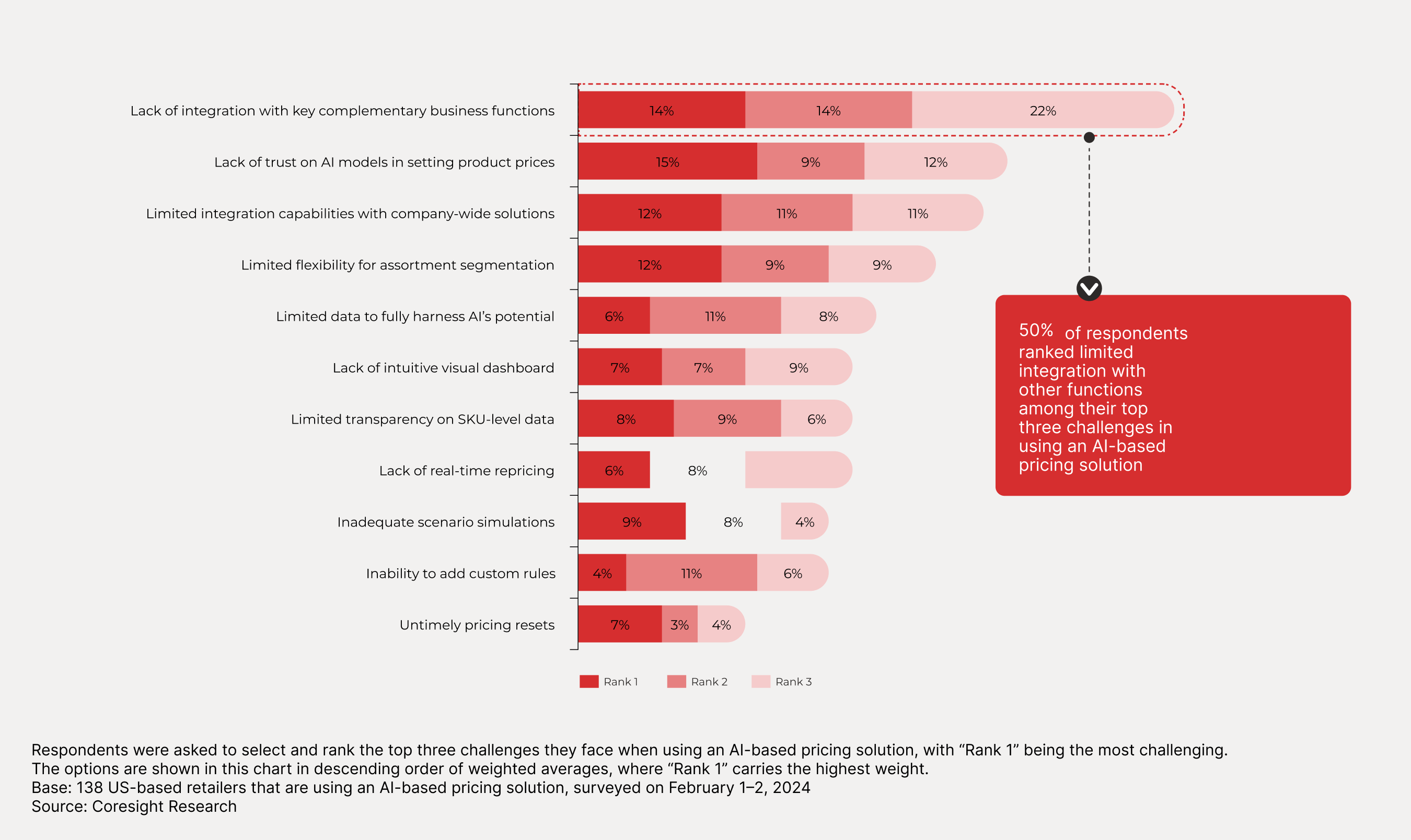

Leveraging AI Can Be Cumbersome and Challenging

- While AI is prevalently used in pricing strategies and its benefits are well-known, the level of sophistication and integration varies across organizations. It can be challenging for companies to leverage an advanced AI-based pricing solution primarily due to the inputs that the algorithm requires to produce robust results.

- The three most widely cited challenges in leveraging AI for pricing are: a lack of integration with key complementary business functions (e.g., promotion planning); a lack of trust around AI models; and limited integration capabilities with company-wide solutions.

-

Integrated Business Functions and Real-Time Pricing Amplify AI-Based Pricing Benefits

- The current state of pricing strategies and the level of integration between pricing and complementary business functions underline the underutilization of technology and a lack of sophisticated tech use. Our survey revealed that, on average, only 41% of respondents stated they have “fully integrated” their price planning strategies with the five complementary business functions we surveyed about. Examining the data by company size reveals that the opportunity is even more pressing for retailers earning less than $1 billion in total sales — only 37% of respondents from this group, on average, cited full integration across key business functions.

- We asked those respondents currently leveraging an AI-based pricing solution about the method they are using to inform pricing decisions and found real-time pricing has huge growth potential, with only 56% of respondents currently using real-time pricing.

