Let's look at the most important results and insights from this year's campaign. When speaking of the Black Friday 2021 campaign, we should not forget that the global CV19 pandemic is not over. What it means is that more and more consumers continuously prefer online deals to the brick-and-mortar experience and the timeline of seasonal shopping has eventually increased as more people tend to begin their holiday shopping even before the Black Friday season starts. These trends aren't new, they were already vivid during the 2020 campaign.

Now, let's look at what was new in 2021. In September this year, Deloitte predicted that total holiday retail sales in the US will increase between 7% and 9% compared to 2020. Taking e-commerce deals only, the forecast was even more optimistic predicting 11% to 15% growth.

Analytics specialized from McKinsey also predicted the growth of omnichannel holiday sales with the online segment even reaching the point of 30% increase in the third and fourth quarters of 2021. Eventually, National Retail Federation also forecasted that the U.S. shoppers will spend up to $859 billion between this November and December, which is by 10% more compared to last year's holiday shopping season.

Considering these numbers alone might give an impression that Black Friday 2021 is just another evidence proving the retail's post-CV19 recovery. And that would be true, but only partially. The other side of the recent campaign is the challenges both retailers and consumers face.

The pandemic has undermined the supply chain sustainability and the industry hasn't fully recovered since that. During the last year's holiday season, an enormous number of consumers struggled with the out-of-stock issue, and, according to McKinsey, only 13% of those were okay with waiting for an item to come back in stock. At the same time, approximately 70% of shoppers switched to other retailers or brands. That's why customer loyalty and retention were one of the biggest concerns of the retailers during the 2021 Black Friday.

Another factor we should take into account is inflation. According to the National Retail Federation, in the last two months, the industry faced the sharpest increase in inflation since 1990, according to the Labor Department's data from October. Moreover, the consumer sentiment is now at a 10-year low. That's what we should keep in mind while looking at the growing sales forecasts.

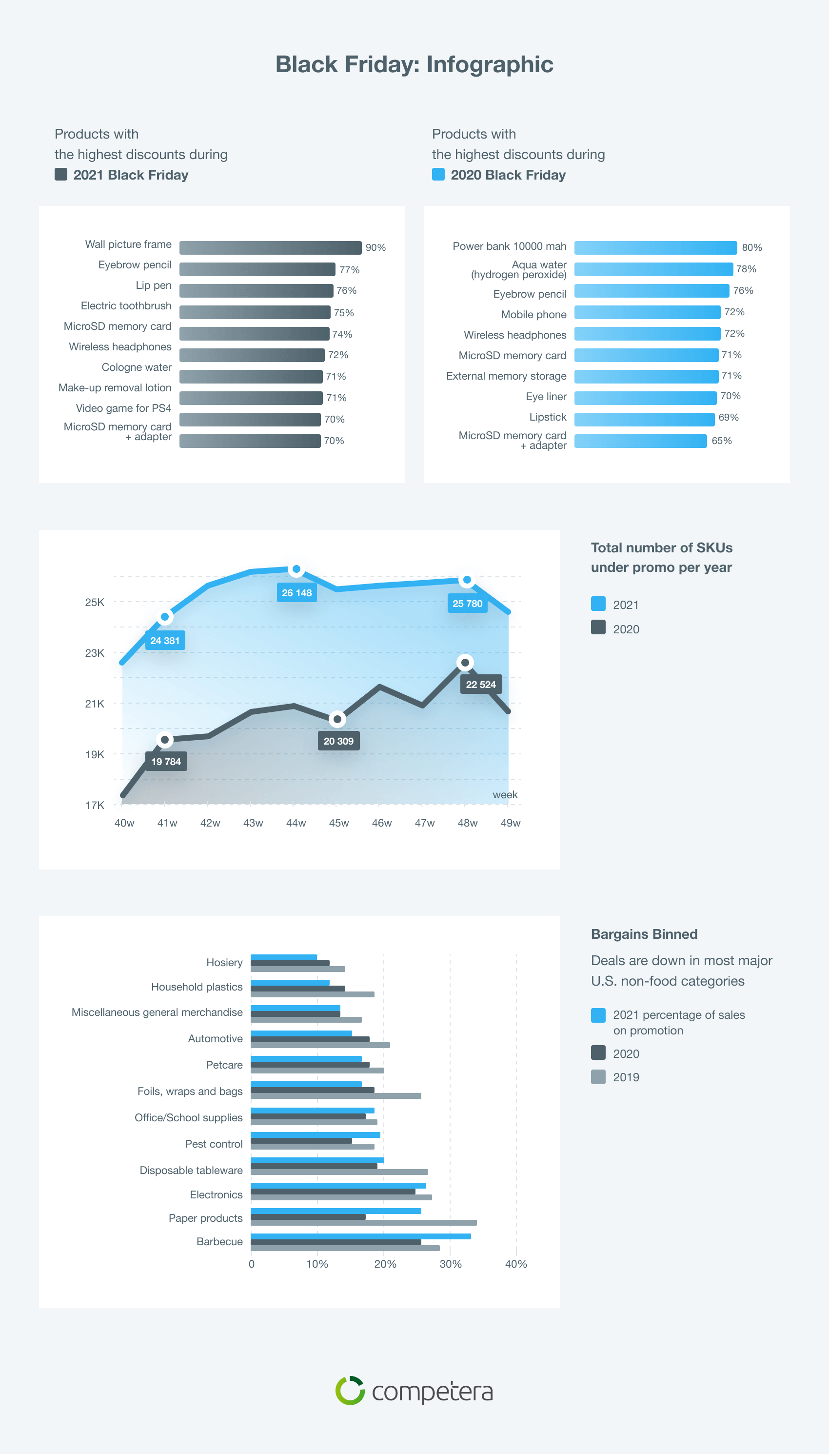

And when it comes to the Black Friday results evaluation, you may find controversies across different reports and stats. For example, you've probably seen numerous reports of the seasonal sales record on Amazon but, on the other hand, IRI Promotion Index below shows there were not only fewer special offers across major U.S. non-food categories, but the discounts were also shallower.

To get through often contradictory findings, we've run our own research analyzing the 2020 and 2021 holiday season data of more than 15 large retailers from the US and Europe. We've chosen retailers selling electronics, hobbies & craft, and FMCG as these are Black Friday's traditional top-performing industries. Look at our findings on the infographic below.

Key Insights from 2020 and 2021 Black Friday

-

The trend of growing e-commerce share continuously prevails which means that the next year the industry's digitalization will remain among the top investment priorities in retail.

-

When considering the % of sales growth from year to year, the inflation rate should also be taken into account.

-

The promo pressure has become and will remain one of the biggest challenges for various types of retailers, especially in particular industries, like FMCG.

-

Sustainable ML-driven growth of the key business metrics remains the only healthy solution to the challenge of evergrowing promo pressure and increasing competition in retail.

-

An ability to retain and keep customers loyal will remain one of the crucial factors underlying the competitive advantage of the businesses.