Content navigation:

- What is Introductory pricing?

- Example of Introductory pricing

- Pros and Cons of Introductory pricing

- How to set a price for a product

So you have a new product (or maybe even a service) which should be presented to your customers. Moreover, it has to be done with profit for your business. Any specialist who is interested in how to make the right pricing decision during the very beginning of the product’s life cycle has, probably, faced these two terms as Introductory or Penetration pricing.

What is Introductory pricing?

Introductory pricing is a pricing approach aimed to attract customers to a new product by offering a special selling price and creating a new customer audience for the new entry. It entails setting a reduced price at the beginning in order to increase market share and then, over some time, gradually raise the price to make the product or service profitable. What is the difference with Penetration pricing then?

In fact, these are synonymous terms with one small difference. The prefix “introductory” says that the first price will serve as one of the product's differentiators (so it is desirable to make it as attractive as possible), while the “penetration pricing” means that the product should try as many customers as possible in a short time due to the low and attractive price. One way or another, these two terms revolve around the same topic – how to price a product at its initial stage.

Introductory strategy is used in a number of circumstances, but the commonality is the goal of gaining market share where the selling price is used as a stimulus for people to adopt and purchase the product or service.

Interestingly, that introductory pricing works against the basic law of supply and demand, where the smaller the price the bigger the demand of goods. Introductory price starts low, and then rises with the hopes that the demand increases too. The idea is to try to expand market share and then gradually increase prices over time.

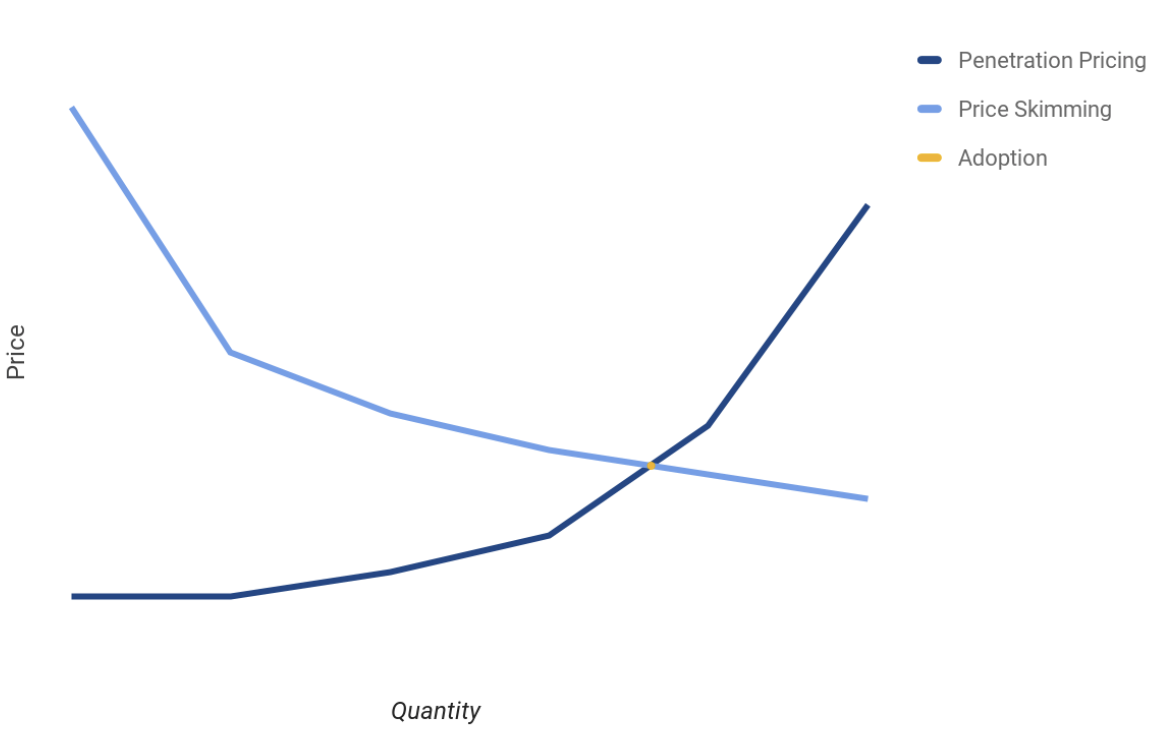

However, there is also an opposite approach called price skimming. It’s a pricing policy whereby business charges a high introductory selling price but then slowly reduces it to skim different segments of the market to maintain profitability over a period. That’s how price first products works:

Example of Introductory pricing

The use of the introductory pricing strategy comes into a hand for certain situations and is suitable for almost all industries. Typically, this strategy is mostly used by discount retailers, manufacturers of mass goods, and businesses whose primary strategy focuses on a cost-based pricing approach. Also, starting with the trend of various online services, introductory pricing is used by almost all SaaS products and applications. Do you remember when you were offered a free trial, a cheap subscription for the first two months, or a free app with built-in monetization? These are all examples of intro pricing across electronic services. However, let's get back to retail.