-

Outlook on AI Usage and Investments Reveals Upbeat Retailer Sentiment

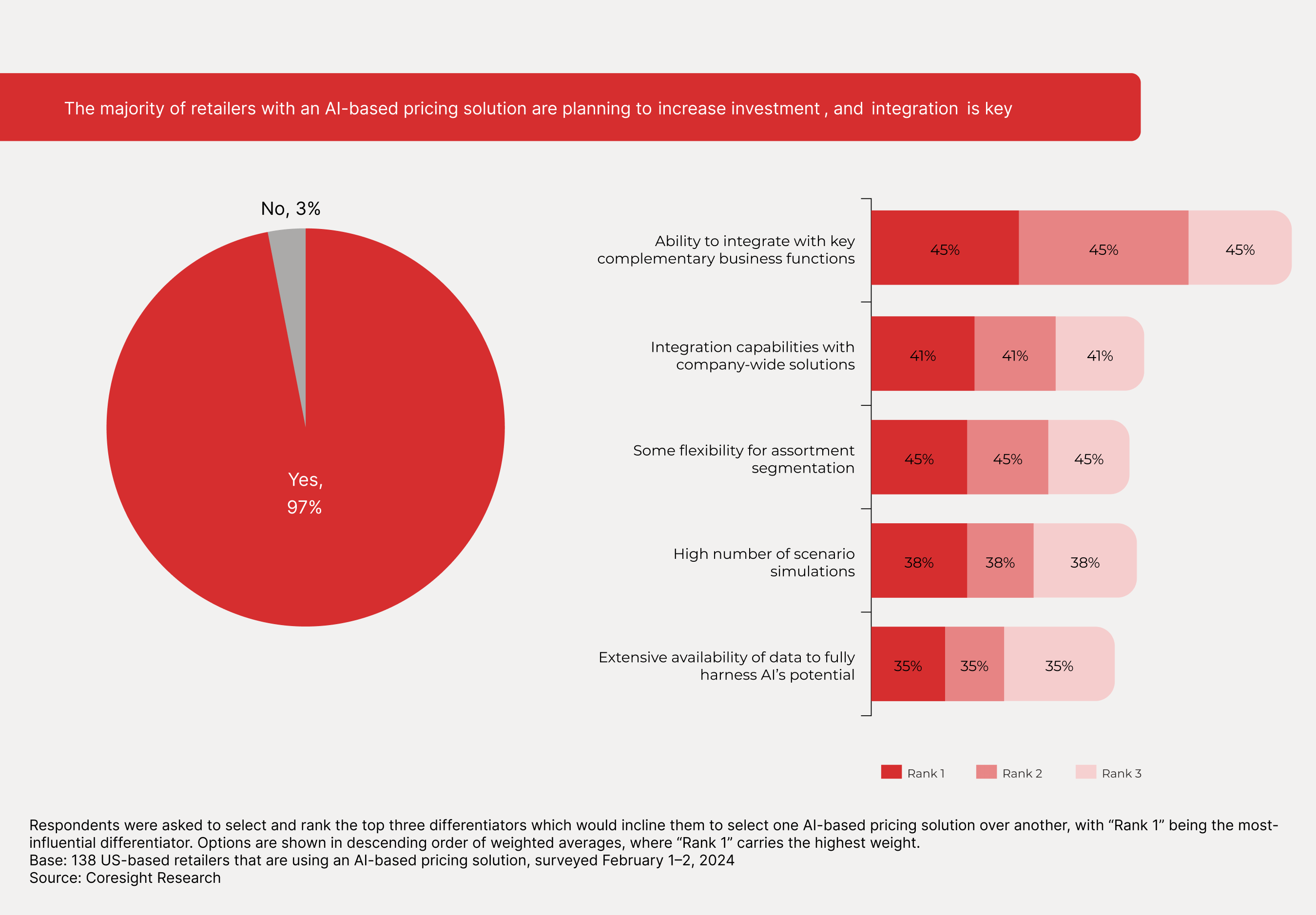

- We asked those currently leveraging AI-based pricing solutions whether they plan to increase investments in AI-based pricing solutions in the coming 12 months: 97% of respondents stated that they plan to increase those investments in the coming year.

- We then asked respondents about which differentiators would cause them to pick one AI-based pricing solution over another. Our results found that the most influential differentiators were those that supported retailers’ integration goals — especially integration with key complementary business functions and with company-wide solutions.

What We Think

An effective pricing strategy can often be a leading driver of profits and provide an edge over the competition. Currently, there is prevalent use of AI-based pricing software in the US market and various major retailers, including Best Buy, Kroger and Macy’s, have recently highlighted the importance of technology-driven pricing strategies. These retailers understand the importance of having an optimal pricing strategy, and our survey findings showcase widespread usage of AI-based pricing solutions and a strong intent to increase investments in the coming 12 months from those currently leveraging an AI-based pricing solution. As retailers look to fully harness AI to inform their business decisions, including pricing decisions, there will be a higher demand for pricing solutions in the retail market. Pricing solution providers that listen to the pressing needs of retailers and offer them integrated, unified and flexible capabilities are positioned to benefit the most in this rapidly growing market.

Investing early with a clear milestone-based approach will help retailers stand out and reap a higher ROI (return on investment) versus late entrants. The coming few years will be critical for retailers as AI advances and margin pressure escalates amid an increasingly competitive retail landscape.

Brands or Retailers Poised To Gain Advantage

- Retailers that can synthesize large amounts of data into a usable format and are able to derive insights across business operations will be better positioned to leverage any advanced technology, including AI and ML (machine learning).

- When introducing AI-based pricing, retailers that focus on scalability and technology integration with company-wide business verticals will be better positioned to align pricing strategies with their overall business goals.

Brands or Retailers That Risk Losing Advantage

- Those slow to integrate AI, ML and data analytics into their pricing processes risk losing important customers to competitors and face margin erosion.

- Retailers relying on legacy systems and lacking a robust digital infrastructure will face challenges in remaining adaptive and responsive to fast-changing market dynamics.

- Retail companies that do not integrate key business functions — including promotion, buying and allocation planning — into pricing decisions risk mispricing their products, which can have significant impacts on profitability.

Introduction

Pricing is a complex business function for retailers due to difficulties in holistically looking at the price elasticity of demand, variance in factors such as demographics and regions, complex business rules and pricing’s interconnectedness with various merchandising functions. However, pricing is a critical business decision that can determine success (or lack thereof) as it directly impacts a retailer’s bottom line and, if done incorrectly, can hinder sales and erode margins.

As technology has continued to advance, its integration into retail operations has become increasingly prevalent but remains far from mature. There is an opportunity for brands and retailers to leverage technological solutions to enhance their pricing strategies and thus improve their profitability.

In this report, we explore the current level of AI (artificial intelligence) usage in pricing strategies and how the technology can be beneficial to pricing overall. We aim to understand the key challenges that retailers face when leveraging AI to inform pricing strategies and how they can alleviate these challenges. We also analyze current technological maturity within pricing strategies and how technology investments are set to change over the next 12 months, discussing the key factors that cause retailers to increase their investment in AI-based pricing and select one software over another. Our analysis is based on two Coresight Research surveys of decision-makers at US-based retailers (see Methodology at the end of this report).

This report is produced and made available to non-subscribers of Coresight Research in partnership with Competera, a pricing solution company that empowers retailers to set and maintain optimal pricing in real time using AI.

Market Scale and Opportunity

The global retail pricing optimization software market is poised for significant growth, reflecting the retail sector’s increased reliance on technology for product pricing amid economic volatility. Coresight Research estimates that the market will total $1.6 billion in 2024, growing at a CAGR (compound annual growth rate) of 16.5% between 2023 and 2028.

The US holds the largest market share, at 51.0% (as of 2023), and is set to grow at a significant 14.8% CAGR during the forecast period, growing to $1.4 billion in 2028 — $53.6 million above the 2023 global market size — as shown in Figure.

Figure 1. Estimated Pricing Optimization Software Market Size (USD Bil.), 2023–2028E

The Future of Pricing — How AI Is Transforming Pricing in Retail: Coresight Research Analysis

