"Overstock is at its worst", "Too many pallets have made floors unwalkable", "Our store has never looked this bad", "Morale is at an absolute low", — these are just a few quotes from the entry by Business Insider about the recent overstock issues in Walmart, Target, Kohl’s, Macy’s and other stores across the US.

The excess inventory is now more than 30%. Many retailers have erroneously piled their warehouses with goods popular in previous seasons due to the delays in the supply chain. But many things have changed under the impact of record-breaking inflation. So now retailers are tackling the overstock by offering up to 70% discounts on furniture, electronics, apparel, workout equipment, etc.

Inventory Disruption — Overstock Comes to Replace Shortage

How did we end up at the point we are now? A good question to start with. But to answer that, we must first trace back the origins of the recent overstock crisis.

Let's not go far away from today.

In April 2022, CBS News published an article titled "Product shortages and soaring prices reveal fragility of U.S. supply chain". A lot of consumers across the US noticed that many products from baby formula or sunflower oil to clothes and tools are either out of stock or available in limited numbers. In total, about one-third of products browsed were unavailable already in the first weeks of April.

The product shortage at that point has, eventually, resulted in the overstock issue the US retailers are struggling with now. Simply put, the products got stuck on their way to retailers causing a shortage of supplies in spring. Interestingly, the demand for these products started to drop before the chain was fixed and goods became available for customers. And now reaching retailers together with the new supplies provokes overstock.