Pricing of a new product is used for, surprisingly, is self-promo and advertising. You can price first products and expect that the buyer will take something else in addition to your new product by attracting a buyer with a cheap product and impersonating yourself as the most inexpensive player in the market. Simply put, you can create unique pairs of complementary products.

As we mentioned above, the second reason for pricing of a new product using this strategy is to reduce competitive pressure. At the same time, you will face the gross margin decrease, but after a market capture, you can raise the price and return the lost profit.

Finally, the most popular approach can be attributed to the introduction of a unique product. Intro strategy, in this case, is a crucial part of taking deep root for a product or a brand in the market. For example, when you offer customers your own new private label's product.

Pros and Cons of Introductory pricing

Introductory pricing is commonly used by retailers to price first products in order to attract customers and generate initial interest in a new product. While it offers various benefits, it also comes with potential drawbacks that you must carefully calculate and consider before implementing. Let's delve into the pros and cons of introductory pricing and find out how to price a new product in a smart way.

Pros or how to price a new product effectively:

1. Attract new shoppers: Introductory pricing can be an effective way to entice new customers to come to your store and buy a product. By offering a discounted selling price during the introductory period, you can capture the attention of those consumers who are not ready to purchase the product at full price.

2. Generate buzz: A data-driven introductory pricing strategy can create excitement around a new product launch. Consumers tend to perceive discounted prices as a limited-time deal so they become more likely to make a purchase.

3. Increase market share: Lowering prices during the introductory period can help retailers gain market share by attracting customers away from competitors. This is particularly important when introducing brand-new products with no stable market or consumer base.

4. Drive adoption: Introductory pricing encourages consumers to try a new product or service at a lower cost, increasing the likelihood of adoption. Once customers experience the value of the offering, they also become more likely to pay the full price for a product later on.

5. Competitive power: By offering an introductory price that is lower than competitors, retailers can gain a competitive advantage. This can be especially effective for new market players eager to reinforce their position in the industry.

Cons or be aware of typical introductory pricing mistakes:

1. Compromised margin: One of the main drawbacks of introductory pricing is the potential impact on profit margin. Offering products at a discounted price during the introductory period implies lowering gross margin and, eventually, risking the revenue. Calculate and be aware of the cost you're paying for low initial prices.

2. Value misperception: Consumers may perceive products with introductory pricing as lower in total value compared to similar products sold at regular prices. Sometimes, even a significant price increase is not enough to rebuild the brand's value in the consumer's eyes.

3. Sales cannibalization effect: Introductory pricing may cannibalize sales of other products within the retailer's portfolio. Customers may opt for the discounted introductory product instead of purchasing higher-priced similar or supplementing products. In this case, the cost of the strategy can become too high for your business.

4. Price sensitivity risks: Introducing low initial prices can attract price-sensitive customers interested only in discounts. Once the introductory pricing ends, these customers would likely stop their purchases which may provoke a drop in sales.

5. Brand image risks: Introductory pricing strategy should be used very carefully, especially by premium retailers, as discounting too much can undermine their strategic brand positioning on the market.

In short, among the gains you can get from the introductory pricing we can highlight the following:

-

A favorable price perception by the buyer.

-

High customer retention rate (before the price increase).

-

A new product with an attractive price is an excellent base for a successful promotion.

-

If we talk about a new market, you take the lead among competitors. Therefore, you will dictate your rules.

At the same time, the strategy of introductory pricing is not a panacea and carries some risks. For example:

-

Your consumers might be disappointed when they'll see the price increasing for a cheap product.

-

In search of a better offer, some buyers can be described as grasshoppers who switch from one offer to another.

-

Your target audience can be extremely narrow, which means that you don't have to work at a loss to meet its needs.

To sum up, introductory pricing is a powerful tool and you should primarily define which particular goals you would like to achieve and then outline the risks and potential drawbacks associated with the strategy. Once you have a risk management plan and a clear vision of how the total benefits of introductory pricing can outweigh the shortcomings, you can start price first products using the strategy. And remember that even the best plan requires regular reviews and readjustments.

How to set a price for a product

Last but not least: let’s consider some tips and tricks on how to maximize your efforts with introductory pricing and minimize all the risks associated with pricing of a new product.