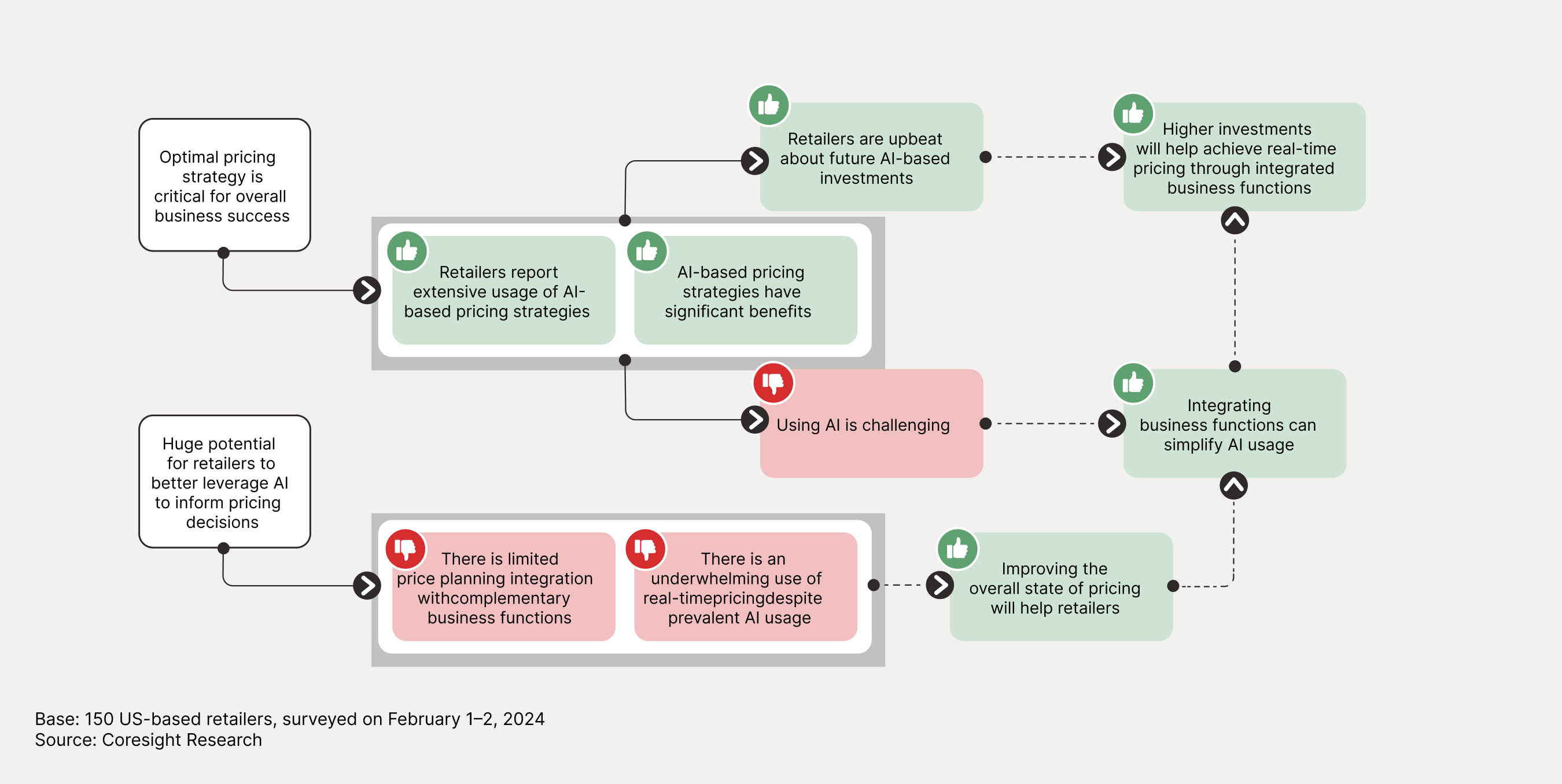

We present key takeaways from our survey analysis in Figure 2 and explore each in detail below.

Figure 2. The Future of Pricing: Summary of Key Takeaways

-

1. Optimal Pricing Strategies Contribute to Success

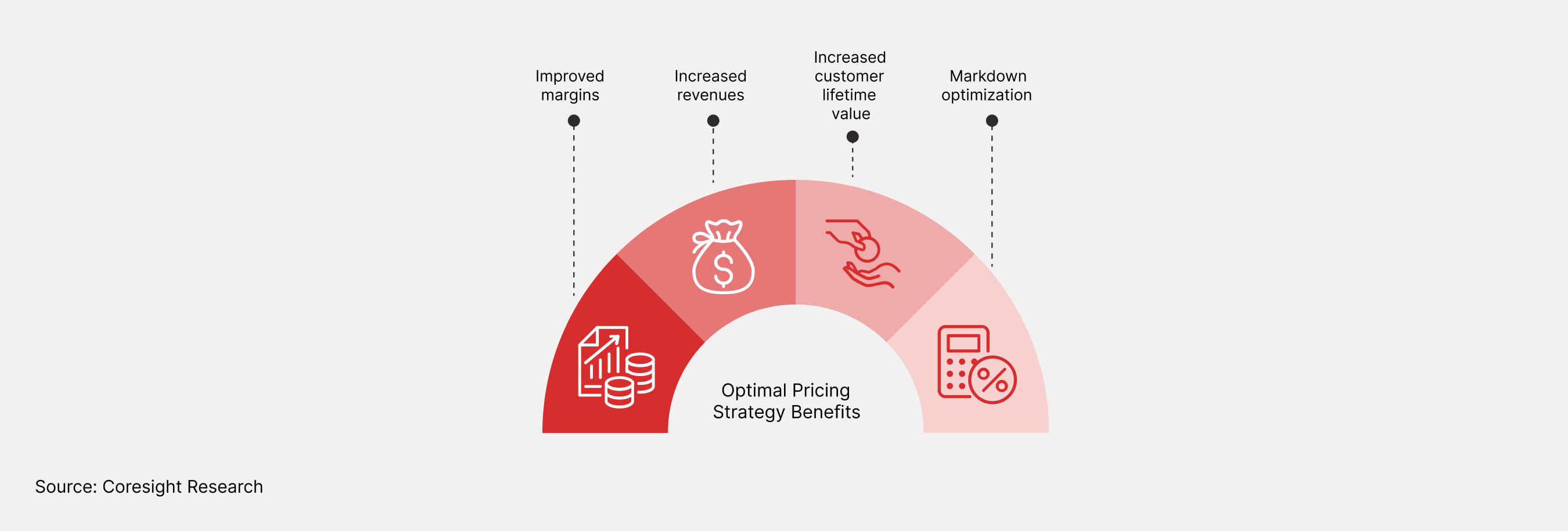

We define an optimal pricing strategy as a comprehensive strategy that takes both external and internal factors — such as promotional calendar and seasonality — into account to ensure pricing is in line with demand and aligns with a company’s broader business goals. Having an optimal pricing strategy directly impacts retailers’ top and bottom lines and is indispensable in supporting sustainable business growth.

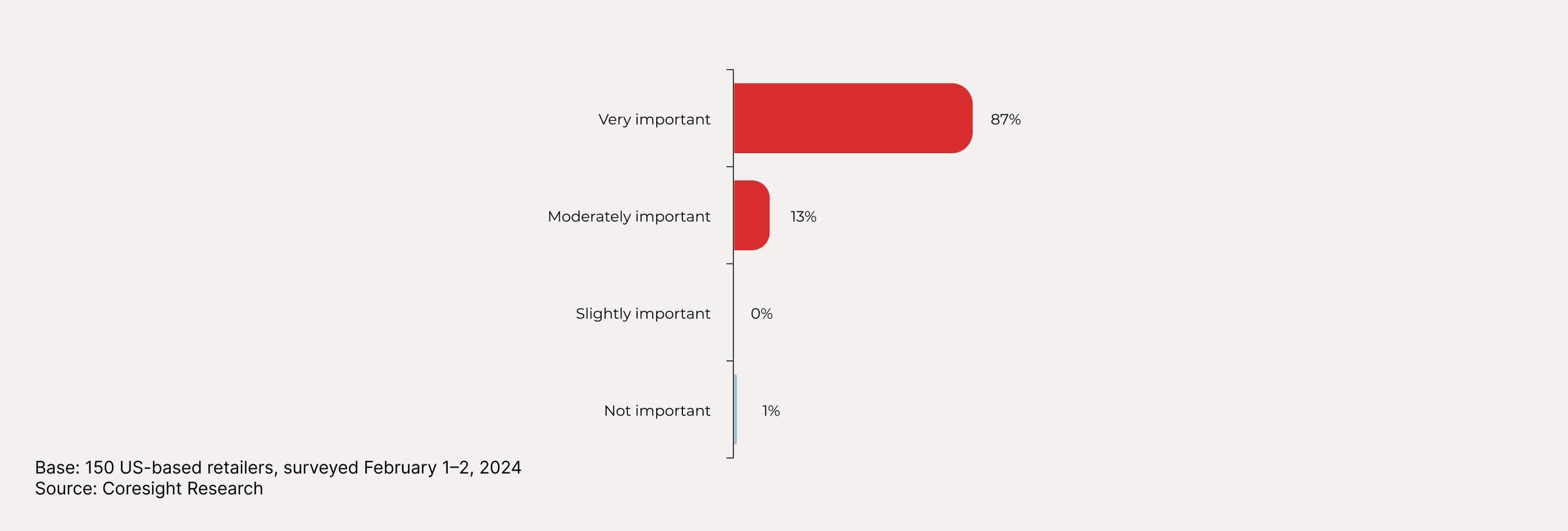

Optimal pricing can, therefore, be a powerful tool for retailers looking to improve margins or increase shopper loyalty and lifetime value. Our survey data reveal that retailers understand the impact that optimal pricing has on the success of their business: 99% of respondents stated that an optimal pricing strategy is either “moderately” or “very” important in determining business success (Figure 4).Figure 3. Business Benefits of an Optimal Pricing Strategy