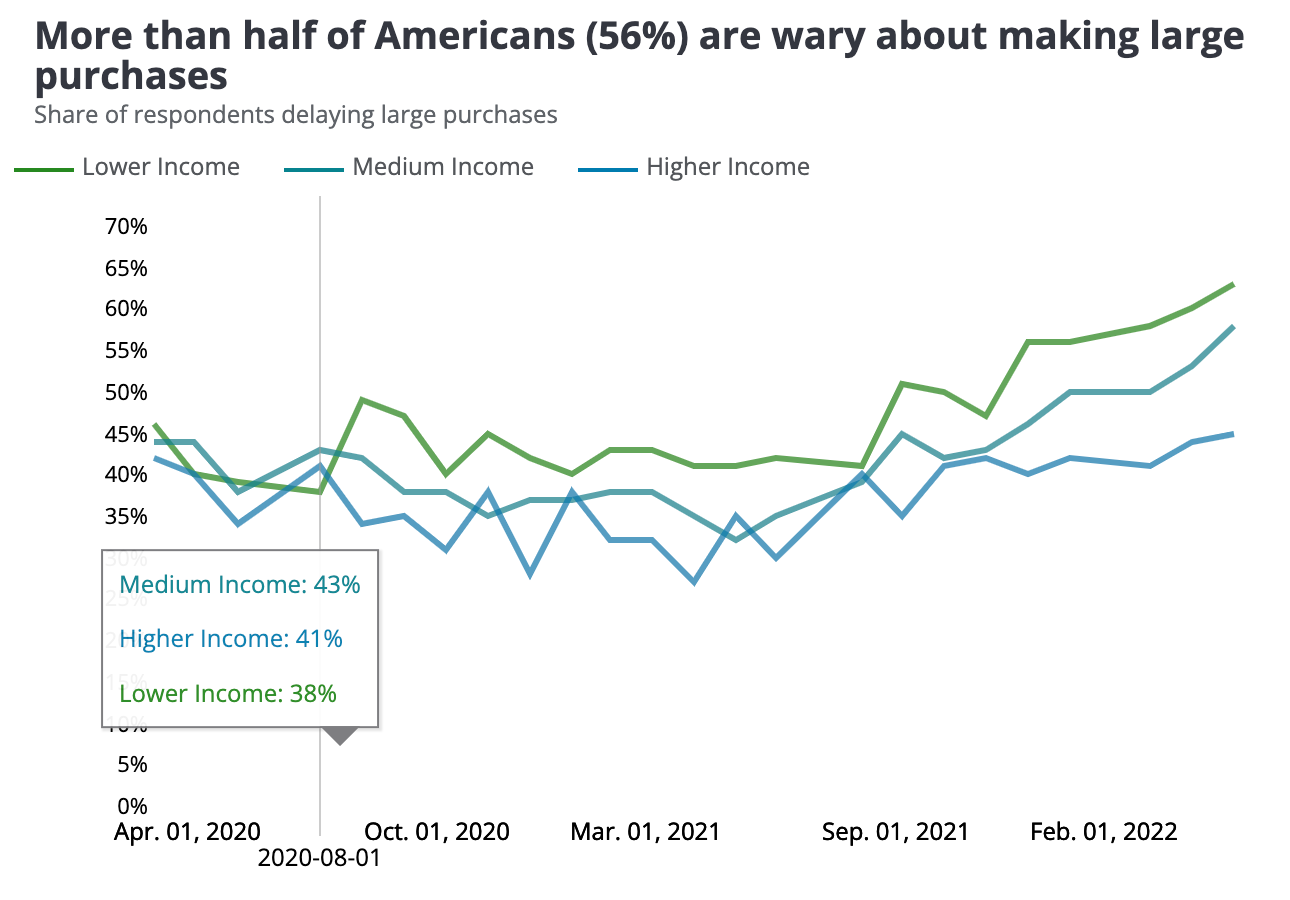

This crisis is formed under the changes in political, social,and economic sectors and couldn’t but impact retail. Raising inflation is transforming customers' purchasing power and behavior. 56% of Americans become wary about making large purchases and focus primarily on the essential groups of products (grocery, beauty, health and wellness).

It's unlikely that the situation will change in the near term. The rising cost of living is a core factor that shapes current buying tendencies. Thus shopping for sports equipment, hobbies, interests, and the like groups of products are now taking a back seat, becoming so-called delayable spending and piling up in the warehouses.

Would retail experience less pressure if the supply chain system was more flexible and adaptive to any external or internal circumstances? Absolutely yes. However, it would require businesses to make their contribution — enhance inventory management with cutting-edge solutions.

What does it mean for retailers?

Once the problem hits, it's crucial for businesses to proactively respond to challenges and changes in their consumer’s behavior patterns. A data driven approach supported with machine learning is a proven and tested solution that can help retailers and brands overcome these challenges. And this crisis is not an exception.

When DCs are overloaded with items and there's a shortage of space for new supplies, retailers tend to set discounts intuitively or by imitating competitors' patterns, forgetting about taking into account various additional inputs and their business advantages. This leads to limited success within markdown optimization and unnecessary erosion of additional margin.

Retailers need data-powered solutions to go through the crisis with minimal risks for their businesses and eliminate cannibalization and margin loss. With AI/ ML algorithms capable of providing differentiated markdown prices, retailers have a chance to get the maximum profit while meeting the need to sell out the overstock by a certain point in time.

Given that, Competera offers solutions for markdown optimization nailing about 10% of gross profit. By applying the specified parameters for ML optimization, retailers can switch from a 'blanket' discounts approach to differentiated discounts keeping in mind elasticity of products, as well as cross-elasticity of related products in the range.

Algorithms offer optimal discounts or even suggest leaving a price unchanged to hit specific business goals. To put it simply, retailers can clear out their stock by setting parameters on sell-through-rate speed either in absolutes or percentages on category level. This allows managers to decide on the average number of units or an exact percentage (e.g. 10%, 20%) to be sold weekly, biweekly, monthly etc. The model is guided by the results of the previous week, therefore the recommendations of markdown prices on the next week consider the sales drivers of the previous week.

Competera’s algorithm-powered markdown optimization also calculates discounts avoiding disruption of the sales of other products offered with a smaller discount or no discount at all. This allows taking into account such constraints as stock (not to deepen discounts to a point when the demand goes higher than the number of products available) and the level of gross profit.

Thinking ahead

After all, prevention is better than the cure. Making data-powered pricing decisions enables retailers to become more resilient and reactive to demand fluctuations. By integrating Competera into your pricing processes, retailers get an optimal price at every stage of the product’s life cycle, with complete control and visibility to all internal and external factors. This way retailers can ensure all products are selling at their optimal sell-through-rates at every stage. Putting them in control of their prices and stock levels, instead of the other way around.