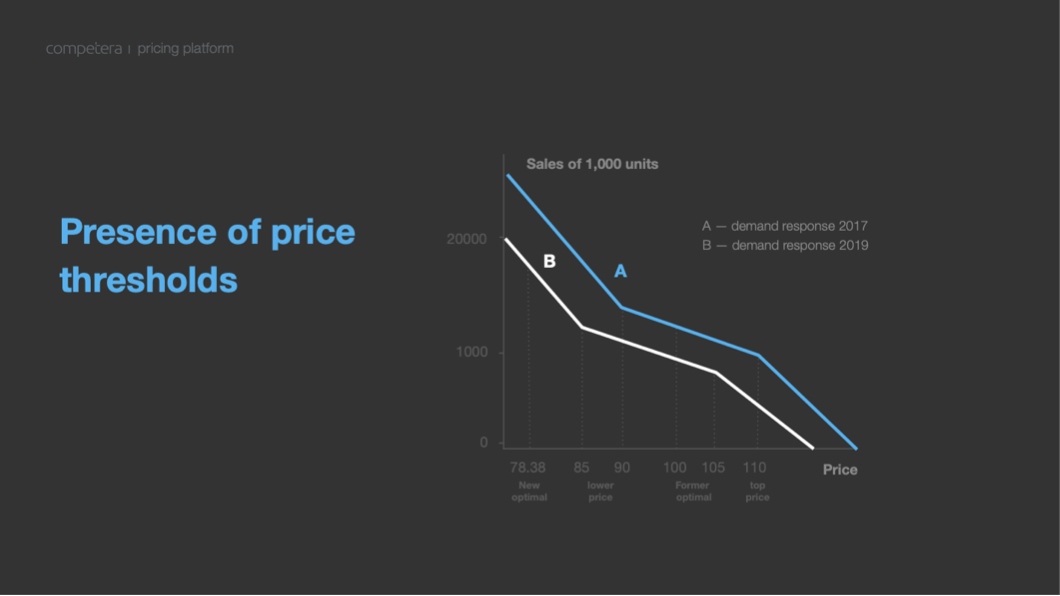

Know the pricing thresholds

Although this topic is related more to the later life cycle of the product, it is inextricably linked to the first price, because sooner or later the business will need to increase it. To keep the customer satisfied with prices as well as make price increases smoother, retailers often resort to using price thresholds. On simple, psychological slides, which indicate the desire of the buyer to pay this or that price for the goods.

The easiest way to know your pricing thresholds is to ask your audience directly and apply the results to the appropriate chart. For example, you can utilize the Price Sensitivity Meter based on a concept of what price most people regard as being reasonable.

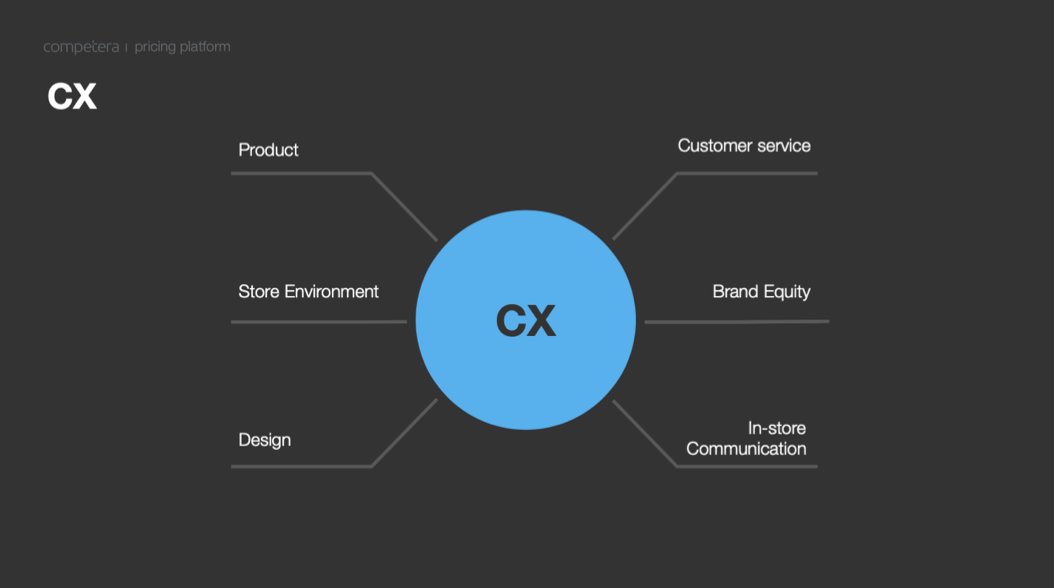

Don't single out the pricing strategy

If you think of how to price a new product, do not forget about important dimensions of traditional marketing mix of 4P and your CX. The better interaction experience (or customer-experience) between the consumer and brand it is, the higher the price can be. It's nothing new and can be implemented even for the totally new products on the market.

Be smart – use technologies

And finally, don't be afraid to use technology. It's not enough to know how to set a price for a product without using data-driven tech. In terms of the simplest things, you can find similar offers on the market almost for each product. You can find them with the help of competitors' data scraping and set the first price on the basis of data. This is a basic approach which is successfully used by companies around the world.

However, at Competera we offer a more advanced solution to pricing of a new product. To recommend the first price we use an AI algorithm that is able to compare all product’s credentials, correlate them with your assortment, find the similar product intersection, and compare prices, elasticity, and other factors. Based on this data, it offers the first price to the Competera’s user. Thus, your new product will avoid any price blockers preventing profit or revenue losses.

FAQ

Introductory strategy is used in different situations, but the commonality is the goal of gaining market share where the price is used as a stimulus for people to adopt and purchase the product or service.

When the demand curve shows that people have already get used to buying the new product, an introductory price could be changed.