Figure 4. Importance of an Optimal Pricing Strategy in Determining Business Success (% of Respondents)

-

2. AI-Informed Pricing Decisions Are Prevalent Among Retailers

Incorporating both internal and external factors and harnessing a vast amount of data — the pathway to optimal pricing — can only be achieved with the help of modern technologies such as AI. Recent economic volatility, changing consumer needs and competitive promotional calendars continue to push retailers to leverage AI to succeed. Our analysis of data from key AI-based pricing software providers, including Competera, reveals that, with an AI-based pricing solution, retailers across different verticals can increase annual revenues by 10%, on average, and improve margins by as much as 5%. Major US retailers that have continued to highlight the importance of pricing and promotions include the following:

- Best Buy: In Best Buy’s earnings call for the quarter ended October 28, 2023, CEO Corie Sue Barry stated that the company’s stable market share could be attributed to its approach to pricing, which is “one of the primary tent poles of the company strategy” for staying competitive. “We have a proven track record of very adept promotional planning around key drive times, whether that’s some of the secondary holidays or whether it’s the main holiday that we’re headed into,” she added.

- Kroger: During a special call aimed at providing an update on the company’s strategic initiatives, held on March 4, 2022, Kroger CEO William Rodney McMullen stated, “In merchandising, we are leveraging data and science to optimize our assortment, implement our pricing strategies and promote in a much more intelligent way,” when discussing Kroger’s go-to-market strategy.

- Macy’s: In its earnings call for the quarter ended April 29, 2023, Macy’s Chairman Jeffrey Genette spoke about preserving margins, stating, “Starting in Q2, we have further enhanced our pricing science capabilities to automate strategic promotions from vendor direct to owned inventory. This gives us the opportunity to bring an automated pricing solution that incorporates category elasticities, maximizes inventory turnover, and optimizes unit sales left and margin dollar expansion to our owned inventory portfolio.”

Our survey found that an overwhelming majority of respondents (92%) currently use an AI-based pricing solution to inform pricing decisions, and all of those respondents reported that they have at least “slightly” benefited from doing so.

Figure 5. Whether Respondents Are Leveraging an AI-Based Pricing Solution (Left; % of Respondents) and the Extent to Which They Have Benefited from Such a Solution (Right; % of Respondents That Use an AI-Based Pricing Solution)

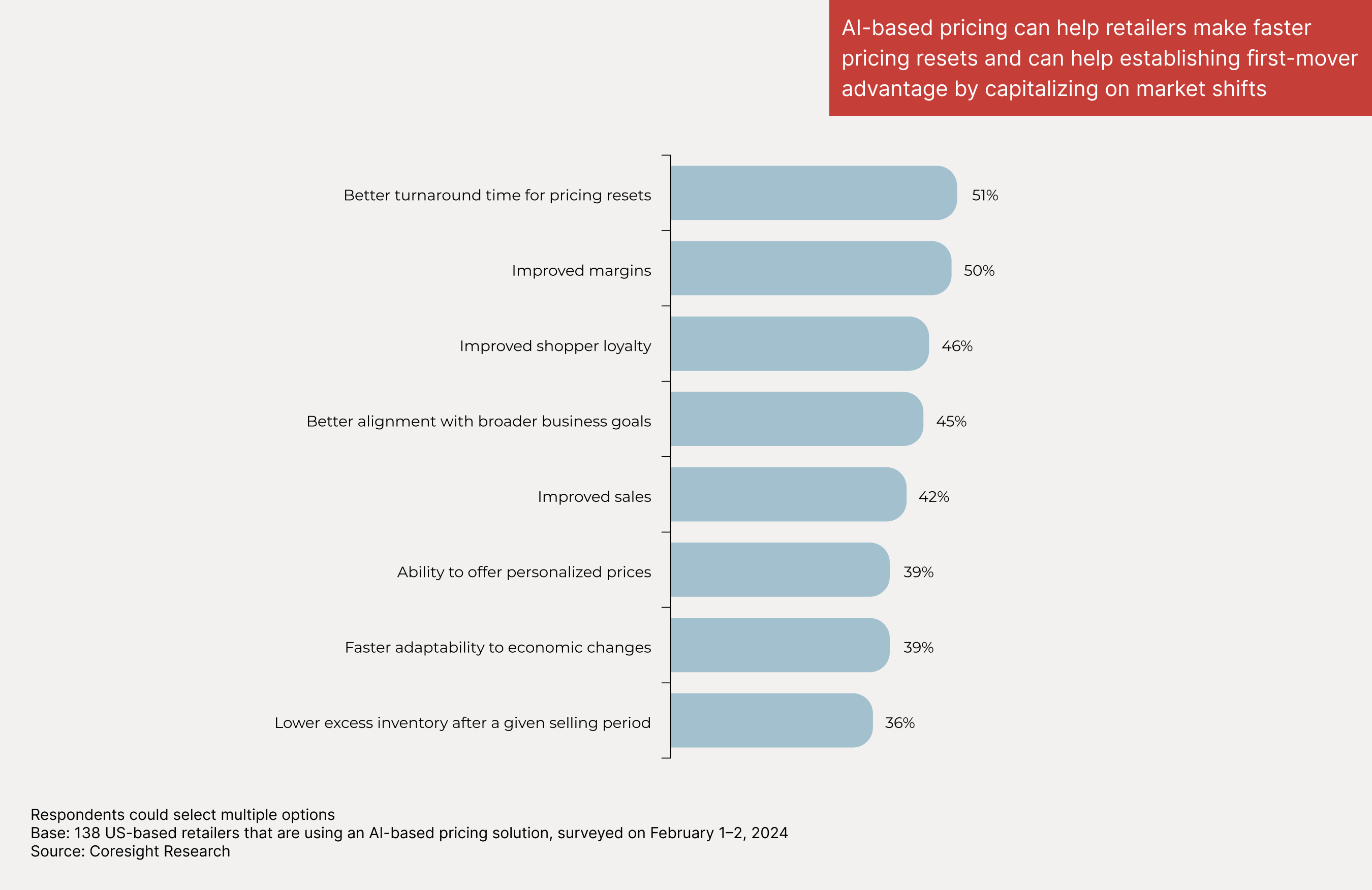

Those benefiting cited the top three benefits of AI-based pricing solutions (cited by the highest proportions of respondents) as follows:

- Better turnaround time for pricing resets (51%) — Timely pricing resets, i.e., updates or a refresh to product prices in line with any change to demand or supply-side factors, translate to monetary benefits as price changes are able to capture shifts in shopper preferences or manufacturing capacity. On the other hand, untimely pricing resets fail to capture these shifts and can be ineffective in producing desired pricing results, such as improved sales or margins.

- Improved margins (50%) — The widespread acknowledgment of improved margins as a benefit of incorporating AI into pricing decisions underlines the power of technology to positively impact retailers’ bottom line.

- Improved shopper loyalty (46%) — AI helps retailers implement a shopper-centric pricing strategy that ensures prices effectively attract target consumers to drive higher conversion and an improved return on investment (ROI) on promotional spending.

Around one-third of respondents selected all the benefits, implying the widespread nature of the benefits provided by an AI-based pricing solution. Other key benefits include better alignment with broader business goals (45%) and improved sales (42%). Pricing can be aligned with broader business goals by feeding business rules into AI-based deep learning algorithms to produce better outcomes, while being competitive on price allows retailers to align their prices with demand and reap higher sales volumes.

Figure 6. Key Benefits of an AI-Based Pricing Solution (% of Respondents)

-

3. Leveraging AI Can Be Cumbersome and Challenging

While the adoption of AI in pricing is already widespread and driving business benefits, our survey also revealed that it can be challenging for retailers to leverage the technology to its full potential. The inputs that AI algorithms require to produce robust results are a key driver of such difficulties, as an AI-based pricing solution that works well for one retailer may prove to be much less effective for another if not given the right quantity and quality of data.

Among the surveyed retailers that currently use an AI-based pricing solution, the top three challenges they have faced in doing so (cited by at least one-third of respondents overall, as shown in Figure 7) are as follows:- A lack of integration with key complementary business functions, such as promotion planning, emerged as the most widely cited challenge overall, with half of respondents citing it among the top three challenges and 14% citing it as the biggest challenge. A lack of integration often leads to a lack of visibility into key operations, and, as a result, retailers often do not have the right amount of data to fully leverage AI and realize cross-functional synergies (we dive further into the topic of integration later in this report).

- A lack of trust around AI models setting product prices was cited by 36% of respondents among the top three challenges and by 15% as the biggest challenge. We believe that technology companies that provide decision-makers with flexibility in regard to defining and adding business rules to ML (machine learning) models and running multiple AI-based scenario simulations; these simulations allow businesses to see how certain metrics could be impacted after a price change is carried out, helping build trust around AI models. Additionally, by improving retailers’ ability to collect and harness data (also cited among the top challenges), technology providers can not only enhance and foster trust around AI but also improve the outcome of AI models.

- Limited integration capabilities with company-wide solutions was cited by 34% of respondents among the top three challenges. This suggests that retailers value having a pricing solution that can work with existing technology infrastructure and take the overall business strategy into account when providing transparent pricing recommendations in near-real time.

Our survey data reveal that all the challenges were selected by at least some proportion of respondents, underlining that the challenges faced when using an AI-based pricing solution span a wide spectrum. Retailers must address these problems holistically, working collaboratively with AI-based pricing solution providers to increase flexibility and integration, as well as work toward real-time pricing, multiple scenario simulations and the ability to add custom rules to solutions.

Figure 7. Key Challenges That Retailers Face When Using an AI-Based Pricing Solution (% of Respondents)

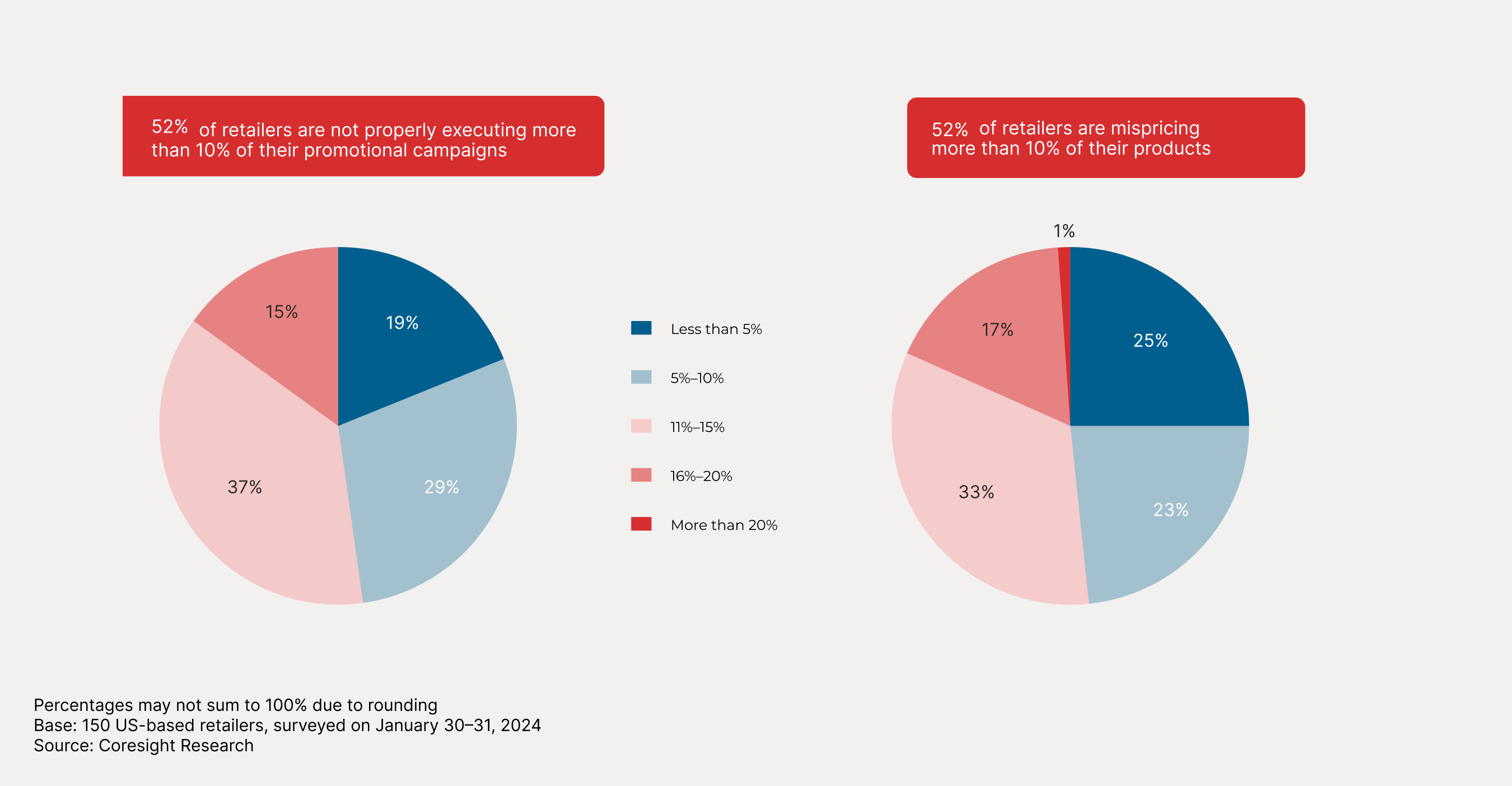

In another recent Coresight Research survey, undertaken in January 2024, we asked US-based retailers about pricing and promotion inefficiencies and found that more than half (52%) cannot execute at least 10% of their promotional campaigns properly in any given selling period. Additionally, on average, surveyed retailers are mispricing 10% of their products under any given category in any given selling period. Using AI can help retailers improve both pricing and promotion execution to overcome these challenges.

Figure 8. Pricing and Promotion Inefficiencies: Proportion of Promotional Campaigns That Are Not Executed Properly (Left) and Proportion of Products That Are Mispriced Under Any Given Category (Right) in Any Given Selling Period (% of Respondents)

-

Integrated Business Functions and Real-Time Pricing Amplify AI-Based Pricing Benefits

To better understand the current state of pricing, we focused our analysis on two key areas: the integration of price planning with complementary business functions — allowing for centralized decision-making and taking multiple business rules into account — and the methods companies use to inform their pricing strategies. Together, these factors can help in understanding the extent to which AI is leveraged.

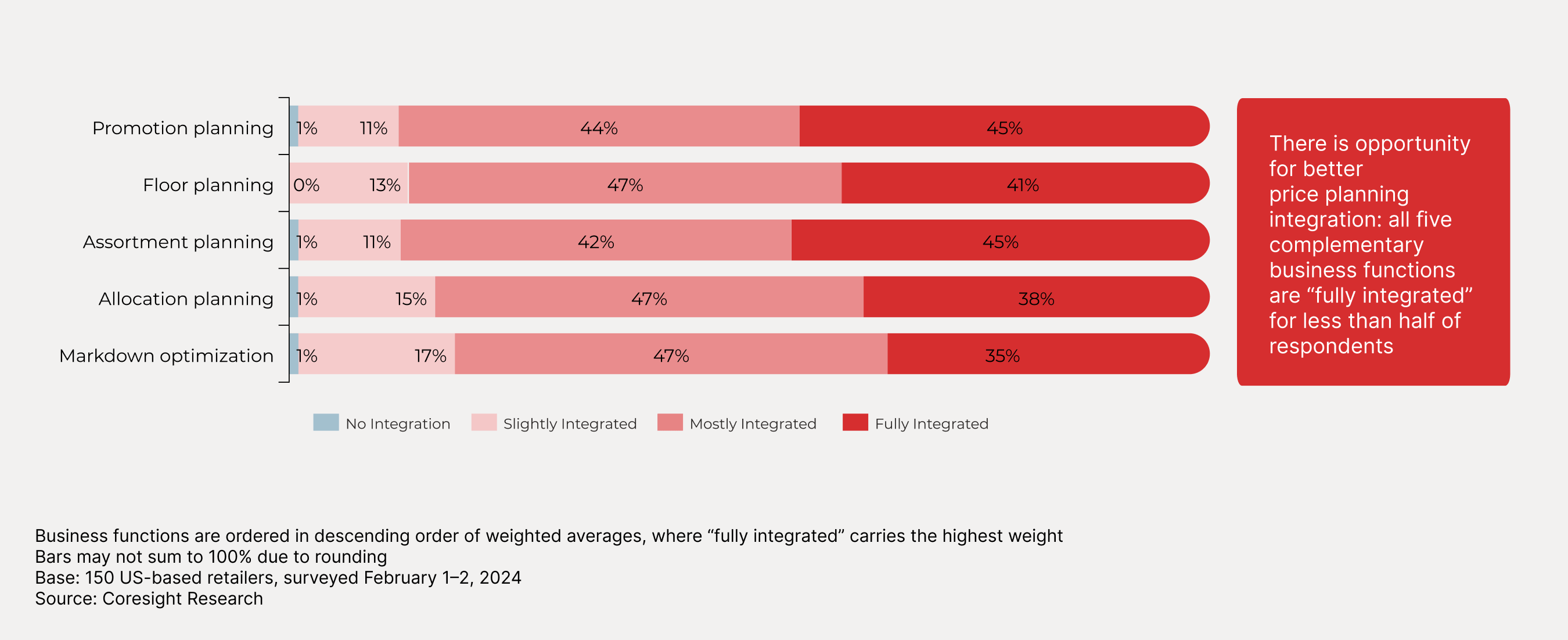

Our survey data reveal that none of the five complementary business functions we surveyed about are “fully integrated” with pricing for at least half of respondents: the functions with the highest rate of full integration are promotion planning and assortment planning, at 45% each (Figure 9).

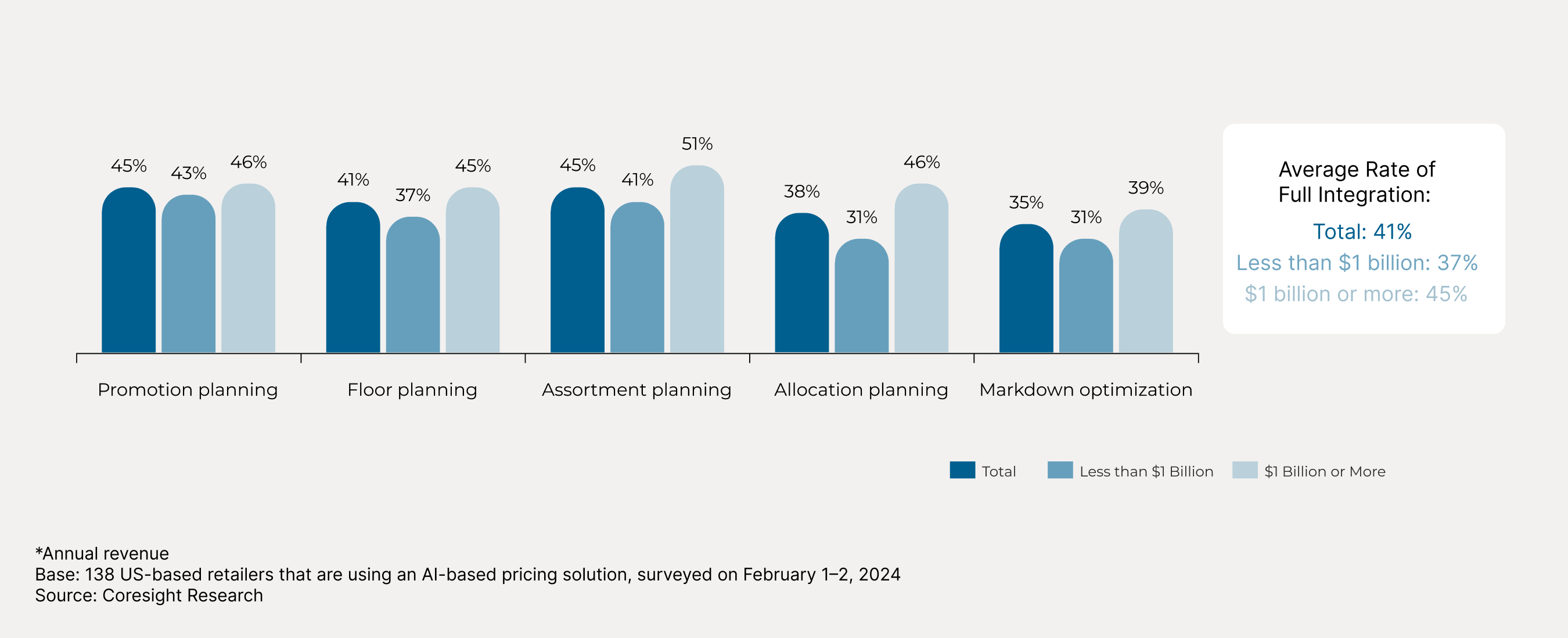

There is a big opportunity for retailers to better integrate price planning with business functions — especially allocation planning and markdown optimization — to fully reap the benefits of AI-powered deep-learning algorithms. On average, price planning is “fully integrated” with the five complementary business functions for only 41% of retailers. Examining the data by company size highlights that the opportunity is most apparent for retailers whose annual revenue is less than $1 billion: only 37% of this subset, on average, cited full integration across the five complementary business functions — 8.0 percentage points lower than the proportion of retailers with annual revenue of $1 billion or more that reported the same.Figure 9. The Extent of Current Integration of Price Planning with Key Complementary Business Functions (% of Respondents)

Figure 10. The Proportion of Respondents Who Reported That Price Planning Is Fully Integrated with Key Complementary Business Functions, Breakdown by Company Size* (% of Respondents in Each Subset)

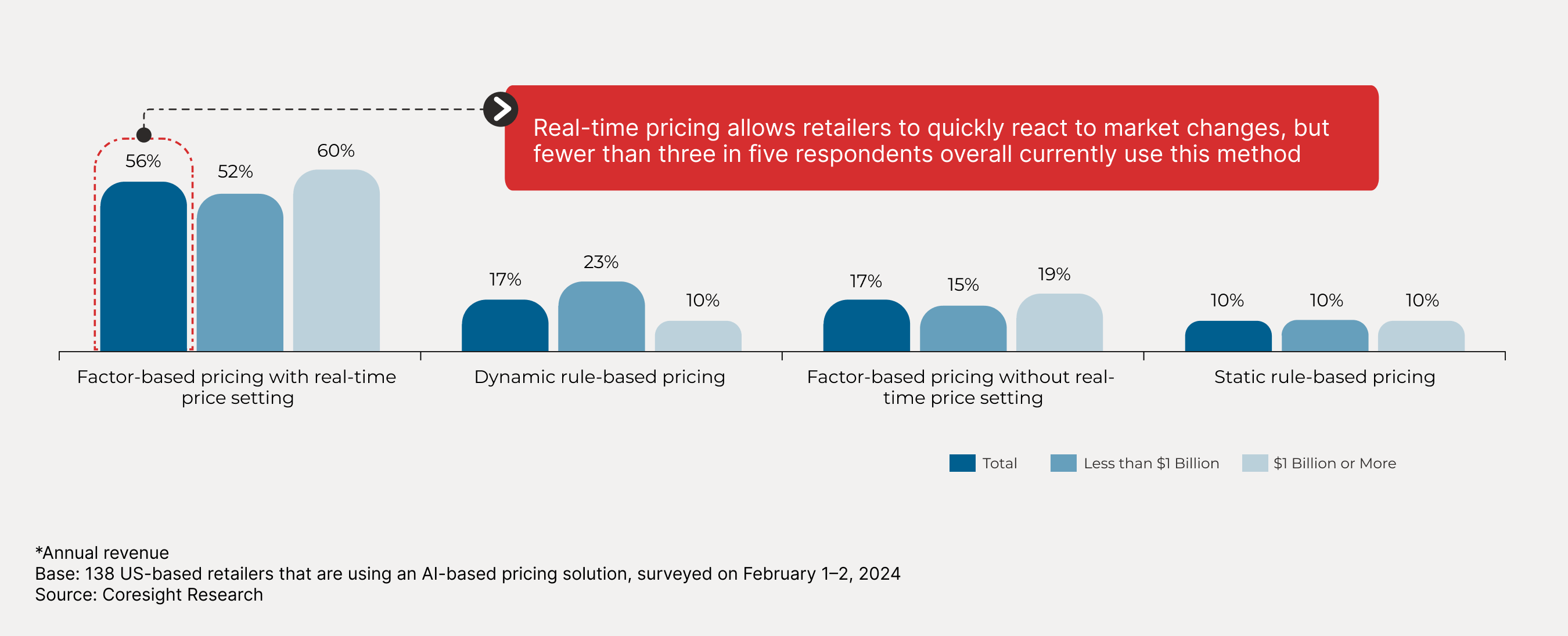

Real-time pricing has strong growth potential: among retailers that currently use an AI-based pricing solution, only 56% use real-time price setting. As discussed earlier (Figure 6), a faster turnaround time for pricing resets is the biggest benefit of an AI-based pricing solution. If done effectively, retailers can reflect market changes in their pricing in near-real time which can not only help boost sales but help in margin dollar expansion.

Figure 11. Method That Retailers Currently Leverage for Price Planning and Setting, Overall and by Company Size* (% of Respondents in Each Subset)

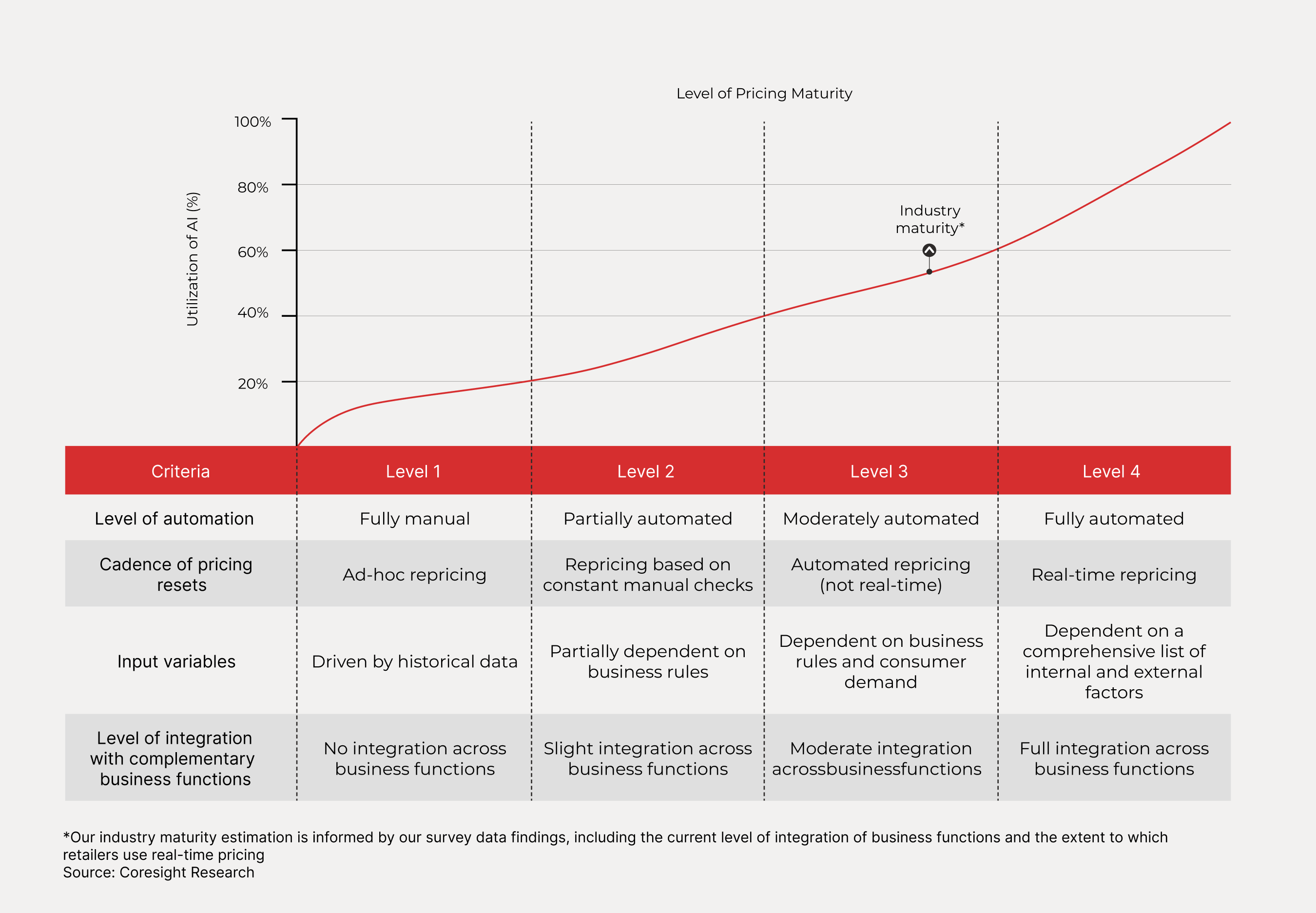

The current state of pricing strategies and the level of integration between pricing and complementary business functions underline the underutilization of technology. Our survey results reveal that we are still in the early days of technology usage and sophistication. As shown in Figure 11, we conclude that the industry is on level three of a four-point pricing maturity scale, the levels of which are differentiated by four key criteria:

- 1. Level of automation

- 2. The cadence of pricing resets

- 3. Input variables

- 4. Level of integration across complementary business functions

Moving up the pricing maturity curve will require retailers to better utilize AI. Having a unified view of data and centralized decision-making processes results in more effective deep-learning algorithms that are fed rich data. Retailers must have a robust understanding of their first-party shopper data, including average order value, purchase frequency, cart abandonment rate and customer lifetime value. Additionally, retailers must be able to identify their priorities and the metrics they want to improve through pricing resets. AI has the potential to predict sales with a very high accuracy rate, and, via multiple AI-based scenario simulations, retailers can understand the effectiveness of their decisions in near-real time, allowing them to select the pricing change that best aligns with their business goals.

Figure 12. The Current State of Price Planning: The Pricing Maturity Curve

-

Outlook on AI Usage and Investments Reflects Upbeat Retailer Sentiment

As competition intensifies among retailers due to higher customer acquisition costs, retailers will have to differentiate through continued investing in technology infrastructure (including AI). Our survey found that 97% of respondents who are currently using an AI-based pricing solution plan to increase investments in this area over the coming 12 months. This finding reveals that retailers have yet to achieve optimal AI-usage levels and have a strong intent to upgrade their AI-based pricing solutions in the near future. Continued investments will also act as a catalyst for retailers to move up the pricing maturity curve in the coming years.

We asked the retailers that are currently using an AI-based pricing solution about the differentiators that are important to them when selecting such a solution and found that the three most influential differentiators (cited by the highest proportions of respondents) are those that support retailers’ integration goals:- The ability to integrate with complementary business functions emerged as the top differentiator overall, with 57% of respondents citing it among their top three differentiators and 20% citing it as the top differentiator. This aligns with the results of the most-cited challenge that retailers face when using an AI-based pricing solution (see Figure 6) and underlines the need for a customizable solution that can take complementary business functions — such as promotional calendars — into account and provide retailers with an array of simulations, allowing them to pick the best output.

- Integration capabilities with company-wide solutions ranked as the second most-influential differentiator overall, cited by 37% of respondents among their top three differentiators and by 14% as the number-one differentiator. The ability for AI-based pricing solutions to integrate with company-wide solutions can help retailers streamline decision-making processes and align functions with overall business goals.

- Flexibility in assortment segmentation ranks as the third most-influential differentiator (by weighted averages), underlining retailers’ need for flexibility and control. More flexibility in assortment segmentation provides retailers with the power to strategically categorize their products based on shopper buying patterns and competitor analysis. We believe that running multiple AI-powered simulations can help retailers understand the impact of moving certain products across categories, improving satisfaction among retailers and giving them more control. This will help build or strengthen retailer trust in AI-based models, leading to long-term partnerships between retailers and AI-based pricing solution providers.

Figure 13. Whether Retailers Are Planning To Increase Investment in Their AI-Based Pricing Solution in the Coming 12 Months (Left) and Influential Differentiators of AI-Based Pricing Solutions (Right) (% of Respondents)

What We Think

An effective pricing strategy can often be a leading driver of profits and provide an edge over the competition. Currently, there is prevalent use of AI-based pricing software in the US market and various major retailers, including Best Buy, Kroger and Macy’s, have recently highlighted the importance of technology-driven pricing strategies. These retailers understand the importance of having an optimal pricing strategy, and our survey findings showcase widespread usage of AI-based pricing solutions and a strong intent to increase investments in the coming 12 months from those currently leveraging an AI-based pricing solution.

As retailers look to fully harness AI to inform their business decisions, including pricing decisions, there will be a higher demand for pricing solutions in the retail market. Pricing solution providers that listen to the pressing needs of retailers and offer them integrated, unified and flexible capabilities are positioned to benefit the most in this rapidly growing market.

Investing early with a clear milestone-based approach will help retailers stand out and reap a higher ROI versus late entrants. The coming few years will be critical for retailers as AI advances and margin pressure escalates amid an increasingly competitive retail landscape.

Implications for Brands/Retailers

- Retailers must focus on introducing scalable AI technologies that enable them to integrate complementary business functions and integrate technology with their overall business infrastructure.

- Shifting a company’s focus to real-time pricing can help it be more competitive and command a higher share through shopper-centric pricing, especially when processes are built on a holistic understanding of which variables impact pricing.

Brands or Retailers Poised To Gain Advantage

- Retailers that proficiently manage and integrate their data across various platforms, including promotion planning and supply chain functions, will have an edge when adopting pricing technologies. Comprehensive data integration allows for a more unified business view, leading to informed pricing decisions.

- When introducing AI-based pricing, retailers that focus on scalability and technology integration with company-wide business verticals will be positioned better to align pricing with overall business goals.

Brands or Retailers That Risk Losing Advantage

- Those slow to integrate AI, ML and data analytics into their pricing processes risk losing important customers to competitors and face margin erosion.

- Retailers relying on legacy systems and lacking a robust digital infrastructure will face challenges in remaining adaptive and responsive to fast-changing market dynamics.

- Retail companies that do not integrate key business functions — including promotion, buying and allocation planning — into pricing decisions risk mispricing their products, which can have significant impacts on profitability.

Implications for Technology Vendors

- The pricing optimization software market in the US is large and growing. Technology vendors catering to the US market while understanding the local economy stand to benefit strongly as the US market commands around 50% of the global pricing optimization software market.

- Technology vendors that demonstrate an understanding of the nature of merchandising functions and acknowledge their interconnectedness are poised to gain a larger share of the growing pricing software market. Vendors providing seamless integration of various retail systems and ensuring data security and quality will be in high demand, as these are key concerns for retailers aiming to optimize their operations and decision-making processes.

- Solution providers that are harnessing AI effectively stand to benefit from technology advances over time and help retailers navigate pricing complexities with ease.

Notes

Data in this report are as of February 26, 2024.

Methodology

Informing the data in this report is an online survey on 150 retail business decision-makers in the US, conducted by Coresight Research on February 1–2, 2024. The results have a margin of error of +/-10%.

Respondents in the survey satisfied the following criteria:

- Their business is operating in the US.

- Job title: Senior Manager or above (primary or joint-business decision-makers in regard to pricing).

- Company annual revenue of $250 million and above.

- Departments such as strategy/executive leadership, distribution/merchandising/trade, operations, planning/pricing and finance.

- Sectors including grocery, department stores, beauty, home and home improvement, electronics, drugstores and mass merchandisers.

Data shown in Figure 8 are from an online survey of 150 US retail decision-makers, conducted by Coresight Research on January 30–31, 2024. The results have a margin of error of +/-10%.

Respondents in the survey satisfied the following criteria:

- Companies: Operating in the retail sector (including DIY, drugstores, grocery, liquor, mass merchandisers, and warehouse clubs/wholesalers), with annual revenues of at least $100 million.

- Job title: Senior Director or above who are familiar with the performance metrics of their retail stores.

About Coresight Research Custom Reports

Coresight Research Custom Reports are produced as part of commercial partnerships with leading firms in the retail, technology and startup ecosystems. These Custom Reports present expert analysis and proprietary data on key topics in the retail, technology and related industries, and enable partner companies to communicate their brand and messaging to a wider audience within the context of brand-relevant research.

This report is produced and made available to non-subscribers of Coresight Research in partnership with Competera.

About Competera

Competera is an AI-driven pricing solution company that empowers retailers to set and maintain optimal prices with speed, precision and simplicity. Our pricing platform harnesses next-generation deep learning technology to continuously calculate billions of price combinations, considering 20+ contextual factors beyond elasticity — from real-time competitive data to hyper-local product behavior. By combining intelligence and automation, we help our customers increase profits an average of 6%, reduce repricing times by 90% and strengthen customer loyalty.